U.S. Credit Card Defaults Fall to 20-Month Low

Americans continued paying their credit card bills on time in December, although the monthly payment rate fell slightly from November. All of the major credit card issuers reported lower default and delinquency rates for the period.

Fitch’s Prime Credit Card Chargeoff Index fell to 8.99 percent, the first time it has dropped below the 9 percent level in 20 months. Banks charge off credit card balances they no longer believe will be repaid, typically 180 after the last payment on the account. Although still high by historical standards, December’s charge-off rate is now 2.38 percent lower than the all time high of 11.37 percent set in February 2010 and is down 16 percent from last year. The index average for most of the last 20 years was just over 6 percent.

Early-stage delinquencies — payments late by 30 days or more — rose by 0.03 percent to 4.54 percent, according to Fitch. Late-stage delinquencies — payments late by 60 days or more — fell by 0.06 percent to 3.37 percent, their lowest level in two years. Overall, late-stage delinquencies have fallen by 26 percent since last year, according to Fitch.

Here are the figures from the major credit card companies:

- JPMorgan Chase’s 30-day delinquency rate — payments late by 30 days or more — fell to 3.65 percent in December from 3.80 percent in November. Its charge-offs fell 0.24 percent to 7.10 percent from 7.34 percent during the same period. Chase’s charge-offs peaked at 10.91 percent in January of last year.

- Bank of America reported a 30-day delinquency rate of 5.24 percent in December, down from 5.47 percent in November. The Charlotte, N.C.-based bank’s charge-off rate dropped to 9.31 percent in December, down 0.61 percent from 9.92 percent in the previous month. BofA’s charge-off rate reached its highest level — 13.53 percent — in December 2009.

- Citibank said its 30-day delinquency rate in December was 4.44 percent, down from 4.71 percent in the previous month. The New York-based bank charged off 8.34 percent of its balances, down 0.86 percent from 9.40 percent in November. Citi’s charge-off rate reached its peak in August 2009 at 12.14 percent.

- Capital One’s 30-day delinquency rate dropped to 4.09 percent in December from 4.26 percent in November. The bank’s annualized charge-off rate was down to 7.01 percent from 7.56 percent in the same period. Capital One’s charge-off rate peaked at 10.87 percent on April of 2010.

- Discover reported a 30-day delinquency rate of 3.91 percent in December, down from 4.15 percent in the previous month. Its charge-off rate was reported at 5.94 percent, at an annualized rate, down from 6.72 percent in November. Discover’s charge-offs reached a top of 9.11 percent in February of last year.

- American Express continued to lead its peers in both categories. The New York-based company reported a 30-day delinquency rate of 2.1 percent in December, down slightly from 2.2 percent in November. American Express’s charge-off rate fell to 4.1 percent from 4.4 percent in November. Its highest level – 10.2 percent – was reached in August 2009.

The rate at which consumers are repaying their credit card debt — the monthly payment rate (MPR) — fell slightly to 19.06 percent in December from 19.23 percent in November, which is consistent with seasonal patterns (i.e. the aftereffects of the holiday shopping), but it is still much higher than the 16 percent long-term average, according to Fitch.

The rate at which consumers are repaying their credit card debt — the monthly payment rate (MPR) — fell slightly to 19.06 percent in December from 19.23 percent in November, which is consistent with seasonal patterns (i.e. the aftereffects of the holiday shopping), but it is still much higher than the 16 percent long-term average, according to Fitch.

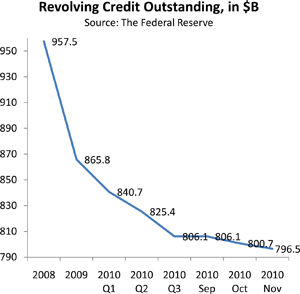

American consumers have now been paying down credit card debt continuously for almost two and a half years and Fitch’s report is just the latest of a series of studies confirming the trend. The latest data released by the Federal Reserve showed that Americans reduced credit card spending in November for the 27th consecutive month, eliminating $177.1 billion of debt in the process. This is all great news, but will it last?

Image credit: Wikimedia Commons.