Required Information for Credit Card Receipts

Each transaction between a merchant and a customer must be documented in a way that provides sufficient information to both parties to enable them to clearly identify each transaction. The information a merchant is required to provide on a transaction document differs based on factors like type of transaction (sale, return or exchange), payment method, environment (physical or virtual), etc.

Today I will review what this information is and how it should appear on a credit card receipt. Additionally, I will review the types of transactions for which a receipt is not required and the requirements with which they have to comply.

Required Information for Credit Card Receipts

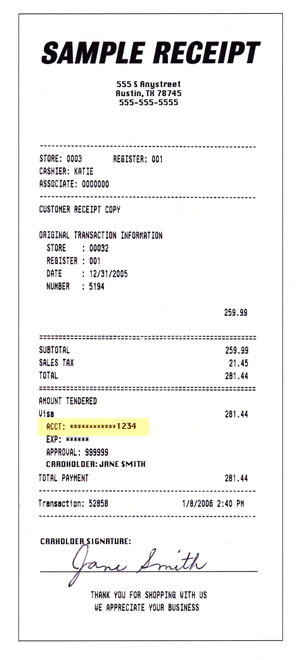

Credit card receipts should provide customers with the following information:

Credit card receipts should provide customers with the following information:

- Doing Business As (DBA) merchant name, city and state, country, or the point of banking location.

- Transaction date.

- A description of the products or services sold. A description of the products and services and their price, including applicable taxes, must be entered on the receipt in detail sufficient to identify the transaction. If no currency is identified on the receipt, the transaction is considered to have taken place in the currency that is legal tender at the point of sale. If the merchant offers multiple currencies, then the sales receipt must indicate all of the following information:

- Transaction amount in the original transaction currency.

- The converted transaction amount in the currency chosen and agreed to by the cardholder and the merchant (the sale total).

- The currency symbol of each.

- The method by which the currency agreed to by the cardholder was converted from the amount in the merchant’s local currency.

- An imprint of the card. A legible imprint of the card must be made on the receipt, or the merchant may electronically record the customer’s card information and the merchant location. If a transaction is completed without obtaining a card imprint or electronically derived card information, the merchant must note legibly on the receipt sufficient detail to identify the cardholder, the merchant, and the card issuer. This information must include at least the name and address of the merchant, the name or trade name of the card issuer as it appears on the face of the card, the account number, the security code, the expiration date (or dual date), the cardholder name, and any company name. If the transaction is completed without obtaining a card imprint or electronically derived card information, the merchant is considered to have verified the true identity of the customer as the cardholder.

Mail orders, telephone orders, pre-authorized orders and e-commerce orders, may be completed without a card imprint. - The cardholder’s signature (required on merchant copy only). In a face-to-face environment, unless the cardholder uses a personal identification number (PIN), the cardholder must sign the sales receipt. Once a signature is obtained, the merchant must:

- Compare signatures. Unless the cardholder uses a PIN, the merchant must compare the signature on the sales receipt with the signature on the card to determine whether they appear to be the same. In particular, the first initial and spelling of the surname must match.

- Discrepancy between signatures. If the merchant believes that the signature on the card does not match the signature on the sales receipt, the merchant must contact the processing bank for instructions.

- Signature not required. Transactions based on mail orders, telephone orders, pre-authorized orders, electronic commerce orders, Guaranteed Reservations, Advance Resort Deposits and Express Checkouts may be completed without the cardholder’s signature (more on that in a bit). The merchant must type or legibly print on the signature line of the sales receipt the letters “TO”, “MO”, “PO”, “EC”, “Guaranteed Reservation / No Show,” “Signature on File / Express Check-out,” or “Advance Deposit” as appropriate.

- Compare signatures. Unless the cardholder uses a PIN, the merchant must compare the signature on the sales receipt with the signature on the card to determine whether they appear to be the same. In particular, the first initial and spelling of the surname must match.

- Authorization approval code (except on credit receipts). If the card issuer has approved the transaction authorization request, unless the transaction is an offline chip-read transaction, the authorization number must be entered on the sales receipt. If more than one authorization is obtained over the course of the transaction (as may happen for hotel, motel, or vehicle rental transactions), all authorization numbers, the amounts authorized, and the date of each authorization must be entered on the sales receipt.

- Merchant’s signature on credit receipts only.

- Primary account number (PAN). The primary card account number must be truncated on all cardholder-activated terminal sales receipts. Subject to local and federal laws, primary account number truncation is permitted on any other sales receipt type. It is recommended that only the last four digits of the primary account number be printed on the receipt. Truncated digits should be replaced with fill characters such as “x,” “*,” or “#,” and not with blank spaces or numeric characters. The name and last four digits of the card’s account number must match those printed on the receipt.

- Delayed presentment. When the merchant obtains approval for delayed presentment, the authorization number and the words “Delayed Presentment” must be noted legibly on the sales receipt.

- Cardholder identification. For unique transactions processed in a card-present environment (with the exception of truck stop transactions and card-read transactions where a non-signature CVM is used), the merchant must include on the sales receipt a description of the unexpired, official government document provided as identification by the cardholder, including any serial number, expiration date, jurisdiction of issue, customer name (if not the same name as embossed on the card), and customer address.

- Transaction certificate. The transaction certificate is not required on the sales receipt. However, if the processing bank chooses to record the receipt of a transaction certificate on the sales receipt, then the merchant must enter the complete transaction certificate on the sales receipt.

- Prohibited information. The transaction receipt or any other document must not reflect the following information, in any manner and for any purpose:

- The cardholder’s PIN, any part of the PIN, or any fill characters representing the PIN.

- The Card Verification Code (CVC 2, CVV2 or CID), which is a three-digit number located on the back of Visa, MasterCard and Discover cards and a four-digit number located on the front of American Express cards.

Each receipt must clearly identify the transaction as a retail sale, credit or cash disbursement.

When Is a Receipt not Required?

Small purchases, particularly those of $25 and less, make up a significant share of all consumer card spending and the major U.S. card networks have all decided to make them easier to process and have developed programs to make that possible. Visa’s Easy Payment Service, MasterCard’s Quick Payment Service, American Express’ No Signature Program and Discover’s No Signature Required Program allow most U.S. merchants to complete small-ticket transactions without having to obtain their customer’s signature on the sales receipt, which they also don’t need to print, unless that is explicitly requested by the customer. Although these programs differ from one another in some ways, they are similar enough, so that we can review them collectively.

1. Who can participate? More than 98 percent of U.S. Merchant Category Codes (MCC) can accept cards without the need for a customer signature. Moreover, a receipt is only generated at the customer’s request. Rather than list the qualified business types, it is easier to do so for the unqualified one. The major MCCs that are excluded from the no-signature programs are Wire Transfer Money Orders (MCC 4829), Automated Fuel Dispensers (5542), Direct Marketing (5960, 5962, 5964, 5965, 5966, 5967, 5968, 5969), Financial Institutions (6010, 5011, 6012) and Betting (7995). Pretty much all other merchant types are qualified.

2. Which transactions are qualified? Transactions, which qualify:

- Are authorized.

- Are for $25 or less. Visa and MasterCard require no signature on transactions of $50 or less for U.S. merchants in two major category codes: Supermarkets (MCC 5411) and Discount Stores (MCC 5310).

- Include unattended terminals, excluding automated fuel dispensers (AFDs) at gas stations, (for Visa and MasterCard, the threshold here is even lower — $15).

- Include all card types — magnetic-stripe, EMV chip and contactless payments.

- Require POS terminals to read and transmit unaltered magnetic-stripe, chip or contactless payment data.

3. Which transactions are not qualified? These transactions do not qualify for the no-signature programs:

- Fallback transactions — these occur when an EMV-enabled terminal processes a chip card by reading its magnetic stripe, not its chip.

- Account funding transactions.

- Cash-back transactions.

- Manual cash disbursement transactions.

- Quasi-cash transactions — these are sales of items that are readily converted into cash, such as money orders, deposits, wire transfers, travelers’ cheques, Travel / Money cards and casino gaming chips.

- Prepaid load transactions.

- Transactions involving Dynamic Currency Conversion.

4. Is registration required? None of these programs has any registration requirements. If your business is eligible (that is to say, if it falls into a qualified MCC), just run the transaction as usual, bypass the signature step and ask if your customer would like a receipt.

Image credit: Bit.com.au.

Thanks for the info.