Why Square and not Chase and the State of Mobile Payments

The Economist has an excellent report on the current state of the mobile payments world, which you should read. I think the author has been a bit too ambitious in his or her attempt to summarize the latest developments in what is a hugely disruptive and very fast-growing industry in a single article, but then I guess these days there is only so much magazine real estate the Economist is willing to allot to anything that has no direct connection to the impending Greek euro exit and the subsequent financial mayhem. I can’t blame them.

Anyway, I’d like to highlight a couple of the questions, which the author attempts to answer in the article and add my own two cents. The first one is why start-ups are playing such a huge role in what looks very much like a traditional bank territory. The second one is whether consumers will use one or multiple mobile wallets (the author assumes, as I do, that the technology will eventually be universally adopted).

Why Square and not Chase?

Here is how the article addresses the first of the questions:

On the face of it, the business of facilitating payments seems a particularly unpromising one for start-ups to enter. Most transfers of money run down a few main highways that link banks to one another. They carry huge volumes of traffic and are generally strictly regulated. “They move quadrillions a day and take just a few crumbs,” says Simon Bailey, a payments expert at Logica, a consulting firm.

…

Yet payments turn out to be a battleground between banks and a slew of innovators trying to disrupt the market. Many of these firms have relatively humble ambitions. Some are trying to grab thimblefuls of the huge flows of money that wash around the world by concentrating on particular areas, such as cross-border payments (see article). Yet they find themselves getting ever closer to offering bank-like services without having to be banks themselves.

I would only add that banks are simply too cautious toward anything that is new and untested and even when they do decide that the potential return may be worth the risk, after all, they are way too slow to move in. And the demand for mobile payments is huge, as testified by the explosive growth of Square, Jack Dorsey’s company that was the first to enable the proverbial plumber and everyone else to accept credit cards through their phones. As the author reminds us, since it went live in October 2010, Square has signed up more than one million customers, increasing the number of credit card readers in the U.S. by a sixth. A bank could never have done what Square did.

How Many Wallets Would You Carry?

I don’t know of a single person who has more than one wallet on his- or herself at any given time. But will that be the case with mobile wallets? Here is how the Economist sees it:

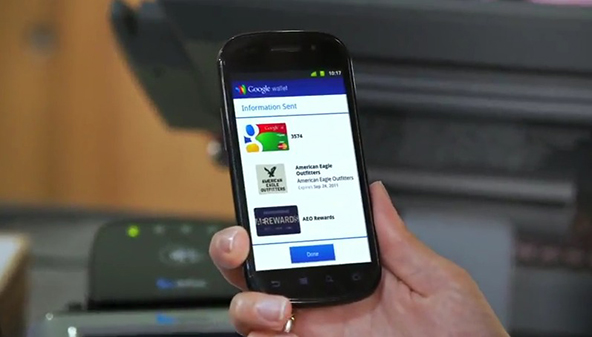

Most analysts think that consumers will gravitate towards a single electronic wallet which will hold many cards. This is because there may be significant benefits to be gained from aggregating transactions and the data associated with them. For example, PayPal’s wallet will allow consumers to use various stores of value besides money when paying for goods or services. These could include coupons, loyalty points from stores and banks and air miles from airlines.

I don’t have a firm opinion on this subject. Yes, it is true that it would be far more convenient to have to deal with only one digital wallet, provided you can store in it all of your bank cards, checking accounts and any other payment products we may be using in the future. Moreover, the more m-wallets you have, the higher the risk that someone will break through your defenses and steal your account information. On the other hand, as the Economist reminds us, the digital wallet providers will try to entice users by offering them various incentives like coupons. So, provided the security issue is resolved, and considering that the second or third digital wallet will not take up any extra room in your pocket, why not sign up for them as well and collect the rewards they have to offer? After all, even though we can get by perfectly well with a single credit card, many of us use two or more, so that we can maximize our rewards (using one credit card for, say, grocery purchases and another for airfare).

The Takeaway

Mobile payments are a growing part of our everyday life. Many of us have already used our phones to complete a payment and in the not-too-distant future all of us will be doing it every day, instead of using our plastic bank cards. That does not mean that credit and debit cards will disappear. They will not. What will happen, instead, is that bank cards will shift their form from a plastic to a digital one. For consumers, that will be more of a cosmetic change than a substantive one, although there will be some benefits, such as the added convenience and the extra rewards mentioned above. For businesses, on the other hand, the new payment technologies hold the promise of collecting much more detailed information about their customers and interacting with them on a much more personal level. Those companies that get this transition right stand to benefit enormously in the new digital payment world.

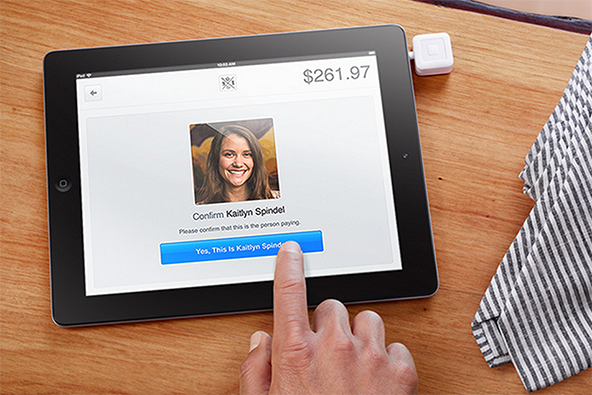

Image credit: Squareup.com.

I can see some benefits in a new mobile wallet, but I still prefer keeping some of my personal information and items on myself at all times. Also, i can’t hand over my phone if I’m pulled over and asked for my driver’s license. I think ID’s will be kept in their physical form for some time to come so I’ll be keeping my wallet for now.

Mobile wallets are very difficult to protect. The NFC technology is yet to prove that it is secure and until it does, we have to assume that it can’t. So how can we trust Google Wallet or Isis with our credit cards?

Security issues are overblown. NFC is much more secure than many people would have you believe. Plus, in case of a fraudulent transaction you are fully protected. And anyway, we’ve been using credit cards since the 50s and haven’t solved the security issue there. So we can’t ge t a perfect protection.

Why not just keep using your credit card instead of putting its information into a cell phone and waving it by the terminal. You can just swipe it and the effect will be exactly the same. I see absolutely no need for these mobile wallets.

We know that Google doesn’t care about the security of our information, as long as they can get it first. Just a couple of months ago Zvelo, a security firm, cracked Google Wallet’s PIN and created a simple app to show just how easy it is. So people should stay away from these “mobile wallets.”

I just don’t get these “mobile wallets.” I mostly use my credit cards for payment, although I still use checks on occasion. I don’t see how these new technologies will make my life any easier. On the contrary, it sounds like there is plenty to worry about them.

Square and mobile wallets are 2 totally different concepts so they should be looked at separately. Square has worked flawlessly from day one, there haven’t been any security issues and people love it. Mobile wallets are still just an idea. Yes, Google Wallet is out there, but no one accepts it, so what’s the point.

Yes, and people are trying very hard to find flaws in Square. I remember when the GoPayment CEO was telling people how “insecure” Square is but a year later everything is still OK. I wish Google took a page of the Square playbook, but I’m not sure if they are paying any attention.

I’ve been using Square for 5 or 6 months and really like it. The only issue I have is that sometimes it won’t read the card, so I have to keep swiping until it does. Also, I think they need to have phone customer support so you can talk to someone when you need help.

I had the same issue but found a way to fix it. Next time Square can’t read a card just put the card in a plastic bag and swipe it again through the reader. It should work. Still, they need to improve the quality of the reader so we don’t have to invent such tricks.

Square’s customer service is terrible. It takes forever to hear back from them if they get back to you at all. Also, they can hold your money for a month or more for the slightest of reasons. I suggest that everyone read the comments to this Square review before signing up for their service: http://www.cardpaymentoptions.com/credit-card-processors/square-review/.

I’ve never had any issues with Square. Everything has been as promised, no hidden fees and no unpleasant surprises. When you have a million customers there will always be some bad experiences, but in Square’s case these are a tiny minority.

I think digital wallets are a good idea and I’m sure I’ll be using one sometime soon. But they will not displace the old fashined leather wallet anytime soon. It’s just IDs but paper money as well. Credit cards didn’t eliminate cash and mobile wallets won’t do it either.

Square is a good idea, but they need to improve their customer support. It is unacceptable that there should be no one to speak with when you need help. With all the money they received from the VCs, there can be no excuse not to have a better customer service.

Square may have created a new market for itself but it’s not serving it well. They did not answer my emails for more than a week and have no customer service phone line, which is unbelievable. The Intuit GoPayment rates are better and you should have written about them in your post. They don’t hold your funds and actually have a live support on their customer service line.

Square is a lot more deceptive than you will know if you just believed all the hype surrounding it. They never disclosed up front the $1000 hold that my account was subjected to. They also tell you that you would get your money in a day, but I am still waiting for my funds and an email response to my inquiry. People who charge more than $1,000 should not use them! Also, find a company with a customer support you can actually call.

Just like any other kind of technology, security is going to be an issue when it takes off. We saw this with online banking and now we’re seeing it with mobile wallets. I wrote a blog about this topic that further explains the current security concerns for mobile:

http://www.zootweb.com/blog/index.php/data-safe/1018/

As for why consumers will adopt mobile wallets, just like you said, it is a combination of convenience and rewards. Some offer benefits like peer-to-peer lending or physical devices to access accounts for uses like NFC. While physical wallets are not going to eliminated for things like IDs, the capabilities offered by mobile wallets still offer value to consumers in terms of convenience for payments. Mobile wallets also add value because of the realtime nature of their direct consumer rewards. For example, a traditional branded card could be beneficial at the checkout counter, but with a mobile wallet, if a consumer even is in the vicinity of a store, they could be sent realtime offers.