U.S. Consumer Debt Is Down, but so Are Credit Scores

Everyone who reads this blog regularly knows that the aggregate amount of consumer credit card debt in the U.S. has been continuously falling for the past two and a half years. Since the fall of Lehman Brothers in September 2008, Americans have reduced their outstanding credit card balances by a whopping $183.5 billion, from $973.6 billion to $ 790.1 billion, a drop of 18.8 percent. Total consumer debt has also decreased for the period, although not quite as precipitously.

That’s great and I hope that we can keep it up. However, there is a negative twist to the story, as a new report by CreditKarma.com, a company that provides free credit scores to consumers, indicates. We learn that, even as both credit card and mortgage debt are down, so are consumers’ credit scores. How can that be? Shouldn’t we be rewarded for being responsible with credit? Well, yes, but the formulas used for calculating credit scores are a bit more complicated than that. Let’s take a look at why.

U.S. Consumer Debt, Credit Scores Fall

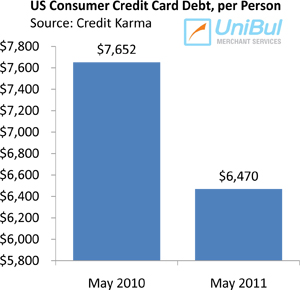

First, let’s see what CreditKarma.com’s Credit Score Climate Report tells us. It provides data for May 2011, with changes calculated on a year-over-year basis. Here are the study’s results for the average debt per person with an account, by category:

First, let’s see what CreditKarma.com’s Credit Score Climate Report tells us. It provides data for May 2011, with changes calculated on a year-over-year basis. Here are the study’s results for the average debt per person with an account, by category:

- Credit card debt is down by 15 percent to $6,470.

- Mortgage debt has fallen by two percent to $172,957.

- Auto loan debt has grown by two percent to $15,217.

- Home equity debt has declined by five percent to $48,310.

- Student loan debt has risen by five percent to $29,680.

Credit Karma does not tell us how the average total debt per U.S. consumer has changed, but it is clear that it has fallen. Yet, average credit scores have decreased by three points nationally to 667. Why is that?

Why Have Credit Scores Fallen?

According to Ken Lin, CEO of CreditKarma.com:

While credit card debt is down, credit scores are also down 3 points. Prolonged unemployment can drag scores down. The poor real estate situation puts additional pressure on credit scores as more consumers evaluate their undervalued property and the decision to keep it.

Yes, unemployment can be a legitimate reason for a credit score drop, but I don’t quite see how the real estate situation can affect it, as lower home prices are not reflected in your credit history; only monthly mortgage payments are.

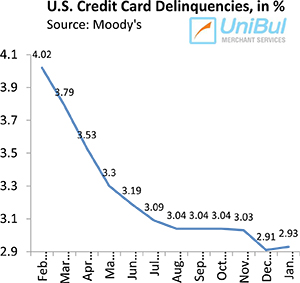

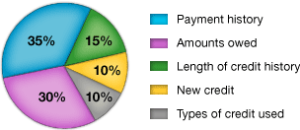

- Payment history. 35 percent of FICO, the most widely used credit score, is based on the consistency of making payments on time. If you don’t make any late payments, your score will improve. Delinquencies have been steadily decreasing in the U.S., so the issue is not here.

- Amounts owed. 30 percent of the credit score is based on the so-called credit utilization ratio, which represents the used portion of the total credit, across all of a consumer’s credit cards. Credit utilization should be kept below 30 percent both for the aggregate and each individual credit card balance.

- Length of credit history. 15 percent of the credit score is based on the credit history and there is not much you can do about it, other than keeping your old credit card accounts open, even if you are not using them. If you closed that old high-rate, no-reward Providian account, as I did years ago, your credit score might have decreased.

- New credit. We all need credit every now and then; it could be an auto loan, new credit card or a mortgage. Make sure you don’t look for credit too often, as every time you apply for an account, a credit inquiry is listed on your credit report, hurting your credit score.

- Types of credit used. Lastly, creditors want to see variety in your report. Most of us have a credit card or three on our credit reports, but we could all use an installment account (e.g. auto loan) or a mortgage to boost our score.

The Takeaway

To find out why the average national credit score has dropped, even as the aggregate consumer debt is falling, we would need more detailed data on how consumers manage their credit accounts.

Still, if you make your payments on time every month and for every account, keep your outstanding balances below 30 percent of your line of credit, keep your oldest accounts open, don’t look for new lending too often and add an installment account (it could be a TV or laptop purchase), your credit score will improve, regardless of whether your home price goes up or down.

Image credit: Kreditkibankov.ru.