Fraud Prevention Resources

If you have spent any length of time accepting credit card payments, chances are that you have come across a fraudulent transaction or two. Fraud victimizes everyone involved in the credit card process: the consumer whose card information is stolen, the merchant whose product is purchased, the processing bank that facilitates the transaction and the issuer who is charged with protecting its cardholders, to say nothing of Visa and MasterCard who spend millions developing products to help prevent it from happening.

The resources on this page will help you understand credit card processing risk and will suggest ways to mitigate it. The articles below will teach you how to build an effective fraud prevention system, to identify weak spots in it and take actions to correct them.

Understanding Credit Card Processing Risk

![]() What Makes Some Businesses Higher Credit Card Processing Risk than Others

What Makes Some Businesses Higher Credit Card Processing Risk than Others

![]() 10 Suspicious E-Commerce Transaction Characteristics

10 Suspicious E-Commerce Transaction Characteristics

![]() 5 Suspicious Card-Present Transaction Characteristics

5 Suspicious Card-Present Transaction Characteristics

![]() PCI Data Security Standard Compliance

PCI Data Security Standard Compliance

![]() How Processors Manage Merchant Accounts with High Levels of Fraud

How Processors Manage Merchant Accounts with High Levels of Fraud

![]() Understanding Credit Card Processing Risk for Travel Agencies

Understanding Credit Card Processing Risk for Travel Agencies

Fraud Prevention Tools and Programs

![]() Visa Card Verification Value 2 – CVV2

Visa Card Verification Value 2 – CVV2

![]() MasterCard’s Card Validation Code 2 – CVC 2

MasterCard’s Card Validation Code 2 – CVC 2

![]() Using the Address Verification Service (AVS)

Using the Address Verification Service (AVS)

![]() MasterCard’s Site Data Protection (SDP) Program

MasterCard’s Site Data Protection (SDP) Program

![]() Member Alert to Control High-Risk Merchants (MATCH)

Member Alert to Control High-Risk Merchants (MATCH)

![]() Visa’s Account Data Recovery Process

Visa’s Account Data Recovery Process

![]() Merchant Audit: Initiation, Review Process and Consequences

Merchant Audit: Initiation, Review Process and Consequences

Risk Management and Fraud Prevention Guides

![]() eCommerce Risk Management Guide

eCommerce Risk Management Guide

![]() 15 Steps to Managing E-Commerce Risk

15 Steps to Managing E-Commerce Risk

![]() E-Commerce Data Security Best Practices

E-Commerce Data Security Best Practices

![]() How Travel Agencies Can Manage Credit Card Risk

How Travel Agencies Can Manage Credit Card Risk

![]() Validating Cardholder Information in E-Commerce Transactions

Validating Cardholder Information in E-Commerce Transactions

![]() Screening International E-Commerce Transactions

Screening International E-Commerce Transactions

![]() How to Handle a Data Security Breach

How to Handle a Data Security Breach

![]() Fraud Prevention Guidelines for MO / TO Merchants

Fraud Prevention Guidelines for MO / TO Merchants

![]() Managing Credit Card Processing Risk in an E-Commerce Start-Up

Managing Credit Card Processing Risk in an E-Commerce Start-Up

![]() How to Validate Credit Card Numbers in E-Commerce Transactions

How to Validate Credit Card Numbers in E-Commerce Transactions

![]() Managing Risk in Recurring Payment Plans

Managing Risk in Recurring Payment Plans

![]() Managing Credit Card Processing Risk at Car Rental Companies

Managing Credit Card Processing Risk at Car Rental Companies

![]() How to Set up and Use E-Commerce Transaction Velocity Limits and Controls

How to Set up and Use E-Commerce Transaction Velocity Limits and Controls

![]() Understanding Credit Card Processing Risk for Travel Agencies

Understanding Credit Card Processing Risk for Travel Agencies

![]() How to Recover Credit Cards when Suspecting Fraud

How to Recover Credit Cards when Suspecting Fraud

![]() Credit Card Fraud Prevention Guidelines for Airlines

Credit Card Fraud Prevention Guidelines for Airlines

![]() How to Handle Potentially Fraudulent E-Commerce Transactions

How to Handle Potentially Fraudulent E-Commerce Transactions

![]() How to Protect E-Commerce Merchant Accounts from Intrusion

How to Protect E-Commerce Merchant Accounts from Intrusion

![]() How to Minimize Fraudulent E-Commerce Transactions

How to Minimize Fraudulent E-Commerce Transactions

![]() Screening Fraudulent E-Commerce Transactions

Screening Fraudulent E-Commerce Transactions

![]() How to Build and Use an Internal Negative File

How to Build and Use an Internal Negative File

![]() Verifying Signatures in Credit Card Transactions

Verifying Signatures in Credit Card Transactions

![]() Authentication of E-Commerce Credit Card Transactions

Authentication of E-Commerce Credit Card Transactions

![]() Managing Passwords for E-Commerce Website Accounts

Managing Passwords for E-Commerce Website Accounts

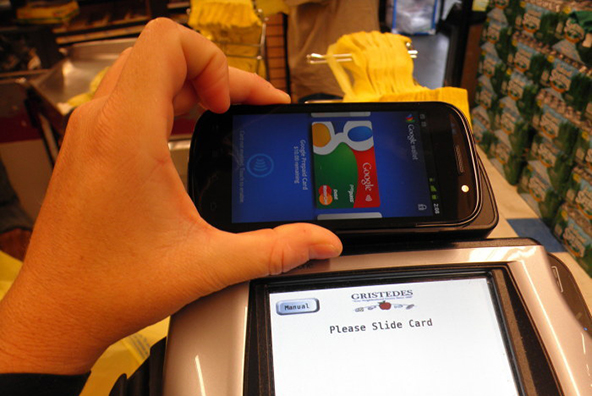

Image credit: Naver.com.

Great list of resources. Very useful. Thank you!