The Square Supremacy

Square’s success has been truly extraordinary. The mobile payments processor’s little card reader is now so ubiquitous that it’s hard to believe that the service went live just over a year and a half ago, when in late October 2010, founder and CEO Jack Dorsey (also of Twitter fame) made the announcement in a now famous tweet: “The doors are (finally) open @Square & we’re going big”. The Square guys hit the ground running and never looked back.

Since then, there have been countless attempts to explain the processor’s phenomenal success and our blog has certainly contributed its fair share. This morning I came across the latest such effort, and this one is more ambitious than most. Business Insider has produced a whole report on the subject and is trying to get people to pay for it. Luckily, there is a summary for cheapskates like myself, which I think should give most of you all you need to know about the authors’ view on Square’s success. Let’s take a look at what they’ve found.

Square by the Numbers

First, though, let’s briefly review Square’s current figures. The processor is using a two-tiered pricing model. Swiped card transactions are processed at a rate of 2.75 percent for all brands (Visa, MasterCard, Discover and American Express) and types of cards (debit or credit). If a swipe is not an option, the user can instead key-enter the transaction information, in which case the processing rate would be 3.50 percent plus $0.15.

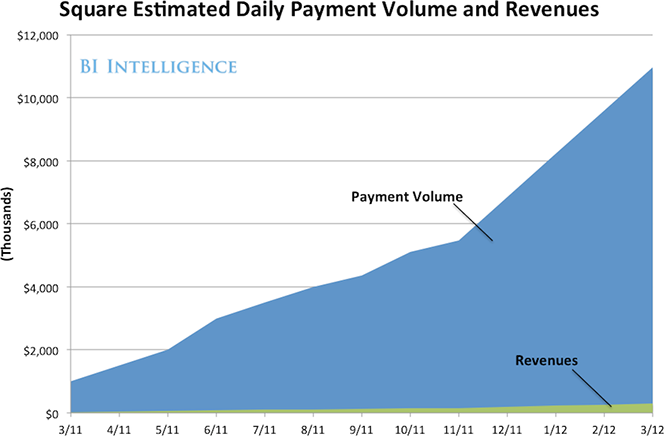

The company’s customer base and processing volume have been growing at an accelerating rate. The New York Times tells us that:

In the first six months of this year, the company has roughly doubled the number of users to two million.

In Fortune we read that:

Merchants are now processing transactions with Square’s Card Reader at a rate of $6 billion a year, up from just $2 billion a year in October, making Square one of the fastest-growing young companies ever by revenue and one of the buzziest in Silicon Valley’s hot startup scene.

Moreover, Bloomberg told us that in the month following the launch of PayPal Here — its strongest competitor to date — Square managed to increase its processing volume by a quarter! And the thing is that PayPal’s offering is a pretty good one. In fact, it’s arguably better than Square’s. And yet, no one has been able to slow Square down. Let’s see how the Business Insider guys explain it.

Why Square Is Winning

Here is the gist of BI’s view on Square’s success so far and their case for why the company is “positioned to be the future of mobile payments”:

- Convenience: Card readers are at least as convenient as the incumbent solutions, and sometimes more so. Paying with your name, as with “Pay with Square”, when it works, is even convenient than cash or credit.

- Distribution: Square has cracked the nut: first, by piggybacking on the existing credit card network, and now by moving up the value chain and providing added services to merchants, ensuring that sellers will use the platform more and more.

Well, I agree that these two are important factors for Square’s rise to the top, but there is a lot more to be added to this list:

- First to the market. Square created this mobile payments niche. It took months for its first competitor to appear on the scene (and it took PayPal more than one and a half years!) and by then Jack Dorsey’s start-up had been able to gather enough momentum to propel it beyond the reach of its enemy’s guns.

- Financial firepower. Square was well-capitalized when it first opened for business, then last year it raised an additional $100 million and is now “close to raising roughly $200 million,” according to the NYT. And the processor has been spending the money mostly on advertisement of various kinds. Everywhere I turn these days I see a Square ad and practically no competitors’ ads.

- Pricing model favoring small merchants.Square’s rates are unacceptably high for most mid- and high-volume merchants. However, there are two groups of merchants, for whom the company’s pricing model has proved irresistible:

- Low-volume merchants: because there are no monthly and annual fees of any kind.

- Small-ticket merchants: because there is no fixed, per-transaction fee, just a percentage of the sales amount.

- Clear terms and conditions. Square’s service contract, unlike some of its competitors’, is a straightforward and catch-free one.

Now, Square is far from perfect and its shortcomings were made plain when PayPal Here was launched. In addition to some minor technical add-ons, PayPal’s offering had these two big advantages over its rival’s:

- Funds are immediately available in the user’s PayPal account, whereas Square’s funding doesn’t take place until the transaction is deemed complete and that can take a couple of business days.

- PayPal Here comes with live customer support, which has been conspicuous with its absence at Square.

And yet, consumers just keep flocking to Square, not to PayPal or someone else.

The Takeaway

So I share Business Insider’s forecast of a bright future for Square. However, I have an issue with their prediction that:

Over time, Square will slowly provide its own payments network. This will boost its profitability (as it will allow it to stop paying expensive credit card fees), and ensure that it controls the transaction. This, in turn, will allow it to turn payments into a software experience and provide value-added services to consumers as well as merchants on top of payments.

People have been predicting the end of credit cards for as long as I can remember and yet they are now as popular as ever. You may remember that Isis, another well-funded mobile payments start-up (but not a direct Square competitor), initially also wanted to create its own payment network, only to suddenly realize just how difficult of a project that would be and abandon the idea altogether. Moreover, why hasn’t PayPal created its own payment network, when it is so much better positioned to do so than anyone else? So I expect that Square will keep their focus on improving their products and expanding their customer base, both domestically and abroad. And that’s what they should be doing.

Image credit: Squareup.com.