Issuers Ramp up Credit Card Rewards

Reuters’ Linda Stern has a nice report on the huge ramp up of credit card rewards programs in the run-up to this year’s holiday season. Of course, the current rush to get customers to spend more heavily on their credit cards started months ago and we’ve been tracking its progress along the way on this blog as well.

In her piece Stern does a nice job of documenting the accelerating pace of beefing up credit rewards programs, while asserting that, as we’ve also been saying, it is not the imminent holiday season that’s causing it. In fact, she begins by quoting an expert stating that the recently enacted Durbin Amendment, which limited the amount of the fees issuers can charge merchants for accepting debit cards for payment, has much more to do with it. I agree.

Credit Card Rewards Get Much Better

Stern gives us a preview of a list of “best cards for holiday shopping,” compiled by lowcards.com, a website providing credit card information. It is really impressive. Here are some of the listed rewards programs:

- Capital One Cash offers a 50 percent anniversary bonus on cash earned on purchases in the previous year and a one-time $100 bonus once you spend $500 in the first three months.

- Chase Freedom gives you $200 cash back after you spend $500 in your first three months.

- Chase Sapphire lets you earn 25,000 bonus points after you spend $5,000 in three months.

- Citi Thank You Preferred gives you 10,000 bonus points after $500 in purchases within the first three months, which is good for a $100 gift card.

- Continental Airlines One PassPlus card offers 25,000 bonus miles the first time you use this card, which is enough for a round-trip ticket within the United States and Canada.

There are several other cards on the list offering various types of really attractive incentives. In fact, I can personally testify for the hugely improved quality of card rewards programs. I have just opened up a Chase Ink card that is giving me a $250 cash back bonus after my first purchase. I have never before been offered anything remotely close to that.

So what’s driving issuers to beef up rewards? After all, better rewards programs are costlier for issuers to maintain.

Why Are Issuers Raising Credit Card Rewards?

Rewards programs are indeed costly for issuers. However, the new limit on debit interchange fees is making credit cards a far more profitable revenue source for banks than debit cards. So much so that issuers are evidently willing to pay consumers hundreds of dollars just to open up a credit card account and run the risk that, once the bonus is collected, the account will be closed or unused and will generate a hefty loss, rather than a profit.

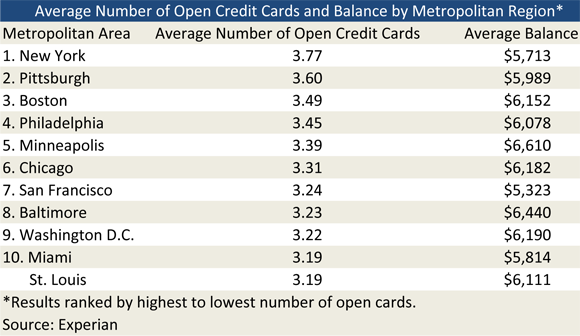

To understand why issuers are willing to take such a gamble, we need to look into the numbers. Let’s compare the profits an issuer can make from transactions involving a debit card and a Visa rewards card.

|

Card Type and Interchange Rate per Transaction |

Issuer Profit per Transaction Amount |

||

|

$25 |

$50 |

$75 |

|

|

|

$0.23 |

$0.25 |

$0.26 |

|

|

$0.59 |

$1.08 |

$1.56 |

As you see, issuers profit a great deal more from credit than from debit card transactions and the difference only grows bigger as the transaction size increases. So banks evidently have calculated that the difference is substantial enough to be worth offering a huge additional incentive to help convince a debit card user to switch to a credit card.

The Takeaway

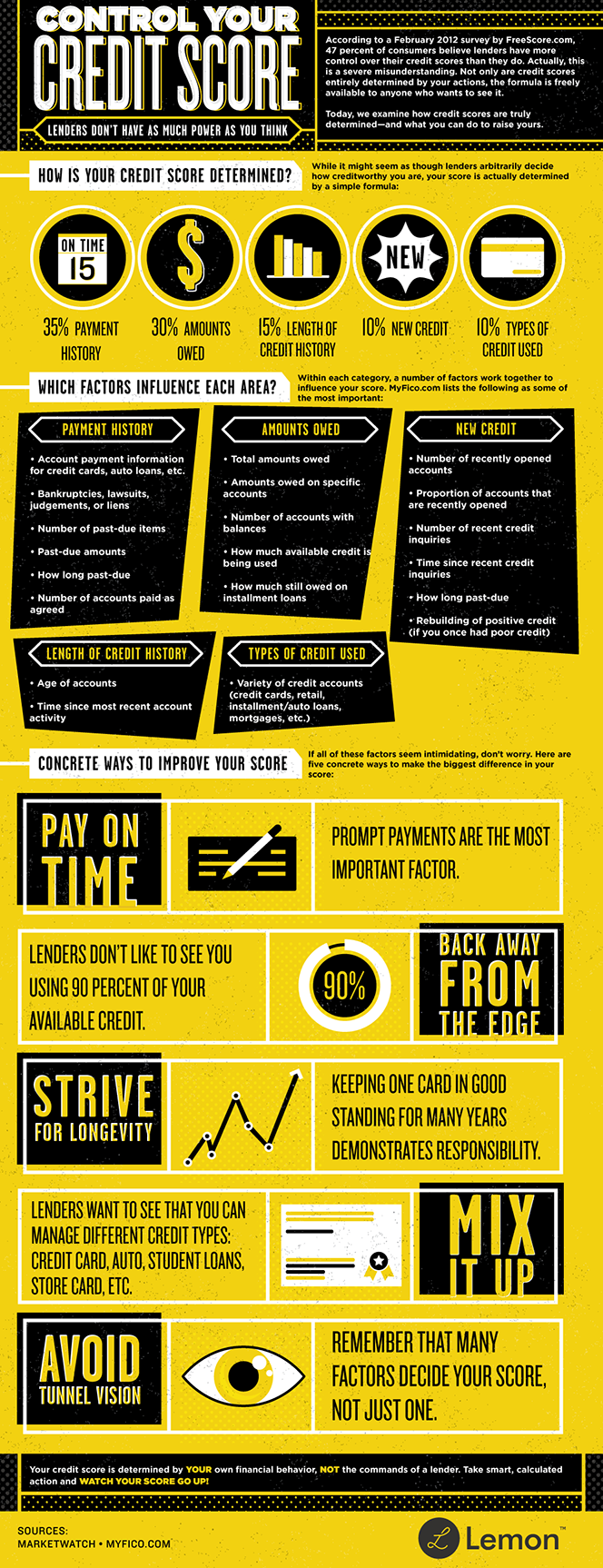

The ramp up of credit card rewards programs currently under way is hugely beneficial for consumers, particularly for those with higher credit scores. In addition to the very attractive sign-up bonuses, many cards also come with improved ongoing reward terms. So you should take advantage of it, if you can.

Merchants, on the other hand, will experience these developments very differently. They fought hard to get debit interchange fees slashed and won. If enough customers switch to credit cards, however, merchants may actually end up being worse off than they were before the Durbin Amendment was enacted, because the interchange fees for rewards cards are much higher than even the old debit interchange fees.

Well, in reality issuers will not be able to convert a high enough number of debit users to realize the above scenario, so on aggregate merchants will still be net winners in the post-Durbin Amendment world. Whatever revenues they cannot recoup through having customers switch to credit cards, however, banks will do in some other way (e.g. pushing prepaid cards, discontinuing debit rewards programs, introducing new or increasing existing bank fees, etc.). So they too will not be net losers. Guess who will end up footing the bill at the end?

Image credit: Simplyfinance.co.uk.