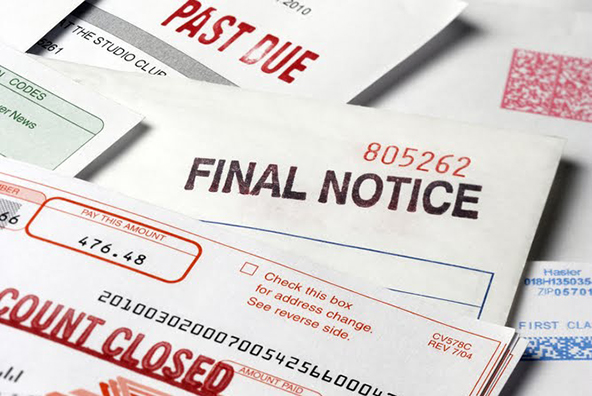

How to Handle Charged-off and Delinquent Accounts

The latest figures released by Fitch Ratings, a credit ratings agency, show that credit card charge-offs surged 1.12% in January to reach 11.37%, the highest level since a record 11.52% in September of last year. Charged-off are credit card loans that issuers don’t believe will be collected and have written off their books as losses. Typically, an account is charged off 180 day after the last payment was received. The same report shows that in January payments that were 60 or more days late were at 4.50%, while those 30 days late stood at 5.72%. These are extremely high levels, but how exactly are consumers affected by delinquent and charged off accounts?

Both delinquent and charged-off accounts are listed as derogatory items on your credit report and affect your credit score. Delinquent payments will reduce your score, but will not have a lasting effect if you resume making payments on time and convince creditors that the odd late payment was an aberration. That is not to say that you shouldn’t be all that concerned with making payments on time. On the contrary, you should, because consistency and honoring the contract terms will help you get the highest possible credit score and lowest interest when you need a loan.

Charged-off accounts present a much bigger challenge and leave a much more lasting effect on your credit history. A single charged-off account can be enough to prevent you from obtaining any form of credit and can hurt your employment prospects. It remains on your credit report for at least seven years and destroys your credit score. Moreover, you are still responsible for the debt after it has been charged off and the lender or a collection agency can still attempt to recover it. The credit reporting agencies report charged off accounts as “negative accounts,” often listing them under “collection accounts.”

The best way to deal with charge-offs is to settle them with your creditor at the earliest opportunity. Remember that the creditor has already written off your account as a loss, so they will be willing to negotiate and accept a settlement for less than the full amount, as little as 50% or less in many cases. Now that you have negotiated a settlement, how does that reflect on your credit history?

Once you settle your debt, the negative information will not be automatically deleted from your credit report. What will change is that your account will be reported as “paid in full” (even if you had settled for less than the full amount), which immediately improves your credit worthiness in the eyes of your prospective lenders.

The best course of action that you should follow, once you settle a charged-off account, would be to:

- Obtain a letter from your creditor stating that you have paid the account in full and they are required by law to issue such a letter.

- Send a copy of this letter to each of the national credit bureaus: Experian, Equifax and TransUnion. Under the Fair Credit Reporting Act (FCRA), the bureaus are required to update your report within 30 days.

- If the information is still not updated after 30 days, the FCRA requires that the account is deleted from your history, which is the best possible outcome for you.

According to FICO, the maker of the most popular credit score, their scores are comprised of the following components:

- Payment history accounts to 35% of the score.

- Amounts owed — 30%.

- Length of credit history — 15%.

- New credit — 10%.

- Types of credit used — 10%.

With that in mind, the following tips will help you improve and maintain your credit score:

- Always make your payments on time, at least the minimum.

- Keep your credit card account balances as low as possible or, better yet, pay them off each month.

- Add new and different types of credit, such as an installment loan, which shows creditors that you can handle regular monthly payments.

Image credit: Wildelori.blogspot.com.