Americans Keep Paying down Old Debt, Get More New Credit

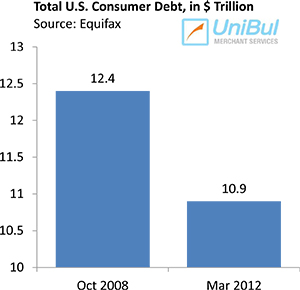

That is the thrust of Equifax’s National Consumer Credit Trends Report for March. The report is consistent with other data that have shown a continual improvement in the health of Americans’ finances over the course of the past couple of years and an easier access to new credit. We learn that, overall, the aggregate amount of consumer debt in the U.S. at the end of the first quarter of this year was lower by 12.1 percent from its peak level reached in 2008 and keeps falling, even as consumers are once again beginning to take on more new credit.

While there has been an improvement in all consumer credit segments, the biggest gains have been registered in the various credit card debt management categories. The aggregate amount that consumers owe on their credit cards is well below its pre-recession high, delinquencies are at an all-time low and defaults are at a five-year low. Let’s take a look at Equifax’s numbers.

Americans Keep Paying down Old Debt

Total consumer debt at the end of March of this year stood at $10.9 trillion, down from its October 2008 peak of $12.4 trillion, according to Equifax. Credit card debt has fallen by $8 billion on a year-over-year basis to $532.8 billion, following a $54 billion decrease a year ago. The available bank card credit – the difference between credit limits and outstanding balances – has grown to $1.9 trillion, the highest level since September 2009.

Total consumer debt at the end of March of this year stood at $10.9 trillion, down from its October 2008 peak of $12.4 trillion, according to Equifax. Credit card debt has fallen by $8 billion on a year-over-year basis to $532.8 billion, following a $54 billion decrease a year ago. The available bank card credit – the difference between credit limits and outstanding balances – has grown to $1.9 trillion, the highest level since September 2009.

Equifax doesn’t offer detailed data on credit card delinquencies and charge-offs, telling us instead that they “were well below pre-recession levels and the lowest in five years.” The latest data released by Moody’s corroborates this claim. At the end of March, according to Moody’s, the credit card delinquency rate stood at 2.86 percent — the lowest ever measured by the ratings agency — and the charge-off rate was at 4.94 percent — the lowest one since the second quarter of 2007.

Student and auto loan default and delinquency levels have also improved, even as both the number and aggregate amount of new loans increased in both categories. It has to be noted, though, that the average amount of a new student loan fell rather sharply — by 20 percent — from its March 2011 level to $4,548, which is the first decline in three years.

What Does It Mean?

Here is how Amy Crews Cutts, Equifax’s Chief Economist interprets the data:

Lower delinquency rates and fewer write-offs coupled with the growth of new credit across multiple sectors clearly outlines the increased activity of consumers and their renewed faith in the marketplace heading into the second quarter. Aside from Home finance, which will require a longer recovery time due to long foreclosure process, the data reflects the improving U.S. economy as consumers explore new financial options and exercise due diligence in repaying their existing debts.

I would add that the ongoing decline of the delinquency and charge-off rates of all consumer debt categories represents a significant shift in consumer attitude toward debt. Americans are focused on paying down existing debt to a much higher degree than they have been in recent memory and are only interested in taking out new loans if they believe they can afford them (student loans are somewhat different in that respect, but even there the average loaned amount has fallen sharply, as we saw). It is telling that, even as credit card delinquencies are now at an all-time low, the repayment of credit card debt is not even Americans’ top debt repayment priority. That distinction belongs to auto loans.

The Takeaway

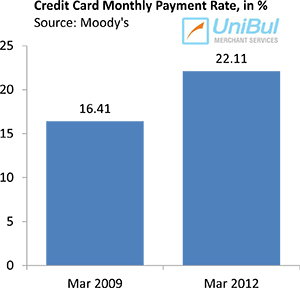

Equifax’s latest data confirm that the consumer debt deleveraging process that began at the onset of the financial crisis in September 2008 is still very much in progress. And this is a trend that encompasses all debt categories. However, as this blog is almost exclusively concerned with bank card-related issues, let me bring up another metric from our industry, which, I believe, best illustrates the current trend: the monthly payment rate (MPR) — the rate at which consumers are repaying the principal on their credit card debt.

Equifax’s latest data confirm that the consumer debt deleveraging process that began at the onset of the financial crisis in September 2008 is still very much in progress. And this is a trend that encompasses all debt categories. However, as this blog is almost exclusively concerned with bank card-related issues, let me bring up another metric from our industry, which, I believe, best illustrates the current trend: the monthly payment rate (MPR) — the rate at which consumers are repaying the principal on their credit card debt.

In March, the MPR stood at 22.11 percent, as measured by Moody’s, an all-time high. The agency tells us that the current level is higher by 5.70 percent than the one recorded only three years ago, a 35 percent increase in the ratio of principal repaid each month. Historically, the MPR has hovered in the mid-teens. Moreover, the already-record-high MPR is still rising and that tells us just how much consumers have adjusted their debt management behavior in the post-Lehman world. And again, credit card debt repayment is not even Americans’ top priority.

Image credit: Etsystatic.com.

Equifax’s data is not trustworthy. Foreclosure and bankruptcy data can be used to say pretty much anything. The debt is going down, but the reality is that the banks are again making windfall profits from people that don’t make payments on time and end up paying far more than the products and services purchased.

I never buy things I can’t afford but I use my credit card every chance I get. Why? The 3% (or more) cash back, which I would not get if I paid cash. Since 2009, with those cash-backs I’ve received I bought a laptop, a Blu-Ray player and I only had to pay $25 extra.

It seems that people are finally starting to get smart about debt and realize they should not be using their credit cards and run up debt they can not afford. This is very good news.

This is true for our family too. Our credit card debt was around 10,000 before the recession. Now we keep it below $4,000, across all of our cards. We didn’t get bailed out and we didn’t default, but we simply kept on paying down the balance.

Many people are now using their debit cards for all their purchases rather than their credit cards and I thing that has a lot to do with the drop in credit card debt. Add to that the limits on debit swipe fees that the banks can charge retailers and I think it won’t be long before the banks start charging fees on consumer’s debit cards.

I think there is data that shows that credit card debt is down mostly because of the record number of bankruptcies that occurred over the past few years, as well as the record number of consumers who just defaulted on their cards.