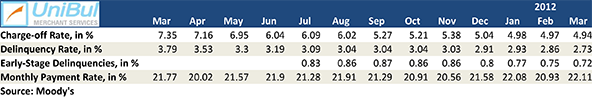

U.S. Credit Card Delinquencies, Charge-offs Fall to New Record-Lows

All major credit card repayment indicators showed improvements in March and three of them set all-time records, according to the latest data from Moody’s. The charge-off rate fell slightly for yet another month and it is now firmly in pre-recession territory. In the late payments category, both the early- and late-stage delinquency rates fell to another all-time low. The biggest improvement was recorded in the monthly payment rate (MPR), which rose by more than a percentage point to its highest level ever.

The news from the six biggest U.S. issuers was mostly positive in March as well. All of them reported lower delinquencies on a month-to-month basis and half of them recorded lower charge-off levels (Chase and Capital One had slight increases and American Express saw no change). Let’s go over the data in a bit more detail.

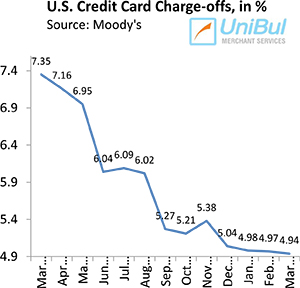

Credit Card Charge-offs Fall to 4.94%

Moody’s reported yet another month of marginally improved credit card charge-offs, which fell by three basis points from their February level. The agency expects the rate to continue its gradual decline for the rest of the year and stabilize at around four percent by early 2013. The current level — 4.94 percent — is lower by 2.41 percent than the March 2011 rate, a decline of 32.8 percent, and is also the lowest one since the second quarter of 2007.

Moody’s reported yet another month of marginally improved credit card charge-offs, which fell by three basis points from their February level. The agency expects the rate to continue its gradual decline for the rest of the year and stabilize at around four percent by early 2013. The current level — 4.94 percent — is lower by 2.41 percent than the March 2011 rate, a decline of 32.8 percent, and is also the lowest one since the second quarter of 2007.

The charge-off (also known as write-off or default) rate is calculated as the ratio of all credit card accounts with delinquent balances that an issuer no longer expect to be repaid by their cardholders, in relation to the total number of open accounts in the issuer’s portfolio. Charged-off accounts are written off of the lender’s books as losses, typically at 180 days after the last payment on the account has been received.

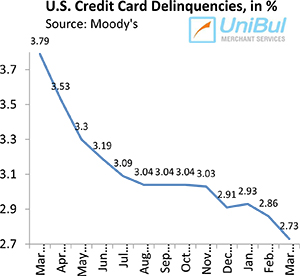

Late Payments down to 2.73% – an All-Time Low

Credit card delinquencies fell by 0.13 percent in March to 2.73 percent. That is the lowest rate ever measured since the ratings agency began tracking the indicator more than two decades ago. It is also the fourth consecutive month in which the rate has remained below the three-percent threshold, which had never been reached before.

Credit card delinquencies fell by 0.13 percent in March to 2.73 percent. That is the lowest rate ever measured since the ratings agency began tracking the indicator more than two decades ago. It is also the fourth consecutive month in which the rate has remained below the three-percent threshold, which had never been reached before.

Moody’s calculates its headline delinquency rate as the ratio of credit card accounts on which payments are past due by 30 days or more, in relation to the total number of open accounts. The agency also keeps track of an “early-stage delinquency rate” for payments overdue by 30 – 59 days. That rate also decreased in March — by three basis points to 0.72 percent — also an all-time low. And Jeffrey Hibbs, Moody’s Assistant Vice President and Analyst, believes that there is still room for improvement:

[S]trong seasonal trends suggest that early-stage delinquencies will continue to fall throughout the spring, setting the stage for even lower overall delinquency rates further out.

If that expectation is borne out, I still believe that Moody’s prediction of charge-offs leveling out at around four percent is a bit too conservative.

Delinquencies Fall at All Biggest U.S. Issuers

All six biggest U.S. credit card issuers reported lower delinquency rates and half of them had lower charge-offs in March. Here are the data:

| ?á |

Charge-off Rate, % of Total |

Delinquency Rate, %of Total |

||

|

February 2012 |

March 2012 |

February 2012 |

March 2012 |

|

|

Bank of America |

5.56 |

5.48 |

3.75 |

3.60 |

|

JPMorgan Chase |

3.97 |

4.17 |

2.42 |

2.34 |

|

Discover |

2.80 |

2.64 |

2.25 |

2.15 |

|

Capital One |

3.84 |

3.85 |

3.62 |

3.25 |

|

American Express |

2.40 |

2.40 |

1.40 |

1.30 |

|

Citigroup |

5.36 |

4.79 |

3.09 |

2.94 |

Here is how the issuers’ March 2012 figures compare to the post-Lehman record-highs in each category:

| ?á |

Charge-off Rate, % of Total |

Delinquency Rate, % of Total |

||

|

Record, %/Month |

Change, % |

Record, %/Month |

Change, % |

|

|

Bank of America |

14.53/Aug 2009 |

62.28 |

8.01/Aug 2009 |

55.05 |

|

JPMorgan Chase |

10.91/Jan 2010 |

61.78 |

4.95/Sep 2009 |

52.73 |

|

Discover |

9.11/Feb 2010 |

71.02 |

5.72/Oct 2009 |

62.41 |

|

Capital One |

10.87/Apr 2010 |

64.58 |

5.80/Jan 2010 |

43.97 |

|

American Express |

10.40/Apr 2009 |

76.92 |

5.30/Feb 2009 |

75.47 |

|

Citigroup |

12.14/Aug 2009 |

60.54 |

6.06/Mar 2010 |

51.49 |

As you can see, American Express has done a better job than its rivals both in absolute improvements, as well as in percentage drops in each category.

The Takeaway

I am amazed at how low the delinquency rates have fallen. And if the early-stage category keeps improving as predicted, which I have no reason to doubt, so will the late-stage one. And as the charge-off rate is a trailing indicator for the delinquency one, it should keep falling until at least the end of the year.

But the best news to come out of Moody’s report is the sharp improvement in the monthly payment rate. The MPR — the rate at which Americans are repaying the principal on their credit cards — is my favorite indicator for gauging the future trajectory of the delinquency and charge-off rates. In March the MPR rose by 1.18 percent from its February level, to 22.11 percent, an all-time high. Moody’s tells us that over the past three years the MPR has grown by 5.70 percent, which is a 35 percent increase in the proportion of principal repaid each month. This record-high, and still rising, MPR reveals just how much the crisis has affected consumer debt management behavior and it is a hugely positive change.