Americans Pay down Auto Loans before Credit Cards and Mortgages

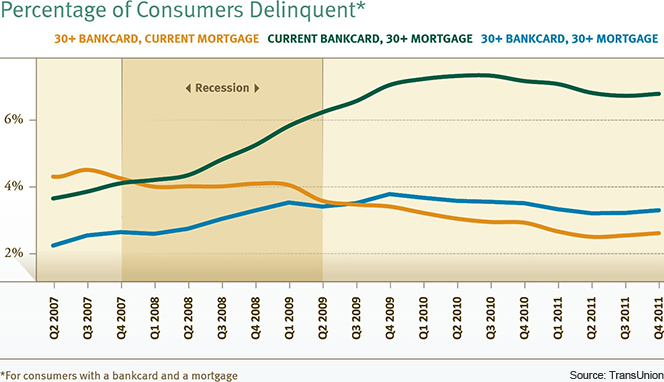

TransUnion has just released the second update to its 2010 Payment Hierarchy study, which has been tracking the changing consumer debt repayment preferences in the post-Lehman world. It tells us that Americans are still far more likely to be current on their credit cards than on their mortgages, which has been the case for the past four years, as seen in the graph below.

However, it turns out that neither of these debt categories is Americans’ top concern. Being current on their auto loans was by a wide margin consumers’ top debt repayment priority in 2011, the new data tell us. Moreover, that was the case in all 50 states, although by varying degrees.

These latest results came as a surprise to many observers who expected that, once the recovery took hold, Americans would again make mortgages their top debt repayment priority, ahead of credit cards and auto loans. Well, that hasn’t happened and the new data seem to be telling us that it will not happen anytime soon.

The Data: Auto Loans Are Paid before Credit Cards and Mortgages

The results from TransUnion’s study are based on data collected in each quarter of 2011 from four million American consumers who had at the time at least one open credit card account, one open mortgage and one auto loan. The study measured the proportion of consumers who were delinquent by 30 days or more on one of these three debt categories, while being current on the other two. Here are the national averages:

- 9.5 percent were delinquent on an auto loan while being current on their credit cards and mortgages.

- 17.3 percent were delinquent on a credit card while being current on their auto loans and mortgages.

- 39.1 percent were delinquent on a mortgage while being current on their auto loans and credit cards.

The payment hierarchy was the same in all states but, unsurprisingly, it was most pronounced in places where the housing bubble grew largest. For example, here are the results for Florida:

- 6.1 percent delinquent on auto loans while current on credit cards and mortgages.

- 11.3 percent delinquent on credit cards while current on mortgages and auto loans.

- 50.0 percent delinquent on mortgages while current on credit cards and auto loans.

By contrast, the respective numbers for Texas, which didn’t have a big housing bubble, were 15 percent, 22 percent and 34.4 percent.

What Determines Americans’ Payment Preferences?

As the Florida / Texas comparison above shows us, there is a direct link between the fall in housing prices in the aftermath of the bubble’s burst and the shifting payment preferences. Tellingly, Florida and California, which experienced the biggest housing bubbles in the U.S., were the states where the trend began. TransUnion tells us that in both states the payment hierarchy shift to prioritizing credit cards over mortgages occurred two quarters earlier (Q3 of 2007) than it did at the national level.

Both in Florida and California the ratio of consumers delinquent on their mortgages while being current on their credit cards has fallen in 2011 from the 2010 peaks. Yet, the payment hierarchy shift has remained just as strong, because the ratio of consumers delinquent on their credit cards while being current on their mortgages has also fallen. So what are we to make of these data? Here is what Matt Komos, a co-author of the study, has to say:

It appears that the shift back to prioritizing mortgage payments ahead of credit cards — or auto loans — may only occur once the housing market has stabilized and begins its recovery and the unemployment situation shows significant improvement. Until that time, based on the last four years of data, it would seem that the current payment patterns will remain status quo.

So the “normalization” process will take years.

The Takeaway

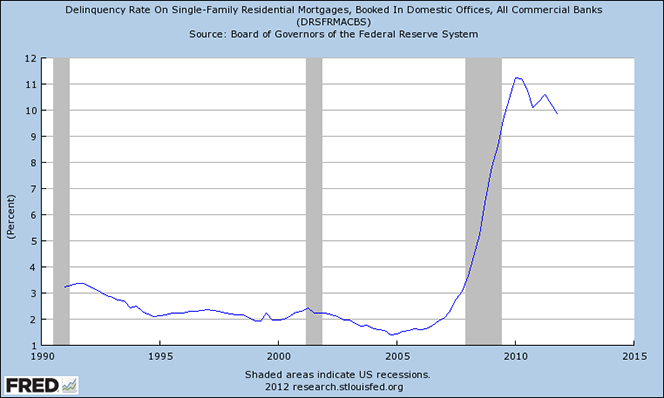

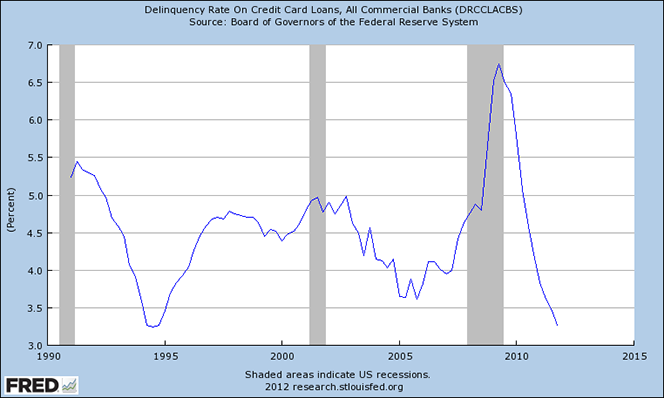

There is another way to illustrate the shift in consumer payment priorities in the U.S. The fact is that both mortgage and credit card delinquency rates have now fallen significantly below their post-crisis peaks. However, while credit card delinquencies are now at a historically low level (and keep falling), mortgage delinquencies are still very, very high by historical standards. The two graphs below drive the point home (source). First, mortgages:

And here is the credit card delinquency graph:

As you can see, mortgage delinquencies have a long way to fall before they catch up with credit cards.

Image credit: Etsy.com.

It all makes perfect sense to me. In America if you don’t have a car you can’t go to work. If you don’t go to work, you can’t make money. If you can’t make money, you can’t pay your credit cards and mortgage. So the payment hierarchy is exactly as it should be.

Lafayette,

That’s a great way to put it and it makes me wonder what the payment hierarchy is in other places, for example in Europe.

Make sure that your credit card never goes over 75% used (1,000 limit ..$750 max) The credit bureaus start penalizing you for any type of revolving credit that maintains a balance of 75% or better. The best way to build your credit up fast is to use your credit car for something small, and then pay it off as soon as you get your bill. Do that for 6 months and there will be a huge improvement in your credit score. Also every time you apply for credit it lowers your beacon score by approximately 7 points, so don’t be a credit seeker. Frequent job changes and address changes also negatively impact your credit score. Hope this helps

The 2 Fed charts say it all: Americans clearly give preference to credit card repayment over mortgages. There is plenty of other data to back up this conclusion. I wish you had posted a similar chart on auto loan delinquencies as well.

Curt,

I probably should have posted a graph on the auto delinquencies, but I didn’t want to have too many of them in this post. You can go to the FRED database for auto loan data.

“It appears that the shift back to prioritizing mortgage payments ahead of credit cards ?Çô or auto loans ?Çô may only occur once the housing market has stabilized and begins its recovery and the unemployment situation shows significant improvement.”

It sounds to me that a re-prioritizing of payment preferences will not happen anytime soon. The housing market seems to be showing signs of bouncing back, but the unemployment rate will be excessively high for some time to come.

Yes, unfortunately we have a long way to go until we get back to anything resembling full employment and not enough is being done to speed up the process.

Thanks for putting the two FRED charts next to each other. It’s amazing to see how credit card delinquencies have climbed all the way up to record-highs and then down to record-lows, while mortgages have also gone all the way up, but have pretty much stayed in record-high territory, rather than fall back down to more normal levels.

Jaylomo,

Yes, the two charts are painting a much better picture than I could do with words. FRED is an amazing tool and I recommend it to everyone!

Fascinating charts that show the various debt repayment dynamics in the U.S. incredibly clearly. It’s truly amazing that, even as credit card delinquencies are at a record-low, Americans are still far more likely to be late on their card payments than on their car loans.

Francois,

Yes, that is a very interesting dynamic.

So if people in Florida and California were the first to begin prioritizing credit card payments over mortgages, did people in states that were the least affected by the bubble were the latest to do it or did they not shift their payment priorities at all?

Terrence,

That is an interesting question, but unfortunately there were no data to help us answer it.