U.S. Credit Card Delinquencies Fall for 19th Consecutive Month

American consumers continued making their credit card payments on time in August. While the delinquencies kept falling, however, the aggregate U.S. credit card charge-off rate was slightly up.

With the exception of Capital One, whose August delinquency rate was marginally higher than July’s, each one of the other six largest U.S. credit card issuers reported lower or levels of late payments in their latest regulatory filings. The charge-off picture was similar, with four of the issuers reporting lower levels of defaults for the month (the exceptions being Capital One and Citi).

Credit Card Charge-offs Up 0.08 Percent

The aggregate amount of outstanding credit card balances charged off by U.S. issuers increased by 0.08 percent in August from the previous month, to 6.41 percent, according to the latest data from Fitch Ratings, a credit ratings agency. Charge-offs (also known as defaults) are delinquent credit card balances that issuers no longer expect to be repaid and write off (charge off) of their accounts as losses, typically 180 days after receiving the latest payment on the account.

Even as the charge-off rate has risen slightly in August, however, Fitch tells us that it is still 35 percent lower than the level measured a year ago and is now close to the historical average of 6 percent.

Credit Card Delinquencies Fall for 19th Month in a Row

The default rate is expected to decrease further, as delinquencies keep falling. The ratio of credit card payments late by 60 days or more — the late-stage delinquency rate — fell again in August for the 19th consecutive month, according to Fitch. The rate was reported at 2.15 percent, down 0.31 percent from the July level and 52 percent below the peak of 4.50 percent reached 18 months ago.

The early-stage delinquency rate — payments late by 30 – 59 days — also fell in August, to 3.02 percent, down 0.32 percent from July.

Top Issuers Report Lower Charge-offs, Delinquencies

Five of the six largest U.S. credit card issuers reported lower delinquency rates in August and four of them also reported an improvement in their default rates:

- JPMorgan Chase’s delinquency rate fell to 2.48 percent in August from 2.52 percent in July, its lowest level in more than four years. The bank’s charge-off rate fell 0.11 percent for the period to 4.67 percent. Chase’s current charge-off rate is its lowest since September 2008 and is significantly below the peak of 10.91 percent reached in January of 2010.

- Bank of America reported a delinquency rate of 3.96 percent in August, down from 4.05 percent in July. It is the 11th monthly decline and BofA’s lowest delinquency rate in more than five years. The Charlotte, N.C.-based bank’s charge-off rate declined by 0.64 percent to 6.79 percent for the month, more than offsetting the 0.46 percent gain registered in July. While BofA’s default rate is still among the highest in the industry, it is well below the peak of 14.53 percent, reached in August 2009.

- Citibank‘s delinquency rate fell slightly in August to 3.35 percent, down from 3.39 percent in July, the lowest level in four years. Citi charged off 6.92 percent of its cardholders’ credit card balances in August, up 0.28 percent from the July level. Citi now has the highest charge-off ratio among the top U.S. card issuers, although it is way down from the peak of 12.14 percent, measured in August 2009.

- Capital One’s delinquency rate rose 0.06 percent to 3.43 percent in August, which is still 2.37 percent below the January 2010 peak of 5.8 percent. The bank’s charge-off rate also rose, 0.33 percent to 4.1 percent for the month, after reaching in July the lowest level in more than four years at 3.77 percent. Capital One’s highest default rate was measured in April of 2010 — 10.87 percent.

- Discover reported a delinquency rate of 2.49 percent, down from 2.6 percent in July and the lowest level in more than five years. The bank’s charge-off rate for August was 3.6 percent, down from 3.83 percent in the previous month, which marked the first time defaults fell below 4 percent since October 2007. Discover’s charge-off peak of 9.11 percent was reported in February 2010.

- American Express continued to lead its peers in both the default and delinquency categories. The New York-based bank reported a delinquency rate of 1.4 percent in August, down from 1.5 percent in July. American Express’s charge-off rate fell 0.1 percent to 2.7 percent, after rising at the same rate in July. AmEx’s highest charge-off rate – 10.4 percent – was measured in April 2009.

The Takeaway

In addition to making their credit card payments on time at a higher rate than at any time since the Great Recession began, Americans are also paying down larger proportions of their debt. Even though the monthly credit card payment rate decreased by 0.62 percent in August to 21.14 percent, the current level is still about 30 percent higher than the historical average of 16.3 percent.

In addition to making their credit card payments on time at a higher rate than at any time since the Great Recession began, Americans are also paying down larger proportions of their debt. Even though the monthly credit card payment rate decreased by 0.62 percent in August to 21.14 percent, the current level is still about 30 percent higher than the historical average of 16.3 percent.

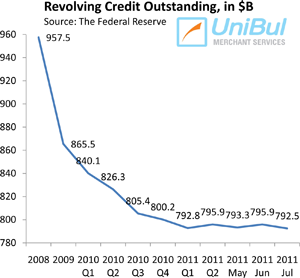

Additionally, Americans are not increasing their credit card borrowing, even as both the number and quality of credit card offers are increasing significantly. The aggregate amount of outstanding U.S. consumer revolving credit, comprised mostly of credit card balances, fell in July by 5.2 percent, more than offsetting the gains registered in the previous two months, according to data from the Federal Reserve.

So all indications are that Americans are both reluctant to increase credit card spending and eager to pay down existing card debt. There is no reason to expect that this trend will not continue for as long as the economy is depressed and unemployment high.

Image credit: Jazzservices.eu.