Data Show Decrease in Credit Card Debt is Mostly Due to Bank Charge-Offs

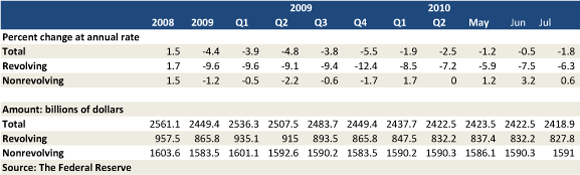

Credit card debt has been consistently decreasing in the U.S. since the financial crisis struck more than two years ago. According to the Federal Reserve, American consumers have reduced their revolving credit lines, comprised mostly of credit card balances, by 6.3 percent at an annualized rate in July from June, a decrease of $4.4 billion. Overall, since the end of 2008, revolving credit, mostly comprised of credit card balances, in the U.S. has dropped by $129.7 billion to $827.8 billion, a decrease of 13.5 percent.

The huge drop in consumer debt has prompted many commentators and analysts to extol the newly discovered frugal streak in consumers’ spending behavior. There are plenty of data that seem to support that view.

For example, according to a recent report by Javelin Strategy & Research, the financial crisis has produced a new type of a credit-averse “cautious consumer,” who is increasingly replacing credit cards with other forms of payment, including cash, checks, debit, prepaid and gift cards. The report showed that credit card use among consumers decreased by 31 percent between 2007 and 2009 (from 87 percent in 2007 to 56 percent in 2009). If this rate of decline holds, by the year’s end credit card use will fall below 50 percent.

But is consumer frugality really the main force causing the decline in credit card debt in the U.S.?

“There is a lot of debate going on right now among economists,” says Cristian deRitis, the director of credit analytics with Moody’s Analytics, as quoted by NYT’s Christine Hauser. “Is there truly deleveraging or are charge-offs removing a lot of balances?” In an attempt to answer his own question, deRitis has been examining the credit card accounts of individual borrowers in a new study that he says appears to show that most of the decline is in the form of charge-offs.

According to another study, released last week by CardHub.com, a credit card comparison website, card issuers have been charging off about $20 billion each quarter from early 2009 through early 2010, which is about equal to the amount of the decline in outstanding credit card balances.

The latest regulatory filings from the biggest U.S. card issuers showed that payment delinquency rates are now at their lowest levels in more than a year, which is seen as an indicator of falling charge-off rates in the coming months. Banks now believe that the worst of the financial crisis is behind them and are adjusting their credit card offers to reflect the new reality of debt-averse consumers.

“We see deleveraging of the consumer,” says Bank of America spokesman Jerry Dubrowski. “As they work the balances down, they are not replenishing that with new debt,” he added.

Instead, consumers are increasingly switching to debit cards as their primary form of payment. Additionally, some issuers, including American Express and Chase, have begun to aggressively market charge cards, which require cardholders to pay their balances in full at the end of each month, preventing them from incurring debt.

There is little doubt that most consumers are keeping a close eye on their credit card balances and are in no mood for allowing them to expand to anything close to their pre-crisis levels. What is not quite as clear is whether this trend will hold once the economy begins to recover in a more meaningful way and unemployment starts to go down. Then again, who knows when this will happen!