Authorization Process for American Express Transactions

Credit card companies devote significant amounts of time and resources to developing their transaction authorization systems and decision models in an effort to mitigate financial losses and American Express is no different. Between the time an AmEx card is presented for payment and the customer receives the things she purchased, a great deal of information is exchanged, analyzed and processed. A procedure that takes a second or two at the point of sale, is actually a hugely complex process of analyzing each transaction.

American Express maintains a zero-dollar floor limit on all card transactions accepted by U.S. merchants. What this means is that American Express requires that merchants obtain an authorization approval on all transactions before processing them. Let’s take a look at how this is done.

What Is Transaction Authorization?

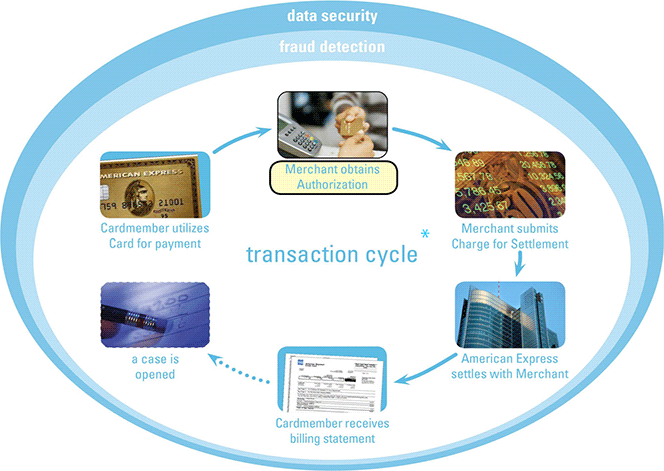

Every card transaction begins and ends with the cardholder and for each one of them the merchant is required to initiate an authorization. The authorization process begins when the merchant sends an authorization request, through her payment processor’s system, to American Express. After requesting authorization, the merchant receives an authorization response, which she uses, in part, to determine whether to complete the transaction. Here is a visual representation of AmEx’s transaction cycle:

The purpose of the authorization process is to provide the merchant with information that will help her to determine whether or not to proceed with the transaction. For every transaction, the merchant is required to obtain an authorization approval, which must be for the full amount of the transaction, except for merchants in the restaurant industry and certain transactions from merchants classified in the cruise line, lodging and car rental industries.

Now, it is important to note that, similar to Visa and MasterCard, an American Express authorization approval by no means guarantees that the transaction is genuine, nor does it protect the merchant against a potential chargeback. AmEx defines the authorization’s purpose as providing the merchant “with information that will help them to determine whether or not to proceed with a Charge.” That is it.

Possible Authorization Responses

Responses to a merchant’s authorization requests are generated by the card issuers and transmitted by American Express to the merchant. Merchants will typically receive one of the following responses to an authorization request, although the wording may vary:

- Approved.

- Declined or card not accepted.

- Please call or referral.

- Pick up.

The merchant should only complete the transaction if the response is an approval.

Obtaining an Authorization

Merchants who process card-present transactions electronically are required to transmit full magnetic-stripe data with their authorization requests through their point-of-sale (POS) terminal. If the POS system is down, the merchant needs to take an imprint of the card to validate its presence and to request a voice authorization. Be advised that voice authorizations are substantially more expensive to obtain.

With each authorization approval, American Express issues a six-digit authorization approval code, which is required for all transactions.

Card Identification (CID) Number

The Card Identification (CID) number is used in card-not-present setting to validate that the cardholder is in a physical possession of the card at the time of the transaction. The CID is part of the authorization process. It is a four-digit number printed on the front of each AmEx card. The CID is the equivalent of Visa’s CVV2 and MasterCard’s CVC 2.

The Card Identification (CID) number is used in card-not-present setting to validate that the cardholder is in a physical possession of the card at the time of the transaction. The CID is part of the authorization process. It is a four-digit number printed on the front of each AmEx card. The CID is the equivalent of Visa’s CVV2 and MasterCard’s CVC 2.

If the CID provided by the customer differs from the one that is printed on the card (and is on file with American Express), the customer should be asked to provide it again. If it doesn’t match again, the merchant should not accept the transaction.

CID numbers, as CVV2 and CVC 2 codes, should never be stored. They are available only for real time transactions.

Authorization Reversal

When a merchant wants to void a transaction that has been successfully approved, the merchant should call the American Express voice authorization center and request an authorization reversal. However, once a transaction is submitted to American Express, it can no longer be canceled or changed.

Authorization Time Limit

An American Express authorization approval is valid for seven days, with limited exceptions. If a merchant submits a transaction to American Express more than seven days after obtaining the original authorization, it is required to obtain a new six-digit approval code before submitting the charge.

Image credit: Wikimedia Commons.