Credit Card Debt Keeps Falling and Americans Aren’t Done with It

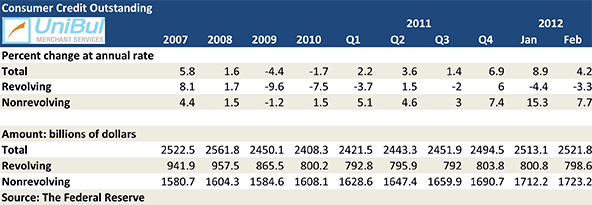

The latest Federal Reserve report on outstanding consumer credit in the U.S. showed a slowdown in borrowing for the month of February. In fact, the aggregate amount of credit card debt in the U.S. fell for a second month in a row, following four consecutive monthly increases (the first time that had happened since the financial crisis began in September 2008). The total was pushed upwards by slower than expected rise in the outstanding non-revolving debt category.

The new data indicate that the growth in credit card borrowing that we saw in the last quarter of 2011 was a blip that was largely attributable to holiday shopping and now we are back to the familiar post-Lehman debt-slashing pattern. That observation is also confirmed by the continuous decline of the credit card delinquency and charge-off rates, which are already at record-lows and keep falling. Moreover, the poor February employment numbers are unlikely to convince consumers that the worst of the crisis is behind us and we can now start spending a bit more freely. So the Great Recession may technically be over, but its aftereffects are very much influencing consumers’ decisions.

Credit Card Debt down 3.3% in February

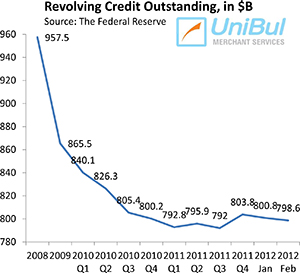

The aggregate amount of outstanding consumer revolving credit, which is made up almost entirely of unpaid credit card balances, fell in February by 3.3 percent, or $2.2 billion, pushing the total down below the $800 billion threshold again, to $798.6 billion. That is only 1.13 percent above the post-Lehman low of $789.6 billion measured in April of last year, which was also the lowest level since October 2004. And it doesn’t seem unlikely that we will break that record sometime in the coming months.

The aggregate amount of outstanding consumer revolving credit, which is made up almost entirely of unpaid credit card balances, fell in February by 3.3 percent, or $2.2 billion, pushing the total down below the $800 billion threshold again, to $798.6 billion. That is only 1.13 percent above the post-Lehman low of $789.6 billion measured in April of last year, which was also the lowest level since October 2004. And it doesn’t seem unlikely that we will break that record sometime in the coming months.

Since the beginning of the financial crisis in September 2008, revolving credit in the U.S. had been falling continually until the end of 2010. However, in 2011 we saw a rise in outstanding credit card debt in half of the Federal Reserve’s monthly reports and in each one of its last four releases for the year. Now, following the consecutive declines in January and February, the total of $798.6 billion is lower by 17.97 percent, or $175 billion, than the $973.6 pre-crisis high.

Overall Consumer Credit Up 4.2%

The non-revolving component of the consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, rose in February. The Fed reported a 7.7 percent rise, bringing the total up to $1,723.2 billion, an increase of $11 billion from January. These are much more modest gains than the ones measured for January when we saw the biggest increase in absolute terms since November 2001.

Non-revolving debt didn’t fall nearly as much as the revolving total in the wake of the Lehman’s collapse and resumed its upward trajectory much sooner. And we now know why. According to recently released data from TransUnion, a credit reporting agency, Americans prioritize the payment of their auto loans much more highly than the repayment of their credit card and mortgage obligations (again, mortgages are excluded from the non-revolving category). Americans would not easily give up their cars, nor could they. The non-revolving total fell by 6.4 percent in August 2011, but it has risen in every other month since July 2010. The current total is higher by 6.54 percent, or $105.8 billion, than the pre-Lehman peak of $1,617.4 billion, recorded in July 2008.

The aggregate outstanding consumer credit in the U.S. — the total of revolving and non-revolving debt — rose by 4.2 percent, or $8.7 billion, to $2,521.8 billion in February, its sixth consecutive monthly increase. The new total is still lower by $66.3 billion, or 2.63 percent, than the all-time record of $2,588.1 billion, reached in September 2008, but will soon surpass it.

The Takeaway

At this point, the fall in the outstanding credit card balances really shouldn’t be coming as a surprise to anyone. Auto loans may be at the top of the Americans’ debt repayment hierarchy, but U.S. consumers are still much more intollerant toward credit card debt than at any time in decades.

In addition to the already mentioned record-low charge-off and delinquency levels, the monthly payment rate (MPR) — the rate at which consumers are repaying their outstanding credit card balances — stood at 20.93 percent in February, according to Moody’s. For comparison, historically the MPR has hovered in the mid-teens. So while credit card spending has been rising (which we know from other data), the high MPR has been pushing the outstanding monthly balances lower.

A back-of-the envilope calculation tells us that, if U.S. consumers had stuck to their pre-crisis credit card debt repayment pattern, the outstanding revolving credit in the Fed’s total would have been increasing pretty much in step with the non-revolving one, if not faster. So I see the decrease as a positive development and all the indications are that we will be seeing more of it in the coming months.

Credit card debt is going down and that is a very good development, one of the few positive side effects of the financial crisis. Unfortunately, student loans are rising very quickly and that is definitely not good, but I just don’t see what we can do about that.

Yes John, student loan totals are growing rapidly and I too don’t see anything short of regulation that could slow down the process.

So that was the biggest miss from expectations in more than six months. Moreover, if we used the Non-Seasonally Adjusted data, this would be the biggest sequential decrease in twelve months (since the dip in February 2011).

This fall in debt comes as a sign that Americans still understand the risks and costs of taking up credit card debt. If this grows into a trend, it would be a huge change from the way consumers spent in the recent past.

Smaller rises in consumer borrowing indicate that U.S. households are continuing to pay off existing debts and / or feel less upbeat about their finances (why would they?). The latest BLS report, as you also point out, showed the economy added fewer jobs than expected in February, indicating that it may take some time before Americans become more confident in taking on more debt.

The Federal Reserve sees this slight rise in spending as a telling sign for how this year will turn out, because spending is what ultimately helps drive the U.S. economy. The credit increase over the past holiday season tells us that Americans actually used their cards to buy gifts ?Çô that much is clear. This was an marked improvement over the past couple of years and indicates that consumers are starting to feel more confident about our economy.

Consumer spending is a major sign for the health of an economy. Americans can’t afford to get into the trap of racking up more debt than they can afford, and especially on their credit cards. If consumers carry a balance on their credit card accounts, the high interest rates issuers are now charging will ruin them financially. If cardholders aren’t able to pay off the whole balance on time at the end of every month, they will start falling into the trap that caused so many troubles during the ongoing Great Recession.

The way I see it, Americans have done a great job in January and February of paying down the debt they accumulated over the holiday season. I hope (and it certainly looks like it) that consumers are finally acknowledging the huge cost of rolling credit card debt over from one month to the next, especially with credit card interest rates being as high as they are.

I think that it is still a bit too early to tell for sure whether or not the rise in the aggregate credit card debt at the end of last year was due to the regained consumer confidence or simply because more consumers needed to use their credit cards to make ends meet. I guess we’ll have to wait and see. If the delinquency rate begins rising in the coming months, it will indicate that it was the latter.

Ellie,

I agree that we should wait before making sweeping conclusions, but it surely looks like consumers are lacking a great deal of confidence. Also, there nothing to suggest that we should expect any significant rise in delinquencies in the coming months.

As the economy is gradually improving, credit is becoming more readily available, so it makes sense that consumers are using more of it, of course as long as they don’t run it up like they did before the housing bubble burst. The lesson should be that we should all be spending less than we earn, it is really that simple.

If I’m not very much mistaken, most economists call what we are going through “deleveraging.” We may also call it getting out of debt, it’s much simpler. And you know what, whatever you want to call it, it is a good thing. It took a huge financial crisis to teach us, but hey, better learn it this way than not learn it at all.

I read on Bloomberg that, while credit card borrowing keeps falling, student loans are going in the other direction, rising in February by $300 million to $453.3 billion. While that total is still way below the credit card total, it is nevertheless a huge amount. Perhaps you would want to pay closer attention to this consumer debt category on your blog?

The ultimate goal is to not have a score at all. Sure you MIGHT pay a liltte more for insurance, but you WILL save a lot more by not living over your means and paying interest. When your brother files for bankruptcy and loses everything, which is just a matter of time, he will realize that having a high credit score was only a trap. Don’t go there. What is best, wealth or ego?FICO was designed to help the credit industry-though not very well-not the individual. It is an I love debt score, nothing more.