Americans Get More Credit Cards, Keep Paying on Time

That’s the gist of TransUnion’s analysis of how Americans were managing credit card debt in the first quarter of this year. New credit card originations grew substantially in 2011 and the trend has continued in Q1 2012. A larger share of the new cards went to consumers with less-than-stellar credit scores, even as demand among prime borrowers also increased.

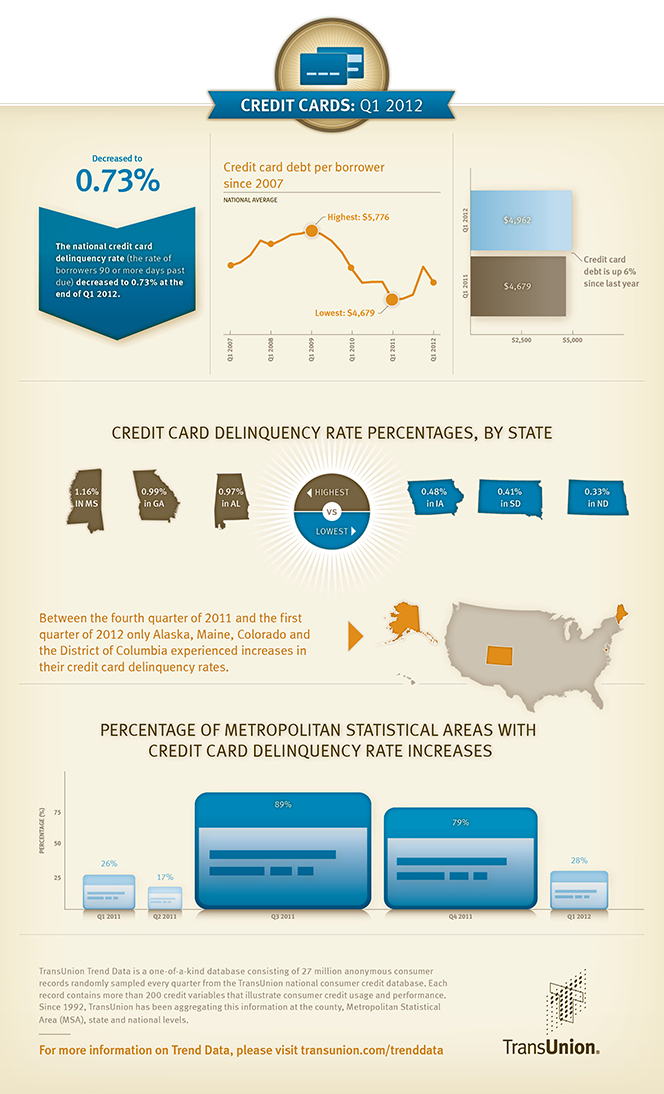

Both the delinquency rate and the average borrower’s indebtedness to credit cards fell on a quarterly basis, following increases in both categories in the previous two quarters, we learn. However, while delinquencies are in all-time-low territory, the average credit card debt has actually risen from its Q1 2011 level. Let’s take a closer look at the numbers.

Americans Get 20% More Credit Cards in 2011

The number of credit card accounts opened in 2011 was higher by 20 percent than the number of accounts opened in 2010, TransUnion tells us. Moreover, while in 2010 only 21.8 percent of the new accounts went to consumers with a VantageScore (a credit score maintained by the three national credit bureaus and ranging from 501 – 990) below 700, that ratio had grown to 24.2 percent in 2011 and was at 24.1 in Q1 2012.

The good news is that the increase in lending to sub-prime borrowers has not led to higher credit card delinquencies. In fact, the rate of late payments has fallen both in 2011 on a yearly basis and in Q1 2012 relative to the previous quarter.

Credit Card Delinquency Rate down to 0.73%

TransUnion reports that the U.S. credit card delinquency rate fell to 0.73 percent in Q1 2012, down from 0.78 percent in the previous quarter, but is virtually unchanged on a year-over-year basis. It is well below the historical averages, we are told.

It is worth pointing out that TransUnion’s quarterly reports are in many ways more valuable than the data we get from the credit card issuers’ monthly regulatory filings, because the credit bureau’s data give us a more comprehensive picture of Americans’ debt repayment behavior. While the issuers calculate their delinquency ratios on a per-account basis, rather than per customer, TransUnion measures it as the proportion of consumers who are late on a payment to any one of their credit cards. Moreover, the credit agency defines a payment as delinquent if it is 90 days or more past due, whereas the issuers use two different time periods: early-stage delinquencies for payments late by 30 – 59 days and late-stage delinquencies for payments overdue by 60 days or more. So TransUnion’s delinquency rate lies somewhere between the issuers’ delinquency and charge-off (default) rates (accounts are typically charged off as losses at 180 days after the date of the last payment).

Mississippi Has the Highest Delinquency Rate, North Dakota – the Lowest

In Q1 2012, only three states and the District of Columbia saw an increase in their delinquency rates. Listed below are the states leading both ends of TransUnion’s table of credit card delinquencies:

1. Mississippi — 1.16%.

2. Georgia — 0.99%.

3. Alabama — 0.97%.

4. Arkansas — 0.97%.

…

47. Nebraska — 0.49%.

48. Iowa — 0.48%.

49. South Dakota — 0.41%.

50. North Dakota — 0.33%.

The biggest year-over-year delinquency decline was measured in South Dakota – 22.64 percent.

Credit Card Debt Slightly Up

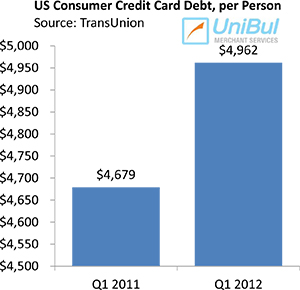

On average, credit card debt per borrower fell by $242 in Q1 2012 on a quarterly basis, to $4,962, but the current level is higher by $283 than the one measured in Q1 2011 — $4,679 — which was the lowest in 10 years.

On average, credit card debt per borrower fell by $242 in Q1 2012 on a quarterly basis, to $4,962, but the current level is higher by $283 than the one measured in Q1 2011 — $4,679 — which was the lowest in 10 years.

Here is the list of the leading states by average credit card debt per borrower on both ends of the agency’s quarterly table:

1. Alaska — $6,801.

2. Colorado — $5,729.

3. North Carolina — $5,626.

4. Connecticut — $5,501.

…

47. South Dakota — $4,251.

48. West Virginia?á– $4,226.

49. North Dakota?á– $3,998.

50. Iowa — $3,893.

The biggest year-over-year decline in credit card debt was recorded in Mississippi — 3.98 percent — and the biggest increase — in New Jersey — 11.75 percent.

The Takeaway

TransUnion’s is only the latest report to show a continuing decline in the nation’s credit card delinquency rate. Moody’s, a credit ratings agency, reported an all-time-record-low delinquency rate in March (measured as the ratio of payments late by 30 days or more) and all six-biggest U.S. card issuers recorded a decrease for the month. Moreover, the ongoing decline of the early-stage delinquency rate (payments late by 30 – 59 days) indicates that the headline rate will keep falling for some more time to come.

TransUnion’s is only the latest report to show a continuing decline in the nation’s credit card delinquency rate. Moody’s, a credit ratings agency, reported an all-time-record-low delinquency rate in March (measured as the ratio of payments late by 30 days or more) and all six-biggest U.S. card issuers recorded a decrease for the month. Moreover, the ongoing decline of the early-stage delinquency rate (payments late by 30 – 59 days) indicates that the headline rate will keep falling for some more time to come.

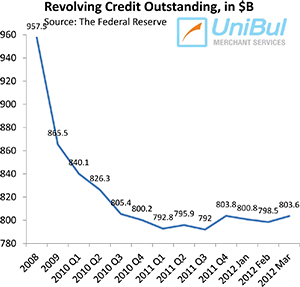

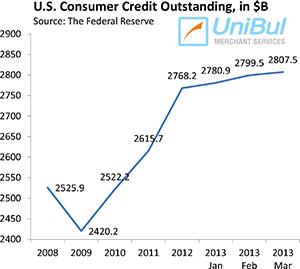

On the other hand, the aggregate amount of credit card debt, having fallen precipitously in the wake of the Lehman collapse in September 2008, seems to have bottomed out and may be on the rise again. The current level — $803.63 billion — is still very close to the post-Lehman low of $789.6 billion recorded in April of last year, but credit is now more readily available and Americans are more willing to use it. The good news is that, even as they are once again spending more freely, Americans are also paying back a much bigger share of the principal than they have done historically.

Here is a nice infographic that came with TransUnion’s report:

Image credit: Jtimothyking.com.

This sub-1% delinquency rate tells you just how terrified people are of carrying credit card debt these days. I don’t see it as a sign of recovery, but as a sign of how bad things have become.

The credit card deleveraging has clearly ended. For about a year now the debt level hasn’t changed significantly and to the extent that it has moved at all, it has increased. And when the delinquencies stop falling, which they will eventually, the credit card debt total will start growing again.

Why are Iowa, the Dakotas and Nebraska doing so much better than the rest of the country on delinquencies and debt? Whatever it is they are doing seems to be working.

Yes, and why is Alaska so far ahead of everyone else in the credit card debt per borrower category? What are these guys spending on up there in the wilderness?

That’s the first time I hear about the VantageScore. There really needs to be a single standard for measuring people’s credit scores. The whole thing is complicated enough and there is no need to make it even more complicated.

I agree, things should be kept simple, although however you measure your credit score the way to keep it high is to pay your bills on time and don’t get in too deep in debt. You do that and you’ll be OK with a VantageScore or FICO.

But these companies make errors more often they they get things right and the more you have of them calculating people’s credit scores, the bigger the mess they create. I agree with John T., there should be one standard and everyone should comply with it.

20% more new credit card accounts in a year… here we go again. Give us a couple of more years at that rate and we’ll be back to where we were in 2008, before the whole thing blew up in our faces.

I don’t see it that way. People are now paying back much more of their debt than they ever have and their finances are getting healthier. Of course, all kinds of things can happen to turn the situation upside down – a Greek collapse comes to mind – but Americans are doing the right thing, for now.

Why bring Greece into this. The data shows that debt has increased since last year, whatever the delinquencies may be. If credit keeps getting easier to come by, debt will keep rising, no Hellenic influence required.

I think people are still getting credit cards just because they can but they aren’t using them. The focus is on debt repayment and rightly so, we have to learn to live within our means.