The South Has a Credit Score Problem

TransUnion has analyzed data for consumers living in the country’s 100 biggest metropolitan areas and has found that the two with the highest average credit score happen to be located in and around California’s Bay Area. Residents of the Memphis metropolitan area find themselves at the wrong end of the table. In fact, the South completely dominates the bottom of the rankings table.

I will resist the temptation to attempt to analyze TransUnion’s findings, simply because I don’t have enough data to do so. Credit scores are made up of multiple components, for which TransUnion hasn’t released any details, so that we don’t know for example what the average credit utilization ratios are for each of these metropolitan areas or what the average rates of delinquencies on the various credit types are, etc. Yet, the findings are nonetheless interesting and I thought I’ share them with you.

What Is VantageScore?

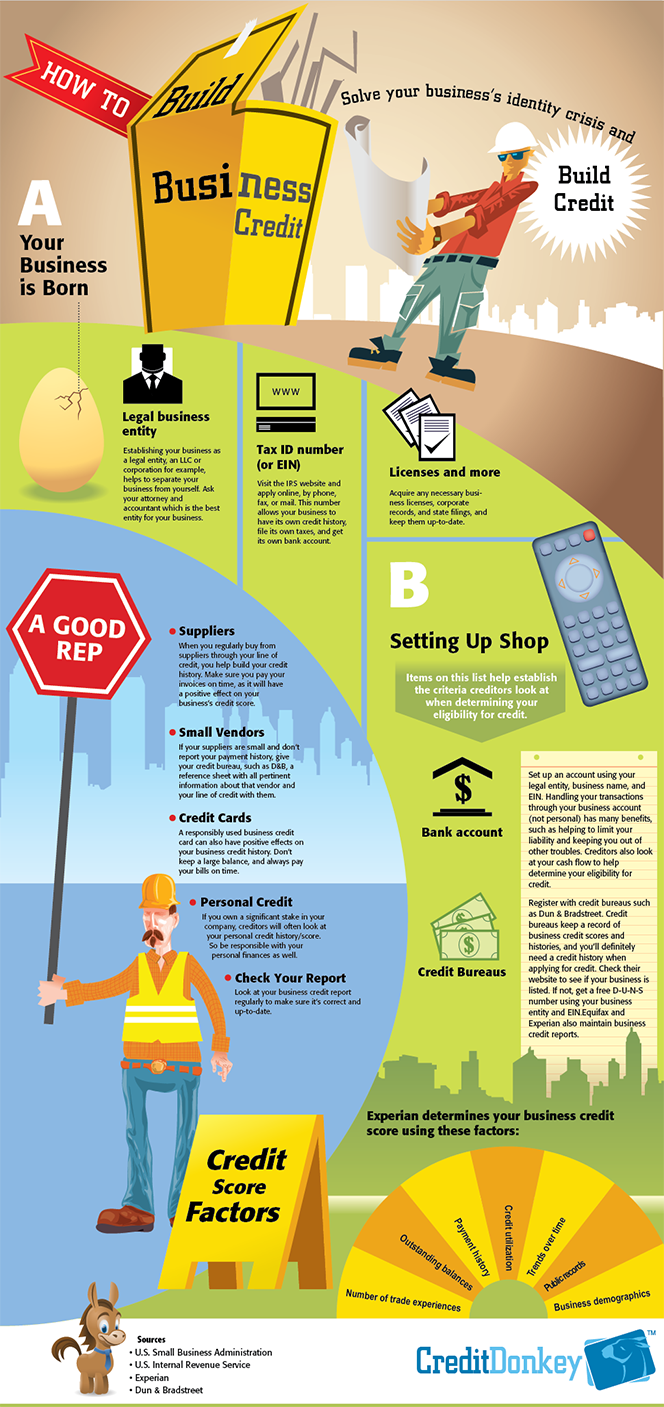

Firstly, let’s briefly go over the basics. A consumer’s credit score is an inverse measure of the risk that she presents to the lender: the higher the credit score, the lower the risk that a loan will be repaid. In TransUnion’s study, consumers’ creditworthiness has been measured using the VantageScore—a credit score developed jointly by the three national credit reporting agencies—Equifax, Experian, and TransUnion—in an attempt to compete with Fair Isaac’s FICO, which is the industry leader. While we don’t know the algorithms used in calculating the two scores, we do know the components of each score. The VantageScore is made up of six constituents, which are all listed, along with their relative weight, in the chart below (image courtesy of WikiMedia).

As you see, a consumer’s payment history accounts for close to a third of her credit score, which is why even one late payment can affect it. Whereas the FICO scores range from 300 to 850, the VantageScore range is 501 to 990. TransUnion grades its scores as follows:

A: 900-990

B: 800-899

C: 700-799

D: 600-699

F: 501-599

The incredible thing is that there is only one metropolitan area in the U.S., whose average credit score made it into the C range, just. All others get a D. Let’s take a look at them.

The South’s Credit Score Problem

Firstly, here are the top ten areas:

| Top 10 Core Based Statistical Areas* with the Highest credit scores | |

| San Jose-Sunnyvale-Santa Clara, CA | 700 |

| San Francisco-Oakland-Fremont, CA | 696 |

| Madison, WI | 694 |

| Honolulu, HI | 693 |

| Minneapolis-St. Paul-Bloomington, MN-WI | 691 |

| Bridgeport-Stamford-Norwalk, CT | 690 |

| Boston-Cambridge-Quincy, MA-NH | 689 |

| Oxnard-Thousand Oaks-Ventura, CA | 685 |

| Portland-South Portland-Biddeford, ME | 685 |

| Seattle-Tacoma-Bellevue, WA | 685 |

So we have seven metropolitan areas located on the country’s west and north-east coasts. Wisconsin is also prominently featured, but the surprise to me was to see Honolulu at fourth place and the reason is that Hawaii often ranks very high on the list of states with highest levels of credit card indebtedness, which is used to determine the credit utilization ratio—one of the major credit score components. Now here are the ten lowest-scoring areas:

| Top 10 Core Based Statistical Areas* with the Lowest Credit Scores | |

| Memphis, TN-MS-AR | 638 |

| McAllen-Edinburg-Mission, TX | 639 |

| Jackson, MS | 642 |

| El Paso, TX | 650 |

| Columbia, SC | 650 |

| Las Vegas-Paradise, NV | 650 |

| Little Rock-North Little Rock-Conway, AR | 651 |

| Baton Rouge, LA | 651 |

| Lakeland-Winter Haven, FL | 651 |

| Augusta-Richmond County, GA-SC | 651 |

*The term “Core Based Statistical Area” (CBSA) is a collective term for both metropolitan and micropolitan areas. A metro area contains a core urban area of 50,000 or more population, and a micro area contains an urban core of at least 10,000 (but less than 50,000) population.

As you see, the South’s domination of the bottom of the rankings table is about as complete as it could be.

How to Improve Your Credit Score

TransUnion makes some valuable suggestions for what you should be doing to improve your credit score and keep it high. Here they are (I skipped the first one, because it is too vague and unhelpful):

– Don’t be tardy with your payments. A history of late payments — even by a few days — can potentially harm your credit score.

– Manage your debts. Keeping high balances relative to credit limits on key credit accounts can likely have a negative impact on a score, so concentrate on paying down debt. As a rule of thumb, keep these balances at or below 30 percent of your total available credit to present the best possible financial image to lenders. Set budget goals and use a tool like TransUnion Plus to monitor not only your credit, but also your key financial accounts like your checking, savings and 401k accounts.

-?áGive yourself time. Long-term credit relationships and a diverse mix of credit accounts may help you achieve a higher credit score. Avoid closing credit cards and other accounts that have been paid on time over a long period, as it can make your credit history appear shorter and could affect your score.

– Limit inquiries. Each time you apply for a new credit card, you should expect that an inquiry will appear on your credit report. Frequent credit card inquiries can make it look like you have a cash flow problem and may lower your credit score. However, when you shop for mortgage or auto loan rates over a two to three week period, credit scoring models typically factor the resulting inquiries together as a single item. This enables you to shop for favorable loan rates with minimal impact to your credit score.

If you follow these guidelines, you will not have to worry about your credit score.

The Takeaway

Looking at TransUnion’s credit score tables I am reminded of the old joke about Bill Gates and Warren Buffett, in which they walked into a bar and immediately made the average patron a millionaire. The point is that the averages in these tables don’t tell you anything about your own particular situation. You may be surrounded by people with credit scores in the mid-500s, but that does not have any direct influence on your own score, which can only be affected by your actions and that is what you need to be concerned with. Still, interesting statistics.

Image credit: Yourmoneydrawer.com.

Well, the consumers with the lowest scores live in the poorest states — surprise, surprise!