Americans Are Slashing Credit Card Debt and Other Facts

Americans have been in a debt-slashing mood ever since the onset of the financial crisis in September 2008 and they have been especially keen on paying down their credit card balances. The aggregate amount of credit card debt in the U.S. has been continually falling since the collapse of Lehman Brothers. It is now well below its pre-recession level and it has been surpassed by the student debt total for a first time ever.

We’ve been tracking the various credit card statistics in real time on this blog, but I thought that we could all benefit from a summary of what has taken place so far and from some historical perspective. So that’s what I will do in this post.

Facts about Credit Card Debt

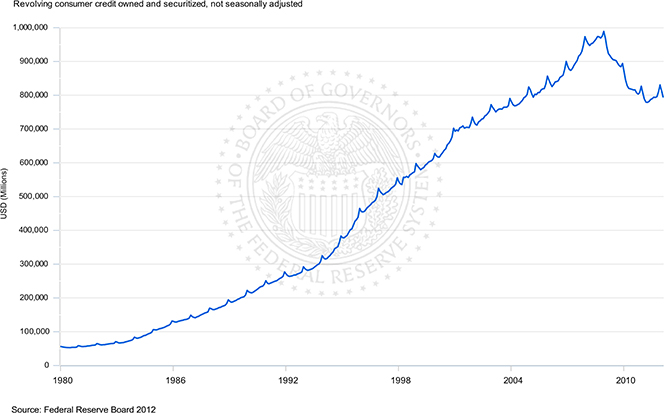

1. Credit card debt. According to the latest available data from the Federal Reserve, the total outstanding revolving credit in the U.S. — comprised almost exclusively of outstanding credit card balances — at the end of February was $798.6, which is lower by 17.97 percent, or $175 billion, than the $973.6 pre-crisis high. Here is the trajectory of the revolving debt category, going back to 1980:

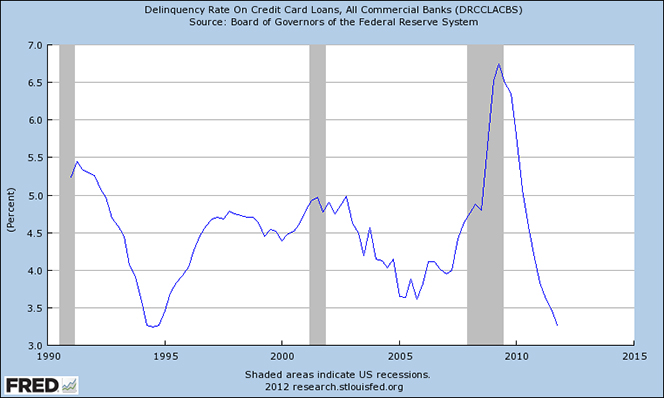

2. Credit card delinquencies. The fall in credit card delinquencies — both early- and late-stage — has been even more impressive. Already at an all-time low, the late-stage delinquency rate — payments late by 30 days or more — is set to dip even further, pushed downward by the declining early-stage rate. Here is the trajectory of the headline delinquency rate, going back to 1990:

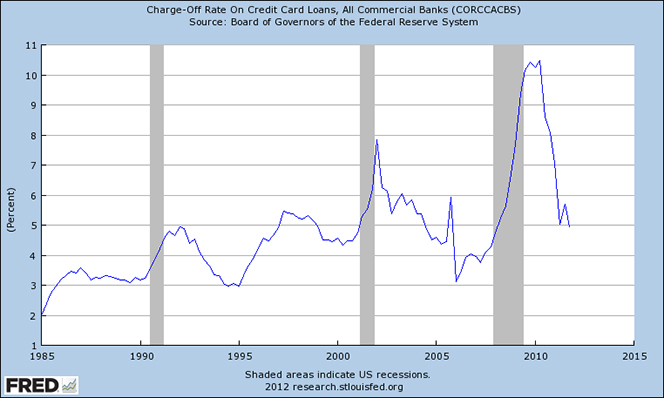

3. Credit card charge-offs. Credit card defaults (or charge-offs) have also fallen significantly from their post-Lehman highs, although their decline has not been quite as impressive as the fall of the delinquency rate. But as the charge-off rate is a trailing indicator for the delinquency one, it will keep falling for months after the late payment rate levels off. Here is the trajectory of the charge-off rate, going back to 1985:

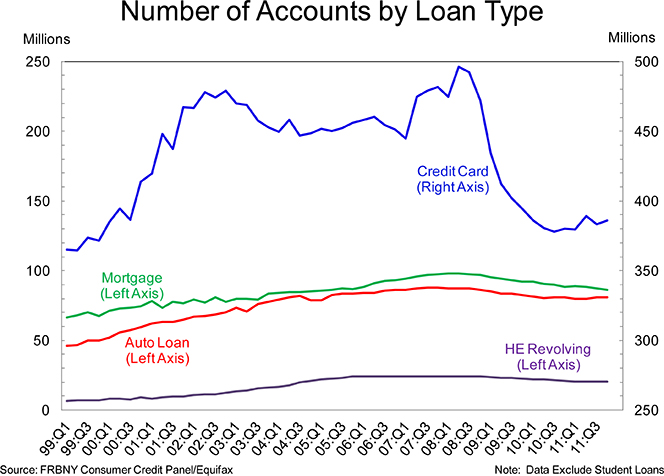

4. Credit card accounts. Card issuers have been increasingly eager to extend new credit to American consumers. The number of active credit card accounts in the U.S., having fallen precipitously in the wake of the Lehman’s collapse, is now on the rebound (albeit a slow one). Here is how the number of active credit card accounts in the U.S. has been changing, going back to 1999 (and note how the growth of the numbers of other types of credit accounts has been affected to a much lesser degree by the crisis):

5. Consumer demand for credit. Americans have started to warm up to credit cards again, with the number of banks reporting stronger demand for credit card loans rising sharply in the second quarter of this year.

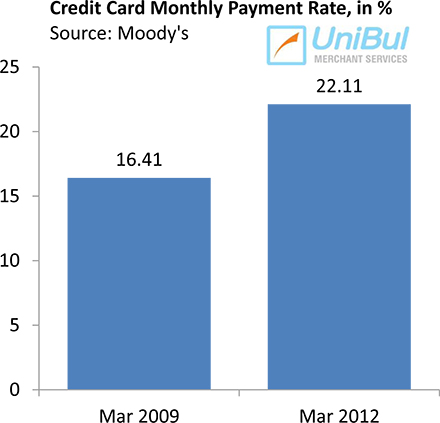

6. Monthly payment rate (MPR). The rate at which Americans are repaying the principal on their credit cards has risen sharply in the past four years. In March the MPR rose to 22.11 percent, an all-time record and a level that is higher by 5.70 percent than the one measured only three years ago. This increase translates into a 35 percent growth in the proportion of principal repaid each month. That is impressive! For a perspective, historically the MPR has hovered in the mid-teens.

The Takeaway

These charts tell a story of a huge shift in the attitude of American consumers toward credit card debt. Paying it off has become a much higher priority in the post-Lehman world than it has been in a very long time and perhaps the statistic that best illustrates that change in attitude is one that I have not visually illustrated here. The early-stage delinquency rate — payments late by 30 – 59 days — has fallen to 0.72 percent, according to Moody’s. That just can’t get much lower!

We don’t know for how long Americans will maintain their newly-developed credit card debt repayment discipline, but as of yet there are no signs of a relapse into the pre-Lehman carefree condition.

Image credit: Uniflick.com.