What Every Merchant Ought to Know about Processing MasterCard Transactions

There have been some changes in the MasterCard transaction process since we last examined it and a fresh overview is now in order. Moreover, there are some details that we neglected to include in our previous review of the MasterCard transaction cycle, so we needed to re-examine it anyway.

Keep in mind that, if you know how to accept MasterCard cards correctly, you will pretty much know how to accept all other payment cards correctly. There are some minor differences between the transaction cycles used by the major card companies (Discover and American Express) and Associations (Visa and MasterCard), which you definitely need to be aware of, but the essentials are the same. So let’s get started.

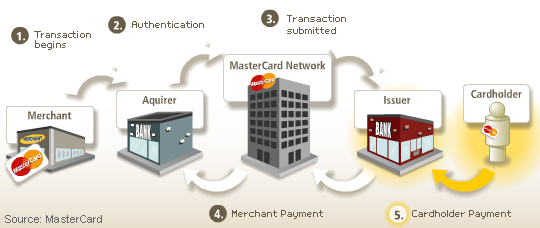

Participants in the MasterCard Transaction Cycle

There are several participants in each debit or credit card transaction:

- Cardholder. Cardholder is an authorized user of the card presented for payment.

- Merchant. Merchant is a business or non-profit entity that has entered into a merchant processing agreement with an acquirer, which authorizes it to accept cards and other electronic payment forms.

- Acquirer. Acquirer is short for acquiring bank (and is also known as merchant bank, processing bank or processor). It is a financial institution that is a member of MasterCard (and usually of Visa as well) that acquires transaction data from its merchant and submits it to the issuing banks for authorization. The acquirer also clears and settles transactions for exchanging funds between issuers and its merchants.

- Issuer. Issuer is short for card issuing bank. It is a member of MasterCard (and usually of Visa) that issues cards bearing MasterCard’s logo. Issuers approve or reject transaction authorization requests. They also bill cardholders and participate in the clearing and settlement processes.

- MasterCard. MasterCard is an association of member banks that licenses its brand to its members and processes payments between acquirers and issuers of MasterCard-branded cards.

MasterCard Transaction Cycle

Following are the stages of the transaction process.

- A card is presented for payment.

- Authentication. The merchant verifies the validity of the card and the cardholder. In a card-present setting, the merchant physically inspects the card for signs of alteration and can request a government-issued ID if in doubt about the cardholder’s authenticity. In a card-absent setting, there are many services that can assist merchants in the authentication process and we have reviewed them in multiple articles before.

- Authorization. In this stage the card issuer approves or rejects the transaction, based on the information provided by the merchant. The possible authorization responses are:

- Approval — the merchant can proceed with the transaction.

- Decline — the merchant should not complete the transaction and ask for an alternative payment method instead.

- Refer to card issuer — the merchant should contact the issuer before completing the transaction.

- Capture card — the merchant should retain the card.

- Valid — used for inquiries (balance inquiries, address verification requests, etc.), this response indicates that the authorization request is not declined. In effect, it is an approval, however there is no actual transaction taking place.

- Clearing and settlement. Although separate processes, the clearing and settlement occur simultaneously. Clearing is the process of exchanging transaction data between an acquirer and an issuer, while settlement is the process of exchanging funds between the two parties. In a typical card transaction, the issuer pays the acquirer the transaction amount, minus the applicable interchange fee. The acquirer then debits the merchant’s account with the amount of the settled funds, minus its own processing fees, which are stated in the merchant agreement.

- Cardholder payment. The issuer, credits its cardholder’s account with the transaction amount. At the end of the month the cardholder makes a payment to the issuer to complete the transaction cycle.

The Takeaway

The merchant is actively taking part in the second and third stages of the transaction process: authentication and authorization. This is where you need to become an expert and it is not so difficult to do so. There are many resources to help you do that and you can find plenty of them on this blog.

If yours is a larger organization, write a policy on authenticating transactions and handling authorization responses. Then train every staff member involved in the sales process on the procedures they need to follow when processing payments. If you do a good job at it, you will see less authorization declines, customer disputes, chargebacks and fraudulent transactions. Which is what you want, right?

Image credit: Wikimedia Commons.