Google Turns Credit Card Issuer

Google is about to start issuing credit cards, we learn from Reuters. The search giant will be offering its new card to select users of its own AdWords advertising program, which is where Google makes most of its money.

Google says that its new card will help small and medium-sized businesses that “are resource-constrained and they are often cash flow-strapped” get “ample” credit on affordable terms. Of course Google no doubt hopes that its low-rate card will induce advertisers to spend more, while collecting the associated finance charges will be a welcome source of additional revenue.

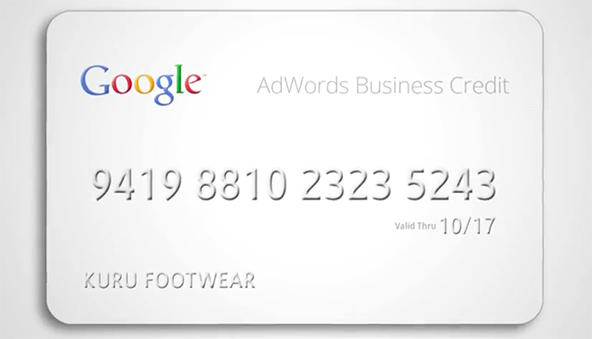

Google’s Card

There is nothing novel about the search giant’s foray into the credit card issuing business. The Google card is in effect a store card (with a twist), much like the ones consumers are offered by retailers like Home Depot, Sears, Macy’s, etc.

Store cards, also known as private label cards, can only be used for payment at a specified merchant, unlike regular credit cards, which can be used anywhere the card’s payment brand (Visa, MasterCard, etc.) is accepted. Other than that, store cards are like credit cards.

The Google card will be issued through a little-known bank called World Financial Capital Bank. However, judging by what Reuters tells us, the search giant will be the underwriter of the accounts. That is also a common arrangement. A company like Google is more than capable of underwriting its customers’ store card accounts, but it cannot actually issue the cards, because it is not a Visa or MasterCard member.

The card comes with no annual fee and a very low 8.99 percent annual percentage rate (APR). It will be a MasterCard, although store cards typically do not display the brand logo. Other details are not disclosed.

How Does Google’s Card Compare?

Whatever Google’s motives for launching a credit card may be, there is no denying that an 8.99 percent APR is a very low one. According to CreditCards.com, a credit card comparison website, the national average APR as of July 13 of this year was 14.91 percent.

However, Google does not offer a lower introductory rate, which many current card offers do. Additionally, the search engine offers no rewards program. Brent Callinicos, Google’s Treasurer, explains why:

I think if you had the choice of an 18 percent credit card and miles versus an 8.99 percent credit card and no miles, it’s a pretty easy choice.

The Takeaway

The choice of credit card to be used with your AdWords account would very much depend on your circumstances. For example, the question of whether the Google card would be the right choice will have different answers in the following two hypothetical scenarios.

Under the first one, the advertiser has a good or excellent credit history and has an easy access to cards with a zero-percent introductory APR for twelve months or more and some kind of a rewards program. In this case, the advertiser would clearly find it more beneficial to use the zero-percent card than the Google one.

Under the second scenario, the advertiser does not have access to a zero-percent credit card, because his or her credit history is not good enough. In this case, the Google card will most likely be the better option, provided the merchant is approved for it in the first place. Of course, if the advertiser pays off the card balance in full at the end of each month, any card with a rewards program would be preferable to Google’s.

Image credit: Google.com.