Student Debt Is Growing at an Accelerating Rate and Other Facts

Student loans have received plenty of attention in recent months, and for a good reason. The aggregate amount of student debt in the U.S. has now surpassed both the credit card and auto loan totals and keeps growing, even as the other debt categories are still shrinking. Moreover, it turns out that college debt is a problem for borrowers of all ages, including for consumers in their sixties.

As we’ve never covered the student debt issue on this blog in much detail before, I thought that we should start by giving you the straight facts. So here they are.

Student Loan Facts

According to the latest available data from the Federal Reserve Bank of New York (FRBNY), the total outstanding student loan balance in the U.S. was $870?ábillion in the third quarter of 2011, up 2.1?ápercent, or 18?ábillion, from the previous quarter. That exceeds the total for credit card balances ($693 billion) and the one for auto loan balances ($730 billion). With the exception of student loans, all types of consumer debt remained flat in Q3 2011. Of the 241?ámillion Americans with a credit report (the FRBNY uses data from Equifax), 15.4 percent had an outstanding student loan on their file.

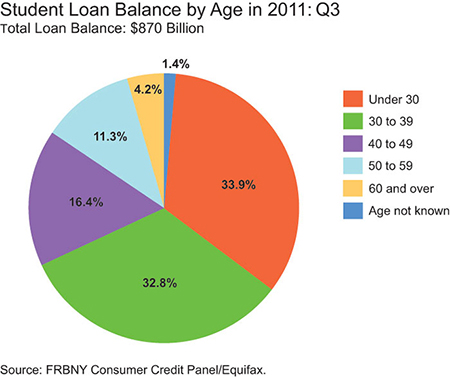

Two-thirds of student loan borrowers were Americans under 40 years old. Here is the distribution:

The under-forty also owed two-thirds of the total outstanding balance ($580 billion of the total of $870 billion). Here is the distribution:

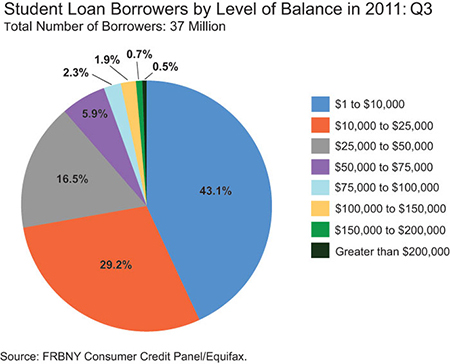

The average student loan balance is $23,300 per borrower. However, the median balance is only $12,800, which means that a small number of borrowers owe much larger balances. In fact, about ten percent of all borrowers owe more than $54,000 and a quarter of borrowers owe more than $28,000. Here is the distribution:

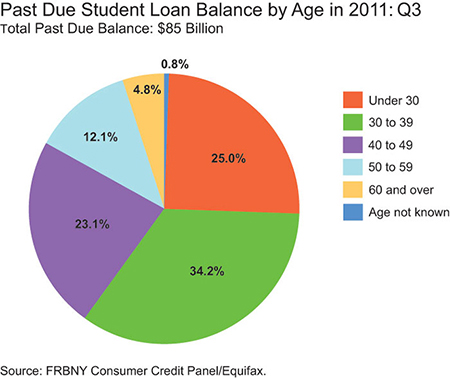

A very high ratio of student loan borrowers — 14.4 percent — had at least one past due student loan account in Q3 2011. In aggregate, $85 billion, or 9.8 percent of the total, were delinquent. By contrast, credit card delinquencies now stand at 2.86 percent, an all-time low. Here is how past due student loan balances were distributed among age groups:

How Did We Get Here?

The very fast rate of growth of student debt is a recent phenomenon. In fact, until 2004, student loan balances grew in step with the rest of the household debt. Here is the chart going back to 1999:

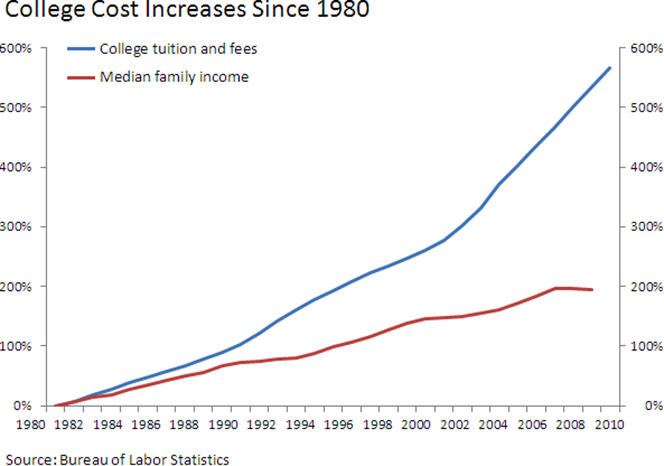

The rise of college costs, on the other hand, began to outpace the growth of the median family income much earlier than that. More alarmingly, the gap between the two has been growing bigger at an accelerating rate, as you can see in the chart below:

The last two graphs seem to indicate rather strongly that Americans had not much difficulty coping with the rising cost of college tuition and fees up until 2004, but not after that. And looking at the rate of growth of college cost post-2004, we can easily understand why.

The Takeaway

Even the slightest glance at the numbers reveals that the current rate of growth of college costs is clearly unsustainable. Yet, that rate is still accelerating, even as the growth rate of the median household income has fallen in the aftermath of the financial crisis of 2008. Even if college costs stopped growing today, which will not happen, the already-high student loan delinquency rate is likely to keep rising for some time, damaging borrowers’ credit scores in the process.

The Obama Administration tried to “increase college affordability” by limiting the monthly student loan payments of more than one and a half million current student loan borrowers to 10 percent of their discretionary income (this program will not start until 2014). Additionally, the plan will forgive the remaining debt balance after 20 years of payments. However, these measures are not dealing with the core issue — the skyrocketing college cost — but are designed to alleviate the symptoms. That’s not going to get it done.

Image credit: Wvco.com.

I owe about $50,000 on student loans and am 27 and out of college. I will now be paying off this debt and that seems right to me. I never expected that these loans would have been forgiven when I took them out and only wanted to ensure that my interest rate was reasonable. I now have a good paying job and think that I’ll get through this.

I finished grad school with $42,000 in student loan debt, but couldn’t find a full-time job for 3 years, even though I was looking everywhere. I finally got a job, but as bills pile up quickly making your student loan payments is not always a simple thing to do. I still manage to pay all of my bills and student loans on time every month, but it is getting very very difficult. I can’t imagine buying a house or raising children. As I said, it’s complicated.

Many students graduate with a degree that is simply not useful for any kind of a well-paid job in today’s job market, but end up with $30-60k student debt all the same. Then they go out and find a job, if they are lucky, that pays $35k. I think you get my point here. Parents and college kids need to do a better job of calculating the return on investment of paying for college. If the math doesn’t work out for a given college and degree, they should look elsewhere.

Am I the only one seeing the inflation of the next bubble? We need to pop this one before it’s too late and there should be no bailouts this time. And no, we should make no exception for all of these professors who couldn’t exist in the real-world environment outside of the bubble of their college campuses.

It is all very simple to me. You make a decision to go to college, you make your pick, you sign a piece of paper with the amount of the college loan on it, the interest rate, the repayment amount and all other terms. You graduate some years later and start paying off your loan. Am I missing something? I paid for my education by working my way through college and see no reason others should not be able to do the same. I’m not a superwoman.

I’m a college student who’s worked hard to save some money and studied hard to improve my chances to get a scholarship. So I’m frustrated when I hear some of my peers asking for their student loans to be subsidized or forgiven. I’ve been able to stay out of debt so far, although it has required making some hard financial choices. I was even willing to go to a community college for my first two years of school, to save some money, but fortunately a state school I also applied with gave me enough scholarships to make it affordable. I can go on and tell you of my part-time job and so on, but the point is that if you work hard and make the right decisions, you will be in good financial shape when you graduate.

Paying off student loans, just as any other type of debt, is not rocket science, but it is a skill that everyone should and can learn. There are way too many Americans who do not have good financial skills or try to game the system and the avoid any consequences to themselves. There should be no forgiveness for student loans and no expiration. What we should have instead are low interest rates, especially in the early years after college, when people are trying to find a good job.

Student loans have made it possible for many millions of Americans to get college education and that’s a good thing. However, no one forced anyone to borrow any money to get through college. It is true that many have graduated college with huge amounts of debt and are having trouble repaying them, but that’s often their own fault for choosing useless degrees. Yes, the economy is tough right now and finding a job is not easy, but as every business person will tell you, there always a place for a highly qualified person in the right type of field.

College tuition used to be paid in cash up until the 60s or so when the government got involved and the costs began to rise, because the bill was now being paid by loan originator, and so people cared less if it went up. The loans were the way to raise the percentage of people who went to college, mostly for political reasons. That opened up the gate to people who should have gone to college but had no means, but also opened it up to those who were not dedicated enough to work their way through or work or didn’t qualify for scholarships. Not to mention that it allowed many to go to schools without much of a chance of graduating.

Students today believe that everyone is entitled to a college education and cost is only a secondary issue and financial help and forgiveness should be provided as needed. And this kind of thinking is often encouraged by parents. Well, if we lived in such a world, we would all be forced to pay for these debts eventually and, because the government will be providing a backstop, college will keep rising just as rapidly as your graphs illustrate above. It all reminds me of the healthcare mess we are in.

By the time I graduated from law school I was looking at $150,000 in student debt and I was fine with that, because I had planned for it. I had looked into my options after college and knew exactly what I was getting myself into. My goal when taking each individual class was to improve my job prospects and potential future income. Once I was out of school, I was able to quickly find a well-paid job and am having no trouble repaying my loan. The way I see it, if you graduated with $50,000 in student debt, but can only find a job that pays $40,000, that’s your problem; you should have known better.

Reading through the comments, you can get the impression that college students are just a bunch of spoiled brats who want everything to be given to them for free. Well, how about actually looking at the graphs, before you comment. Unless you are blind, you would see the obvious: college costs are already out of every proportion to family incomes and are growing ever faster. Is that fair? Or if you don’t care about fairness, is that sustainable? Or should we just let the rich educate their children and everyone else find a job at Walmart?

The very high delinquency rate on college loans clearly tells us that college costs are not a priority for borrowers. After all, credit card delinquencies are 3 times lower and as we know auto loans are an even higher repayment priority. This seems to be suggesting that many Americans with believe that their student debt will be forgiven at some point, or at least that not paying it wouldn’t be as damaging as not paying other types of debt. This shouldn’t be allowed to happen, but some help is clearly needed. I think lowering the interest is a good place to start.

College is expensive and that fact should provide powerful motivation to people to think twice before they decide where to go. It is true that in today’s world, nevermind the one of tomorrow, college is pretty much a a requirement to qualify for any kind of a job, but that doesn’t mean that it is an entitlement. College kids should be thought to make sound financial decisions and one of the most important ones they are ever likely to make is selecting the right kind of college. Tuition costs and fees matter, but the likely return in the form of salary post graduation should also be considered. It is never too early to start teaching your kids how to evaluate their educational options.

College expenses have been allowed to increase uncontrollably. Rather than being evaluated against future income and job availability, it has been promoted as a source of higher income, without any actual cost-to-benefit analysis. By making paying for college appear easier, government subsidies have facilitated this process and colleges have taken full advantage of it. But the most damaging outcome is the lowering of the overall quality of our higher education.

Rather than forgiving student debt, Obama should propose a legislation forcing colleges to reduce the cost of tuition. $10,000 a year sounds like a reasonable limit to me. Costs are out of control and this can’t be allowed to go on.

Common sense says the runaway debt and overgrowth of college costs needs to stop right now, before the system breaks down. The debt/college costs feed upon each other like an addiction. This addiction will likely lead our higher education system to nowhere. Like the Great Recession, the unsustainable bubble will burst. Nowheresville is a very ugly place. We need Real Leaders in Government and Education to step up and actually find a path out of the woods. Where are those Leaders now? Where are our Leaders in Business, Government and Education? Why have they disappeared from the planet? Are they the addicts themselves feeding on the bubble? Are they Real Leaders then or just feeders of the system they helped to create? Who will step up? Who will Lead?