U.S. Consumer Credit Card Debt Down 4.1%

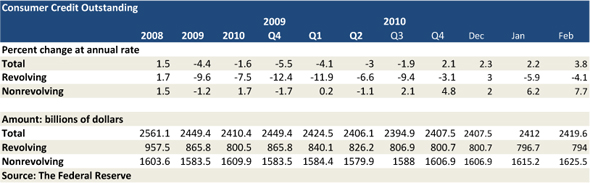

After a revised 5.9 percent drop in January, U.S. consumer credit card debt fell further in February, continuing a trend that began in the wake of the financial meltdown of 2008, according to the latest report released by the Federal Reserve on Thursday. Overall non-mortgage consumer debt, however, rose in February for a fifth consecutive month and at its fastest pace since June 2008, the data showed.

Credit Card Debt Down 4.1% in February

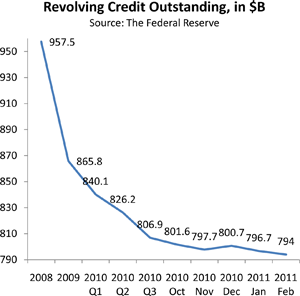

The total outstanding amount of revolving credit, a category comprised almost exclusively of credit card balances, fell in February by 4.1 percent, or $2.7 billion, on a month-to-month basis, bringing the total down to $794.0 billion, marking a new post-Lehman record and the lowest level since September 2004. In fact, since the events of September 2008, revolving credit has increased only once, in December of last year.

Overall, since August 2008, the month before the collapse of Lehman Brothers, the total amount of outstanding revolving credit in the U.S. has decreased by $179.6 billion, from $973.6 billion to $ 794.0 billion, a drop of 18.4 percent. The average U.S. family with outstanding credit card debt — 54 million by the Fed’s count — has reduced its burden by $3,326 for the period.

Overall Consumer Credit Up 3.8%

Although Americans continued paying down their credit card balances at a brisk rate in February, their non-revolving debt, which includes auto loans, student loans and loans for mobile homes, boats and trailers, but not loans for home mortgages and other real estate-secured assets, increased for a seventh consecutive month. The Federal Reserve reported a 7.7 percent spike, bringing the total to $1,625.5 billion, up $10.3 billion from January.

Overall, the total of revolving and non-revolving consumer credit rose by $7.6 billion, or 3.8 percent, to $2,419.6 billion in February, after increasing by a revised $4.5 billion in January. It was also its fifth consecutive month of increase.

Shifting Consumer Priorities

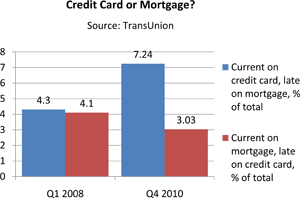

The financial crisis of two and a half years ago has triggered a major shift in the financial priorities of American consumers, according to a study by TransUnion, one of the three major credit reporting bureaus.

The financial crisis of two and a half years ago has triggered a major shift in the financial priorities of American consumers, according to a study by TransUnion, one of the three major credit reporting bureaus.

According to TransUnion’s report, a new debt re-payment hierarchy has emerged in the wake of Lehman’s collapse, where homeowners place a higher priority on their credit card debt, which they pay down before their mortgages, even if that means defaulting on their home payments.

TransUnion’s data show that the proportion of homeowners who were late on their mortgage payments but current on their credit cards in Q4 2010 was 7.24 percent, a level that is 68 percent higher than the 4.3 percent ratio measured in Q1 2008. By contrast, the proportion of homeowners who were late on their credit card payments but current on their mortgages in Q4 2010 was 3.03 percent — the lowest level ever measured and 26 percent below the Q1 2008 ratio of 4.1 percent.

Credit Card Takeaway

Consumers are still paying down their credit card debt, even as they begin to spend more freely than they have in a long time. The rate of increase in non-revolving debt was the highest since October of last year. Auto sales were particularly strong, growing by 27 percent in February, even as gas prices continued to climb upwards.

Consumers are still paying down their credit card debt, even as they begin to spend more freely than they have in a long time. The rate of increase in non-revolving debt was the highest since October of last year. Auto sales were particularly strong, growing by 27 percent in February, even as gas prices continued to climb upwards.

In addition to cars, in February Americans also spent more on electronics, sporting goods and clothing, all items that consumers often pay for by credit cards. Yet, credit card balances did not increase, as some analysts had predicted. On the contrary, credit card debt fell again and quite substantially at that. Does that mean that the “Americans living beyond their means” label is a thing of the past?