Your Credit Card Mail Is not Junk Anymore

You may want to start opening up your credit card mail, before throwing it into the trash bin. You will find that the offers you are getting are much more enticing than they have been in quite some time. That is what the latest data from Mintel Comperemedia, a company tracking direct mail, print and online banner advertising, tell us.

Well, of course there is a twist. Your credit score needs to be high enough to attract the issuers’ attention, but then that has always been the case, only the number is different, depending on where in the business cycle we are.

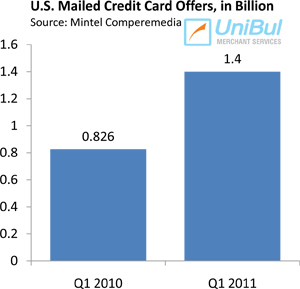

Credit Card Offers Up by 69%

Mintel has calculated a 69 percent jump in credit card offers mailed by U.S. issuers in the first quarter of 2011, compared to the same period of 2010, from 826 million to 1.4 billion. This is still well below the peak of 1.8 billion offers mailed out in the fourth quarter of 2007, but the growth rate is impressive.

About 60 percent of the credit card offers contained some form of incentive and most of them went to Americans with credit scores of 720 or higher. Consumers with lower scores were also getting more offers, only not quite as appealing.

Cash Is King Again

About a quarter (23 percent) of the credit card offers in the first four months of the year featured a cash incentive, according to the report. By comparison, cash incentives were offered in only 1 percent of the Q1 2010 mailings. How do they work? Andrew Davidson, senior vice president of Mintel Comperemedia, explains.

About a quarter (23 percent) of the credit card offers in the first four months of the year featured a cash incentive, according to the report. By comparison, cash incentives were offered in only 1 percent of the Q1 2010 mailings. How do they work? Andrew Davidson, senior vice president of Mintel Comperemedia, explains.

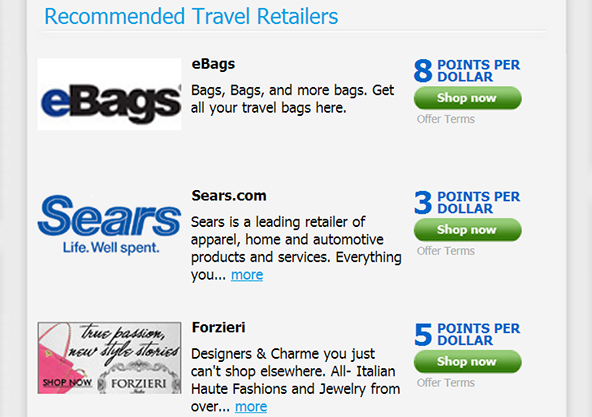

An additional cash incentive, usually triggered upon first purchase or once a cardholder spends a specific amount on the card, has been popular in the competitive cash back card segment… However, we are now seeing cash used as an additional incentive for some mileage cards, as well as cards without rewards.

Chase, the biggest U.S. card issuer, is leading its peers in the incentive department, Mintel tells us. Some of its Freedom card mailings offer $300?áas a cash incentive, while some British Airways Visa Signature cards offer 100,000 bonus miles — the equivalent of two transatlantic or four domestic round-trip tickets. This is quite amazing.

A Growing Trend

Issuers began ramping up their offers as yearly as at the beginning of 2010, after an all-out collapse in credit card mailings in the aftermath of the financial meltdown in September 2008. Globally, mailed credit card offers nearly doubled in 2010, to 2.73 billion from 1.39 billion in 2009, according to Mail Monitor, the credit card mail tracking service of Synovate, another market research firm.

The trend is clearly intensifying, as only in the U.S., which admittedly accounts for as much as 90 percent of all worldwide credit card mailings, the Q1 2011 number of new offers is half the global number for the entire 2010.

The Takeaway

Clearly now is a good time for opening up a new credit card, provided your credit score is high enough to have made you the recipient of one of the great offers issuers have been mailing out. Unfortunately, that will not be the case for the majority of Americans.

The average American had a credit score of 667 in May 2011, according to CreditKarma.com, a provider of free credit scores to consumers. That is three points below the May 2010 average and certainly not enough to warrant a high-incentive credit card offer. What an average credit score may warrant is an offer for a zero-percent interest rate on balance transfers or purchases, which is a pretty good deal as well.

So the bottom line is that everyone will benefit from the new crop of high-quality credit card offers, only to a different extent, which is always the case.

Image credit: Mybanktracker.com.

One Comment