Carriers Open up Mobile Commerce Platform Isis to Visa and MasterCard

For a start-up that is not expected to begin doing business until sometime next year, Isis has been producing plenty of news already. In the latest development of the saga, the joint venture created in November of last year by mobile carriers AT&T, Verizon and T-Mobile has significantly scaled back its original ambitions, we learn from the Wall Street Journal. As a side effect, the newly announced direction the company is taking will greatly benefit consumers. That is if it stands.

How Isis Was Supposed to Work

In addition to the three biggest U.S. wireless carriers, Isis had two other founding members: payment network Discover and British bank Barclays. The goal was to create a nation-wide mobile commerce platform that would allow users to make NFC-based mobile payments at participating merchants.

The start-up was never explicit about the exact set-up of its business structure and apparently for a good reason, as it now seems that its executives may not have had a clear idea of how the whole thing would work. Still, there were bits and pieces that allowed us to make educated guesses.

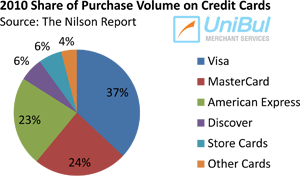

It was initially stated that payments would be processed on Discover’s network, the fourth-largest in the U.S. This automatically excluded all other card brands (i.e. Visa, MasterCard, American Express, etc.) from the venture, as their card payments are processed on their own networks.

Barclays was “expected to be the first issuer on the network, offering multiple mobile payment products,” according to the press release that announced Isis. Now, why Barclays was needed in the first place is unclear, as Discover not only processes but, unlike Visa and MasterCard, also issues its cards. Anyway, that was the plan.

The News: Isis Opens up to Visa and MasterCard

The initial course has now been modified and the Wall Street Journal tells us that “the group [Isis] has adopted the less ambitious goal of setting up a “mobile wallet” that can store and exchange the account information on a users’ existing Visa, MasterCard or other card.”

The initial course has now been modified and the Wall Street Journal tells us that “the group [Isis] has adopted the less ambitious goal of setting up a “mobile wallet” that can store and exchange the account information on a users’ existing Visa, MasterCard or other card.”

Now, if you don’t know how the payment card industry operates, this may seem as no more than a minor adjustment, like flipping a switch or something like that. After all, Isis had planned to work with one payment network anyway, now it would simply add two more in the mix. Well, it is more complicated than that.

See, under the initial set-up, Isis would have been a full-fledged mobile commerce platform, one that would have closed the entire transaction cycle, from the wave of a cell phone at a retail store to make a payment to the settlement of the funds. Most important of all, Isis would have pocketed at least a portion of the processing fees (it was never clear exactly how much) that Discover would have charged participating merchants.

Now the start-up’s service is transformed into a mere “mobile wallet,” much like what rival Sprint is planning. In other words, the cell phone of an Isis’ user will be a repository for credit card information and the start-up will be cut off from the transaction process and incidentally will not be able to collect any portion of the associated fees. Talking about scaling back! How Isis will be making money under the current plan remains to be explained.

The Takeaway: The New Set-up Benefits Consumers

Although presumably reluctantly taken by Isis, the new course promises to be beneficial to consumers. As we have written many times on this blog, the best mobile payments set-up, from a consumer’s point of view, would be one that allows users to select the card they would use with a given m-payment service. That way, we can choose the card with the best rewards program, lowest APR, etc.

The current Isis set-up promises to offer just that, although there is still a lot of time until the start-up gets off the ground and many things can (and probably will) happen in the interim.

Image credit: Isis.

Its about time someone made this possible form mobile phones. I for one cannot wait to have a mobile walllet :-)

Hi, This is nice post you are providing best knowledge about Visa. So we are very thankful to you. You are providing to all people best knowledge.

Thank you for the info!

Excellent article! I appreciate you spending the time and effort to create this content. I appreciate you taking the time and effort to create this informative article. This excellent article will be linked to on our website. Continue your excellent writing.