Submission, Clearing and Settlement of Credit Card Transactions

By accepting credit cards at your store, you become an integral part of the payment processing system, which is why it is important that you develop a clear picture of the card transaction process: what it is, how it works and who participates in it. This basic knowledge will help you understand the major payment processing components and how they affect the way you do business.

We have already written at some length in other posts about best practices for verifying the validity of the card and the cardholder, as well as the authorization of card transactions. In this one I will go over the final three stages of the transaction process — submission, clearing and settlement — and toward the end of the article you will find a detailed graph that nicely illustrates each stage of MasterCard’s payment cycle.

The Card Transaction Process

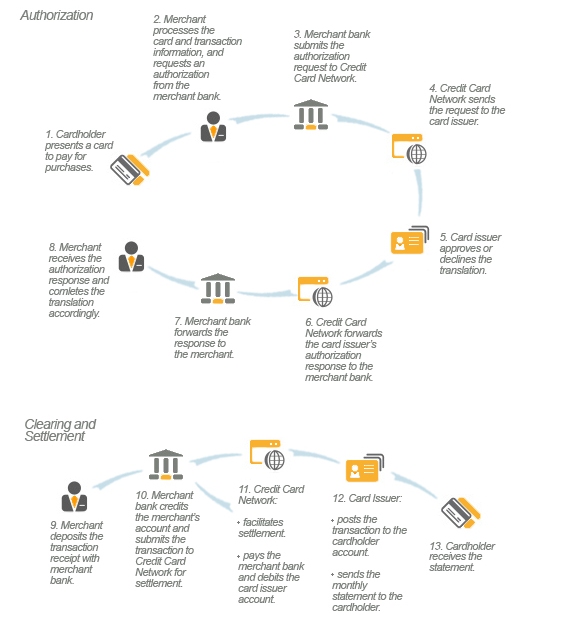

The diagram below represents the stages of the credit card transaction process:

We’ve already dealt with transaction authorization, so let’s move on to the other three stages.

Transaction Submission

Credit card payments are not completed until the transaction information is submitted to the processing bank. Typically transactions are submitted electronically and all point-of-sale (POS) and virtual payment processing systems are programmed to automatically do that at pre-defined intervals, usually at the end of the business day. Exceptions are made for merchants who cannot connect to the processor at the time of the transaction, for example taxis and limousine services, street fairs, etc. In such cases, merchants can submit their transactions on paper.

You should submit all payments accepted during a given day at the end of it, so that if for some reason one of them does not go through, you can contact the customer and request an alternative form of payment within no more than twenty-four hours of the transaction date.

If you cannot deposit your sales at the end of the day, you should within three business days of the transaction date, with some exceptions, as mentioned above. If nothing else, the sooner you deposit your transaction receipts with your acquirer, the sooner you get paid. Transactions submitted into the system more than 30 days after the original transaction date may be charged back to you. Be advised that, for card-not-present transactions (e-commerce and MO / TO), the transaction date is the shipping date, not the order date, so you should not deposit sales before you have shipped the associated items.

Clearing Basics

Clearing is a process through which a card issuing bank exchanges transaction information with a processing bank and occurs simultaneously with the settlement. You don’t have any influence over it, once you have submitted your transactions. Clearing is only present in Visa and MasterCard transactions, as American Express and Discover are both issuers of the cards bearing their logos and processors of the payments made with them.

Your payment processor will connect your card acceptance system to Visa and MasterCard, as each of the two companies uses their own system for authorization, clearing and settlement. In the case of MaseterCard, the Global Clearing Management System (GCMS) accepts your transaction data, edits them, assesses the appropriate fees and routes the data on to the appropriate card issuer. The clearing messages contain data, but they do not actually exchange or transfer funds, that is done during the settlement process.

Visa’s equivalent of MasterCard’s GCMS is called VisaNet. Part of Visa’s retail electronic payment system, VisaNet is a collection of sub-systems, which includes:

- An authorization system through which card issuers can approve or decline Visa credit and debit card transactions.

- A clearing and settlement system, which processes transactions electronically between Visa acquirers and issuers to ensure that:

- Visa transaction information flows from the acquirers to the issuers for posting to their cardholders’ accounts.

- Payment for Visa transactions flows from the issuers to the acquirers to be then credited to the merchants’ accounts.

The “cleared” transaction is then settled to conclude the process.

Dual-Message and Single-Message Clearing

Both Visa and MasterCard operate two different types of payment systems for processing card transactions. The first one is called a dual-message system, which was designed for use in credit cards but today it is also used for some debit card transactions. This system usually relies on a cardholder signature as an authentication method.

The second payment system is named single-message and is designed for automated teller machines (ATMs) and point-of-sale (POS) debit transactions. In most circumstances, this network requires cardholders to authenticate the transaction by entering a pre-selected personal identification number (PIN).

There are some major differences in the clearing processes of these two card networks (which will be discussed later in this post), but in both types Visa and MasterCard facilitates transactions among the same key participants: cardholders, merchants, card issuers and acquiring banks. MasterCard and Visa are each equally responsible for collecting all transactions and for operating a payment gateway in their respective systems. Both payment brands exchange data between their issuers and acquirers, set the rules and processes for participation in their networks, create formatting standards for data flowing across the network and facilitate the settlement between the participating banks. Now let’s examine the specifics.

Dual-Message Clearing

The dual-message process is used by Visa and MasterCard for credit and signature-based debit transactions. Dual-message transactions usually require a physical or electronic signature. This category includes credit card transactions (with the exception of transactions where credit cards are used for cash advances at ATMs) and signature-based debit transactions. When a merchant’s card processing system receives an authorization message, it creates a record of that authorization through the so-called “electronic draft capture” (EDC). All EDCs in a given period are then lumped together in a “batch” until the merchant initiates a “batch processing”, which usually takes place at least once a day. However, while high-volume merchants may process their batches multiple times a day, some low-volume merchants may well do so less often. Whatever the batch frequency, however, all merchants submit their authorized transactions to their acquiring bank in a batch mode, rather than as individual transactions.

MasterCard and Visa rules set specific time frames for the submission of transaction data and you should submit your transactions to your acquirer within that period. The acquiring bank, for its part, has its own time restrictions to comply with for sending that information into network clearing. As long as those time periods are met, the issuers are required to honor the transaction. Furthermore, issuers are required to honor transactions cleared outside of the specified time period, provided the cardholder’s account is still open and in good standing with them.

Both Visa and MasterCard receive many millions of electronic drafts for clearing each processing day, as you can well imagine, comprising enormous, and continually increasing, amounts of data. To handle the traffic, each of the two networks has built a solid system for managing these huge volumes in a stable and reliable manner. First, the system identifies the issuing banks for each of the incoming drafts. The information is then organized into electronic reports to be sent to the respective issuers. Those reports contain all the data the issuers need to conduct their activities, including posting transactions to their cardholders’ accounts and managing disputes on behalf of their customers.

By crunching all these data, the two card brands are also able to calculate the total amount owed by each issuer and the amount owed to each acquirer. This function of the clearing process, as we’ve already seen, is critically important to the final settlement stage of the card process.

Single-Message Clearing

In the U.S., all MasterCard and Visa transactions where a PIN is used for cardholder authentication purposes are single-message transactions. (Europe uses dual messaging for all card transactions, irrespective of whether they are authenticated using a signature or with a PIN.) In contrast to dual-messaging, in single-messaging the authorization and clearing processes are performed in a single dispatch and all the data needed to post the transaction to the cardholder’s account are exchanged at the time the transaction takes place. That, in turn, eliminates the batch processing stage, which the dual-message process requires. In single-message processing systems, transactions are sent directly into clearing and then only monetary settlement is required.

Single-message transactions have only one cut-off time each day, which is the same for all network participants and is non-negotiable. At the cut-off time, the system (whether Visa or MasterCard) calculates the total monetary positions for all client banks (acquirers and issuers) for all of the day’s single-message transactions. These include PIN-based sales transactions, as well as ATM transactions which occur at “foreign” ATMs (defined as ATMs which are not operated by the bank that has issued the card used during the transaction). The ATM category includes ATM withdrawals made with debit cards, as well as ATM cash advances made with credit cards.

Settlement

Settlement is the exchange of funds between a card issuer and an acquiring bank to complete a cleared transaction and the reimbursement of a merchant for the amount of each card sale that has been submitted into the network. Whether the transaction is dual- or single-message, there is only one settlement window and settlement is done on an aggregate net basis. This means that all credits and debits of a given bank are summed up and the net amount is transferred in a lump sum to the bank’s account with the respective network (i.e. Visa or MasterCard), in the case of an acquirer, or from the bank’s account, in the case of an issuer.

Most of the issuers’ transactions are debits: their cardholders are using their cards to buy things, for which the issuer will then pay into settlement on its cardholders’ behalf. But some cardholder activities, product returns most prominent among them, are credits. Furthermore, the issuer may have made cash disbursements through its ATMs to cardholders of other issuing banks and these transactions would also be treated as credits. The network calculates the total amount of the debits, subtracts the total value of the credits from them and the net amount is then collected from the issuer through settlement.

For acquirers, in contrast, most of their merchants’ transactions will be credits: merchants are selling things to other banks’ cardholders and their acquirers get paid for those through settlement. However, merchants will also be processing returns and issuing refunds, which generate debits to the merchants (and credits to the cardholders). These debits will be deducted from the total amount owed to the acquirers and the net amount will then be deposited into the acquirer’s account through settlement.

Another type of transaction which generates debits for the acquiring bank (and its merchants) and a credit for the issuer (and its cardholder) is the chargeback. Most chargebacks take place when a customer disputes a sale, which is consequently reversed and the transaction amount is credited back into the issuer’s account.

Also during settlement, interchange fees are collected from the acquiring banks and credited to the card issuers for all sales transactions. For cash advances and withdrawals, credits and returns, the opposite takes place and the issuers pay interchange fees to the acquirers.

Merchant accounts are typically funded daily and the settlement total is calculated as from the face amount of the submitted charges are subtracted all applicable deductions, which may include the following:

- Discount fees. These are the fees your processor charges you for each card transaction. They are specified in your merchant agreement.

- Amounts you may owe to your processor.

- Any chargeback amounts.

- Any credit amounts you may have submitted.

Funding is typically done through ACH transfers into your designated bank account, although wire transfers are not at all uncommon, especially in high-risk merchant accounts. Most processors can now fund your account as soon as on the day following the transaction, however time frames can vary.

There are two main payment options and yours should be specified in your merchant agreement. These are:

- Net pay — you are paid the full amount of the submitted charges minus the discount and other applicable amounts.

- Gross pay — you are paid the full amount of the submitted charges, and then a second adjustment is applied to deduct the discount and other applicable amounts.

Typically you have ninety days to dispute any errors regarding discount or other fees or payments for charges, credits or chargebacks. You should be reviewing your settlements daily, or at the very least you should be spending some time on your monthly statements, although errors are much more difficult to see there, especially for larger-volume merchants.

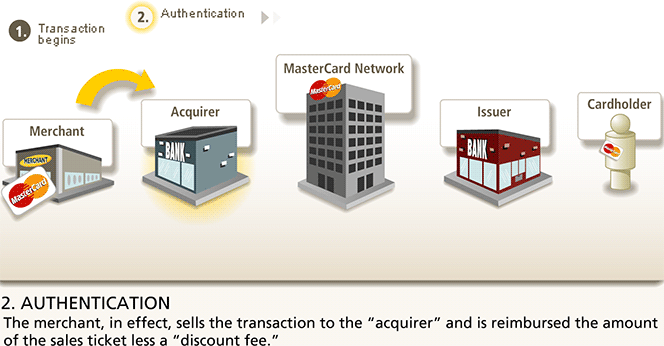

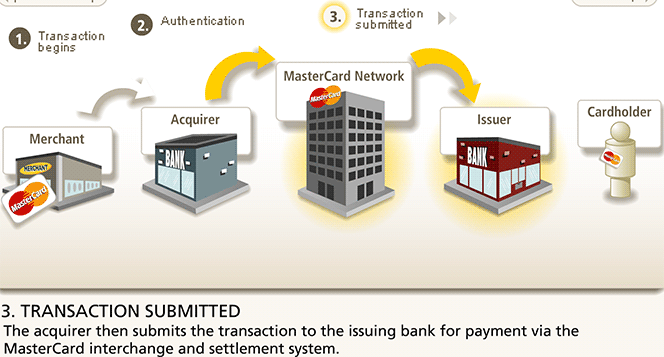

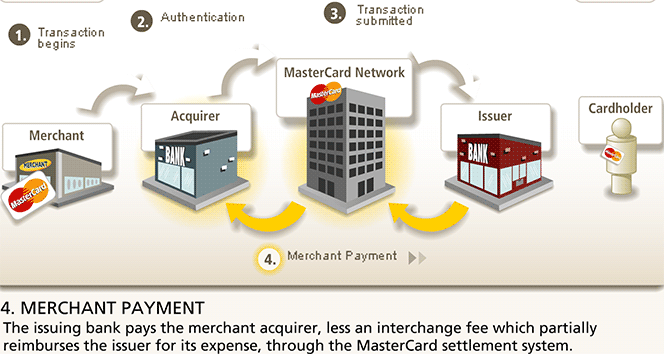

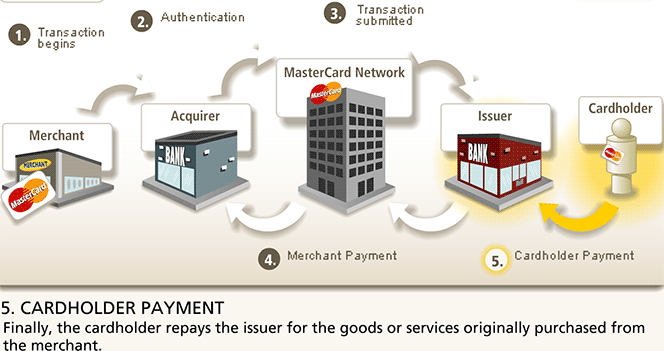

Finally, here is a detailed look at the way MasterCard processes its transactions:

Image credit: Bizlawcenter.com.

I hope you can help me with some advice. I have clients who does all their big international transactions with credit cards. They do it on the basis that they have “batch accounts” with Visa and MasterCard and the transactions are done “offline” with authorization codes obtained directly from VISA and MasterCard. They can therefore link any of their credit cards from any issuing bank to these batch accounts. Are you familiar with this type of practice and is it possible?

i havent claimed the transaction by my customer and it has been reversed to customer what should i do now

Hi,

My citi bank credit card was misused in snapdeal with the amount of 93k. Could you please help me to resolve this issue.

Thanks,

Kumar

how long should a merchante take to bank the POS transactions

as per RBI guidelins it’s 3 days

I hope and request your help with comments or suggestions.

We issue prepaid Mastercard cards. However, after customers preload the cards with a certain amount and make their international transactions, which are authenticated by PIN. Soon after the clearing and settlement cycle are completed, most of these cards present with negative balances (the card accounts are in an overdraft situation). What could be the possible cause?

We’ve already talked to our processor and haven’t gotten a convincing answer.

Great Read. How do I get my money back from a credit card transaction?