U.S. Household Debt Falls, but Very Slowly

Having risen slightly in the first quarter of this year, ending a streak of nine consecutive quarters of decline, the aggregate amount of debt held by U.S. households has resumed its downward trajectory in the second quarter.

That is what the latest Household Debt and Credit quarterly report, issued by the Federal Reserve Bank of New York, tells us. Outstanding balances on most types of consumer loans fell in the second quarter of this year, but by very small amounts.

U.S. Household Debt Down 0.4%

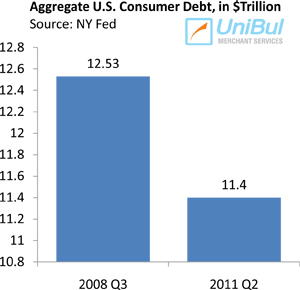

The Fed report’s headline news is that the overall indebtedness of American households at the end of June was $11.4 trillion. That is 0.4 percent lower than the level measured at the end of the previous quarter and 8.6 percent, or $1.08 trillion, lower than the peak level reached in the third quarter of 2008, at the end of which Lehman Brothers collapsed and the financial sector melted down.

The Fed report’s headline news is that the overall indebtedness of American households at the end of June was $11.4 trillion. That is 0.4 percent lower than the level measured at the end of the previous quarter and 8.6 percent, or $1.08 trillion, lower than the peak level reached in the third quarter of 2008, at the end of which Lehman Brothers collapsed and the financial sector melted down.

The New York Fed’s report relies on data provided by Equifax, one of the three national credit reporting agencies. Here are some of the key findings:

- Mortgage balances fell 0.2 percent ($20 billion) and are now 8.3 percent below their peak level.

- Home equity lines of credit (HELOC) balances fell by 3 percent ($20 billion) – 12.7 percent below the peak.

- Non-real estate indebtedness declined by 0.4 percent ($10 billion) to $2.28 trillion – 9.5 percent below the Q4 2008 peak.

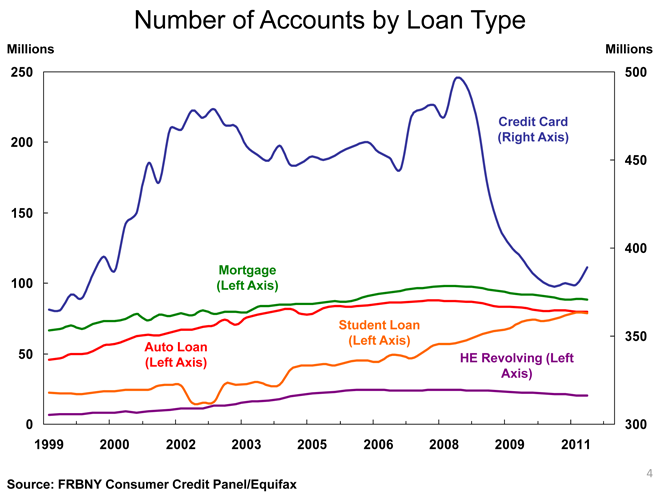

Credit Card Accounts, Limits Increase

The number of open credit card accounts spiked by 10 million, to 389 million, in Q2 2011, according to the NY Fed. That stands in a marked contrast with the trend of the post-Lehman period, which saw the number of open accounts fall by about 24 percent by the end of Q1 2011. Even with the new gains, however, consumers have closed a total of 199 million credit accounts during the last four quarters, while opening only 168 million and the number of open accounts at the end of Q2 2011 is still 22 percent below the peak level reached in Q2 2008.

More importantly, the aggregate outstanding balances on these open credit card accounts have fallen dramatically and are now 20 percent below their peak level reached in Q4 2008. Yet, even as their balances are falling, Americans are getting higher credit card limits, which have increased by 2.1 percent ($60 billion) on aggregate, the second consecutive quarterly increase.

The Takeaway

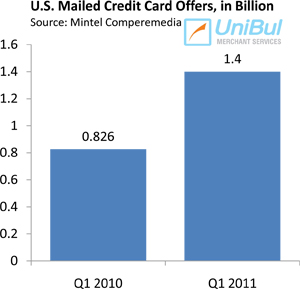

The increase in newly opened credit card accounts comes as no surprise. A recent report by Mintel Comperemedia, a company tracking direct mail, print and online banner advertising, told us that credit card offers mailed by U.S. issuers in the first quarter of 2011 jumped by 69 percent from the same period of 2010. Many of these offers featured various cash incentives, bonus miles or other perks that made them very attractive to consumers.

The increase in newly opened credit card accounts comes as no surprise. A recent report by Mintel Comperemedia, a company tracking direct mail, print and online banner advertising, told us that credit card offers mailed by U.S. issuers in the first quarter of 2011 jumped by 69 percent from the same period of 2010. Many of these offers featured various cash incentives, bonus miles or other perks that made them very attractive to consumers.

Moreover, again from Equifax we knew that card credit in the U.S. was on the rise. The credit bureau told us earlier this year that Americans had 35 percent more credit available on their cards in March of 2011 than they did in March of last year.

So with card credit more easily available and at much better terms than in a long time, it is no surprise that consumers have been actually using it more freely in the past couple of months than at any time since the financial meltdown. The aggregate amount of outstanding consumer credit card balances rose in June by 7.9 percent, the second consecutive monthly increase, after reaching in April its lowest level in almost seven years, according to the Federal Reserve.

Yet, even as they begin to spend more, Americans are also paying back their credit card debt at a record high rate. In June U.S. cardholders were repaying 21.40 percent of the principal amount of their?ácredit card debt at the end of the monthly cycle.

It appears that Americans are now using their credit cards well within their means.

Image credit: Marketplace.org.