E-Commerce Transaction Settlement

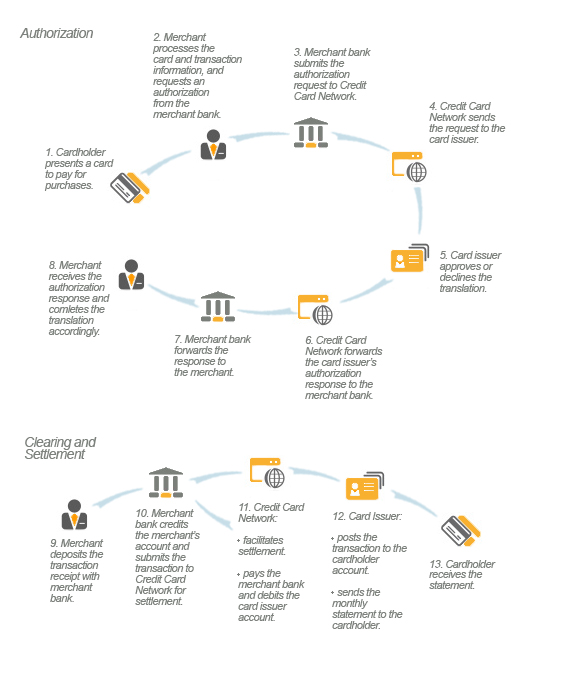

When a cardholder uses a credit or debit card for payment, the processing bank reimburses the merchant for the transaction’s amount, after subtracting its processing fees. The processor then clears and settles those funds by presenting the transaction to the card issuing bank. Clearing is the exchange of transaction information between the processing bank and the card issuing bank, through Visa’s or MasterCard’s payment systems. Settlement of a card payment is the process of exchanging funds between the card issuer and the processor to complete a cleared transaction.

The clearing and settlement of a card transaction are facilitated through an interchange, which is the electronic infrastructure that Visa and MasterCard set up to process financial and non-financial transactions between their member banks. The clearing and settlement of a transaction occur simultaneously. The settlement process may vary slightly from one processing bank to another but it generally goes through the following stages:

- When a service has been provided to a customer or a product has been shipped (in card-not-present transactions, the transaction date is the date on which the product has been shipped), the merchant captures the transaction’s payment information and submits it, together with all other transactions captured this day (forming what is known as a “batch“), to its acquiring bank (processing bank) for settlement.

- The processing bank then submits the transaction information to the Credit Card Association (Visa or MasterCard) whose card was used for settlement.

- The Credit Card Association sends the transaction information to the card issuer and then settles it by crediting the merchant processing bank’s account and debiting the card issuer’s account. The amount that is debited from the card issuer’s account is equal to the transaction amount, minus the interchange fees (the processing fees, established by Visa and MasterCard, which processing banks pay to card issuing banks). The amount credited to the processing bank is equal to the transaction amount, minus interchange, minus the association fee (the fee that Visa and MasterCard charge for facilitating every card transaction).

- The processing bank receives its funds, usually within 24 hours of the transaction, and credits the merchant’s account, usually within 48 hours of the transaction. The merchant receives an amount that is equal to the amount credited to the processing bank’s account, minus payment processing costs (the rates and fees that the merchant has agreed to pay for card processing services).

- The card issuer posts the transaction information on its cardholder’s account and sends a monthly statement. The cardholder has the option to pay the full amount or a lesser amount, but no less than a minimum amount, established in the cardholder agreement. If the cardholder chooses to pay an amount, lesser than the full amount, the remaining balance will be charged an interest rate.

Image credit: Lifelock.com.