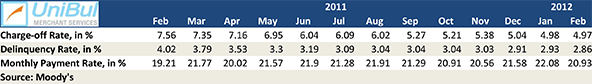

U.S. Credit Card Delinquencies Fall to Lowest Level Ever

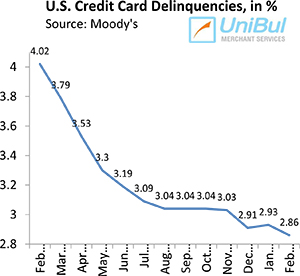

The main credit card repayment indicators continued their downward slide in February, we learn from the latest Moody’s Credit Card Indices. Having fallen below the five-percent threshold in January for the first time since before the Great Recession began, the charge-off rate fell only marginally in February. However, both delinquency rates monitored by the ratings agency dropped to their lowest levels ever.

The six largest U.S. issuers reported mostly positive results for the monthly performance of their credit card portfolios. Half of them recorded lower charge-offs, with Citi, Discover and American Express going the other way, but all issuers had lower or flat delinquencies. Not all news, however, was positive, as is usually the case. The fly in the ointment this time was that the monthly payment rate fell by more than a percentage point. Let’s go over the numbers in a bit more detail.

Credit Card Charge-offs Fall to 4.97%

Credit card charge-offs were expected to decrease in February, as they are for most of the year, but the drop – one basis point – was a marginal one. Yet, Moody’s says that the rate should fall to around four percent by the end of 2012 (revised from the earlier expectations of a drop to a level “below four percent”). The current level — 4.97 percent — is lower by 2.59 percent than the February 2011 rate, a decline of 34.26 percent, and is also the lowest one since November 2007, the last month before the Great Recession officially began.

Credit card charge-offs were expected to decrease in February, as they are for most of the year, but the drop – one basis point – was a marginal one. Yet, Moody’s says that the rate should fall to around four percent by the end of 2012 (revised from the earlier expectations of a drop to a level “below four percent”). The current level — 4.97 percent — is lower by 2.59 percent than the February 2011 rate, a decline of 34.26 percent, and is also the lowest one since November 2007, the last month before the Great Recession officially began.

The charge-off (or default) rate is the ratio of all credit card accounts with outstanding balances that an issuer no longer expect to be repaid by their cardholders, in relation to the total number of active accounts in their portfolio. Charged-off accounts are written off of the issuers’ books as losses, typically at 180 days after the last payment on the account was received.

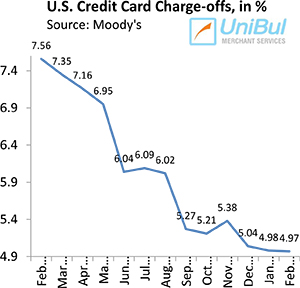

Late Payments down to 2.86% – Lowest Ever

Moody’s credit card delinquency rate fell by seven basis points in February after rising by two in the previous month. The new level — 2.86 percent is the lowest one ever measured by the ratings agency since it began tracking the indicator more than two decades ago. It is also the third consecutive month of below-three-percent delinquencies, whereas prior to December of last year they had never fallen below that threshold.

Moody’s credit card delinquency rate fell by seven basis points in February after rising by two in the previous month. The new level — 2.86 percent is the lowest one ever measured by the ratings agency since it began tracking the indicator more than two decades ago. It is also the third consecutive month of below-three-percent delinquencies, whereas prior to December of last year they had never fallen below that threshold.

Moody’s headline delinquency rate is the ratio of credit card accounts on which payments are late by 30 days or more, in relation to the total number of active accounts. The ratings agency also monitors an “early-stage delinquency rate” for payments late by 30 – 59 days. That rate also fell in February — by two basis points to 0.75 percent — another all-time low.

Moody’s expects that the tax refund season will lead to even lower early- and late-stage delinquency rates in the coming months. These record-low and falling delinquency rates will inevitably lead to lower default rates, which is why Moody’s expects them to fall by about a percentage point by the end of the year. If anything, I think that their four-percent prediction is a bit too conservative.

Delinquencies Fall at Biggest U.S. Issuers

The six biggest U.S. credit card issuers reported lower or flat (in the case of American Express) delinquency rates and were evenly split in their charge-off results for February. Here is what each one of them reported:

| ?á |

Charge-off Rate, % of Total |

Delinquency Rate, %of Total |

||

|

February 2012 |

January 2012 |

February 2012 |

January 2012 |

|

|

Bank of America |

5.56 |

5.63 |

3.75 |

3.80 |

|

JPMorgan Chase |

3.97 |

4.25 |

2.42 |

2.45 |

|

Discover |

2.80 |

2.75 |

2.25 |

2.31 |

|

Capital One |

3.84 |

4.08 |

3.62 |

3.78 |

|

American Express |

2.40 |

2.20 |

1.40 |

1.40 |

|

Citigroup |

5.36 |

5.27 |

3.09 |

3.13 |

Here is how the issuers’ February 2012 figures compare to the post-Lehman record-highs in each category:

| ?á |

Charge-off Rate, % of Total |

Delinquency Rate, % of Total |

||

|

Record, %/Month |

Change, % |

Record, %/Month |

Change, % |

|

|

Bank of America |

14.53/Aug 2009 |

61.73 |

8.01/Aug 2009 |

53.18 |

|

JPMorgan Chase |

10.91/Jan 2010 |

63.61 |

4.95/Sep 2009 |

51.11 |

|

Discover |

9.11/Feb 2010 |

69.26 |

5.72/Oct 2009 |

60.66 |

|

Capital One |

10.87/Apr 2010 |

64.67 |

5.80/Jan 2010 |

37.59 |

|

American Express |

10.40/Apr 2009 |

76.92 |

5.30/Feb 2009 |

73.58 |

|

Citigroup |

12.14/Aug 2009 |

55.85 |

6.06/Mar 2010 |

49.01 |

As you can see, American Express has done considerably better than its rivals both in absolute declines, as well as percentage drops in both categories.

The Takeaway

Low as the headline delinquency rate already is, there seems to be more room left for improvement, as indicated by the continuing fall of the early-stage delinquencies. One way or another, we will be seeing falling charge-offs, as the default rate is a trailing indicator for the delinquency one.

Perhaps the best early indicator we have for gauging the future trajectory of the delinquency and default rates is the monthly payment rate (MPR) — the rate at which consumers are repaying the outstanding balances on their credit cards. In February the MPR fell by 1.15 percent from its record-setting January level, to 20.93 percent. Although big, that drop was consistent with seasonal patterns, Moody’s tells us, so we can reasonably expect it to rebound in the coming months. Historically the MPR has hovered in the mid-teens, so the current level is still high by comparison. This much higher rate of credit card debt repayment is one of the best side effects the crisis has had on consumers and is a hugely positive one.

Thanks for keeping track on all this! Now that I know that early-stage delinquencies are at 0.75% I understand why the card issuers are giving away sign-up bonuses worth hundreds of dollars to new customers.

Yes, customers paying their loans back does help card issuers out.

If late-stage delinquencies are under 3% now and early-stage delinquencies are at 3/4 of 1%, doesn’t that mean that it is very likely that some time late in the 3rd or in the 4th quarter the charge-off rate will also fall to somewhere around 3% and then will keep falling? What else can affect the charge-offs?

Josh,

I also expect that charge-offs will fall to under 4% at some point before the end of this year.

So the average American pays back about a fifth of what he owes on credit cards at the end of each month and that is considered a great rate? I mean he still has to pay about 14% APR on average on the other 80%, right? There is a lot of room left for improvement.

Yes, I agree that although high by historical standards, the MPR could be higher still. In reality, though, it is unlikely to rise much further, if at all.

So American Express has much lower delinquency and charge-off rates than the other credit card companies, even though they were hit during the crisis just as badly as the others. I guess in times like these it helps to a more affluent customer base than your competitors.

Dana,

Yes, AmEx has benefited during the crisis from having a more affluent customer base than its rivals. However, AmEx is now going after less affluent customers with its charge cards and, primarily, with its prepaid card, which I think is the best one available on the market.

There is no doubt that the charge-off rate will keep falling throughout this year and will fall below 4% before the year’s end. That will happen regardless of whether the delinquency rate will keep falling, but it looks like it will.

Ravi,

I agree with your assessment.

I guess any decline in delinquencies is a good sign. There are indicators the economy is improving, albeit at a very slow rate.

The sad truth is that as these indicators continue improving, getting credit will become easier over the coming years. What does this mean?

It means another GFC will inevitably strike. Its happened before and it’ll happen again, sadly as the pain and suffering eases, all seems to get forgotten and the same mistakes happen time and time again…

Mark,

Unfortunately, I have to agree with you. History does find ways to keep repeating itself.