The Month in Numbers – July 2012

When it comes to mobile shopping, men prefer phones, while women prefer tablets; m-payments are inexpensive, needed, secure, simple to set up and altogether worth it; credit card companies are going social in a big way; Square is simply demolishing the competition in the mobile credit card acceptance market it created. These are just a few of the more or less arguable statistics that have been presented in infographics or other visual forms and have made it into our monthly column. Oh, and you can learn how to identify and fix errors on your credit report (and you do need to know how to do that).

Every now and again, I would read somewhere that infographics are not nearly as popular as they once were. Well, that may well be true, but I have to tell you that there is an amazing number of well-researched and beautifully done infographics that are still being produced and I hope that this will keep being the case, as the best of them are truly irreplaceable.

Now here are our picks for July 2012.

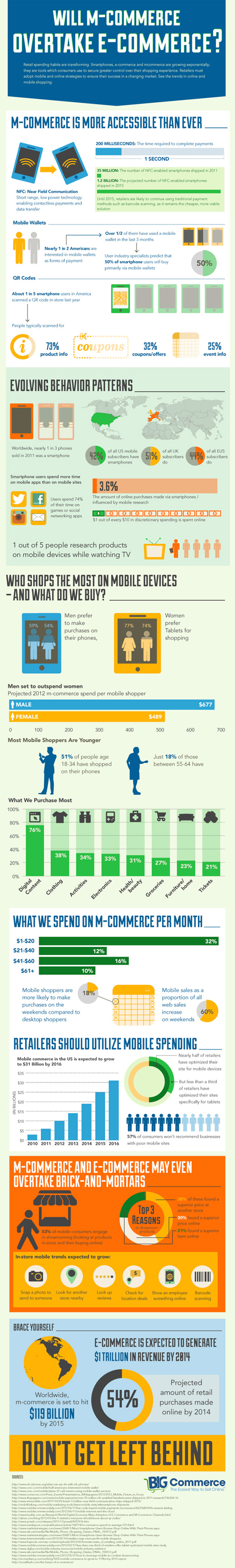

1. M-Commerce vs. E-Commerce

Via CardPaymentOptions.com, a BigCommerce.com’s infographic is showing us why m-commerce is set to overtake e-commerce sometime in the near future. Among other things, we learn that, when it comes to mobile devices, men prefer shopping from their phones, while women prefer tablets. Moreover, this year men are expected to outspend women by quite a margin.

2. The Mythology of Mobile Payments

Myths are keeping Americans from making the jump to mobile payments, declares Intuit in a new infographic devoted to debunking said myths. M-payments are secure, simple to set up and altogether worth it, we are told.

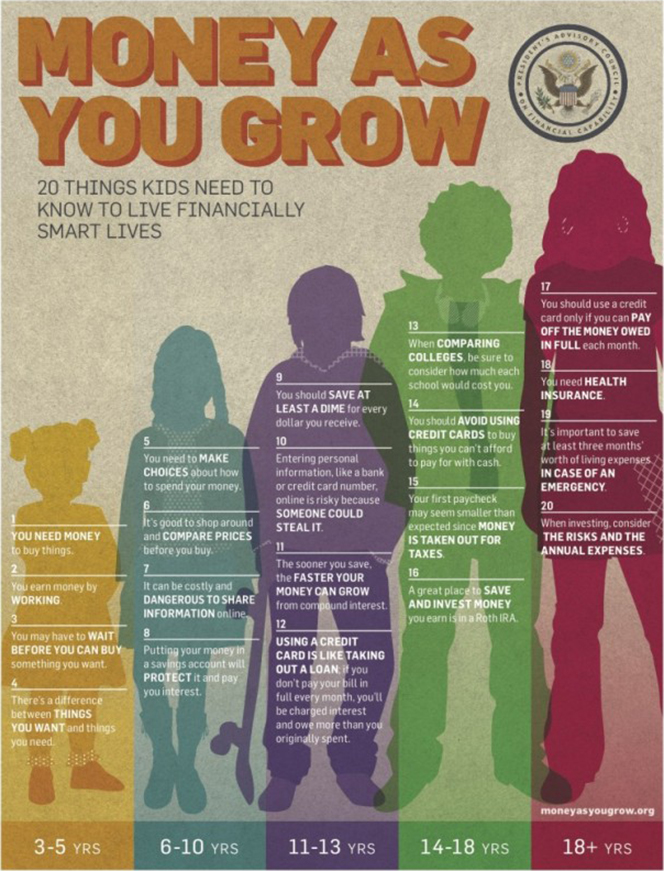

3. 20 Thing Kids Need to Know about Money

Money as You Grow is a website that provides 20 age-appropriate financial lessons — with corresponding activities — that kids need to learn as they grow. Here they are represented in an infographic:

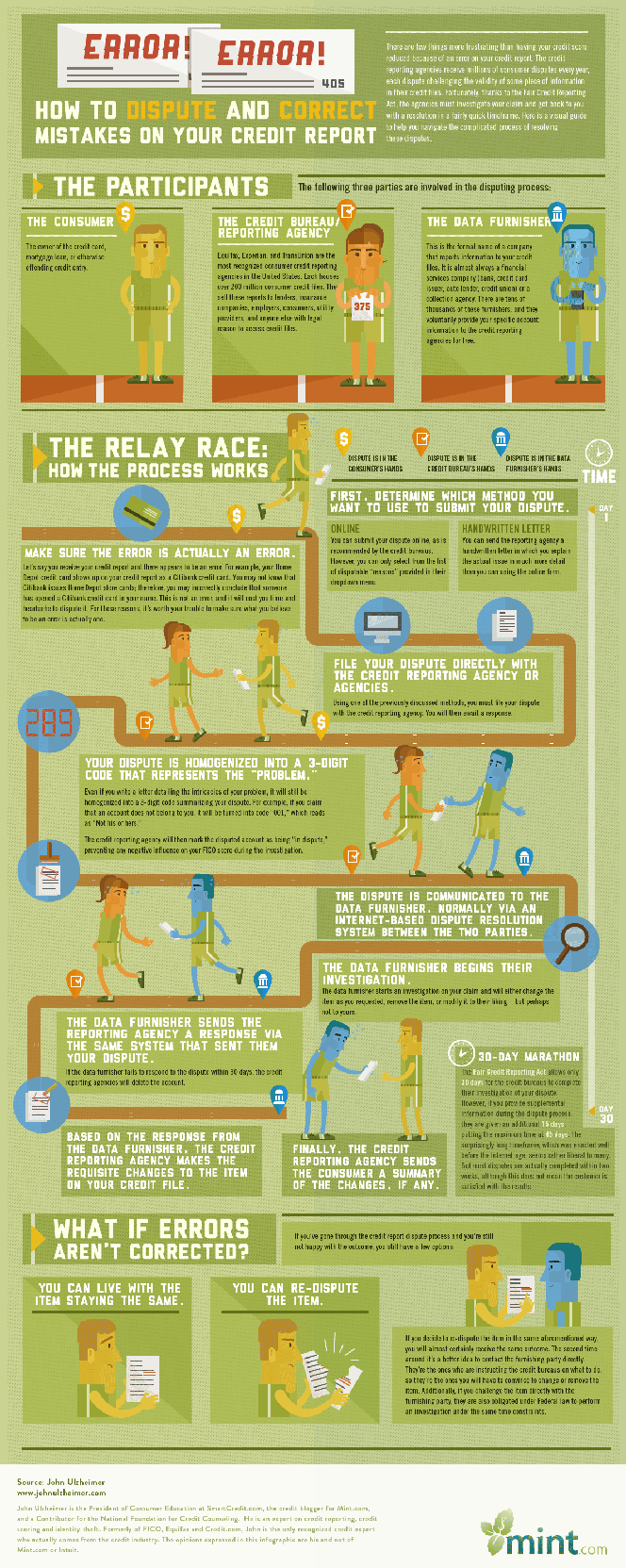

4. Fixing Credit Report Errors

Credit reporting agencies make errors more often than one might think and these can be very costly. So it is critical that you keep a close eye on your credit report and correct such inaccuracies if or when they occur. Mint.com has created an excellent infographic to teach you how to do just that.

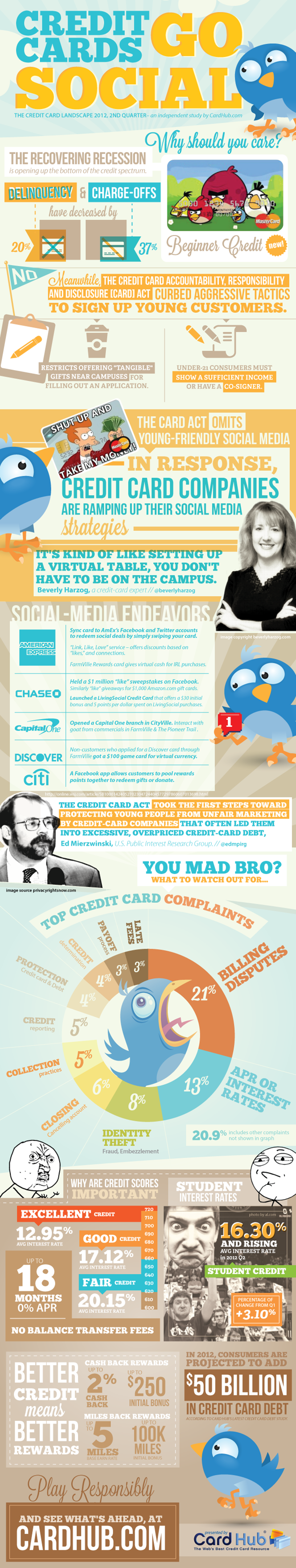

5. How Credit Card Companies Are Going Social

Card issuers can no longer set up tables at college campuses, but they have found more ingenious ways of reaching out to college kids and Card Hub is tracking them down for us in an excellent infographic.

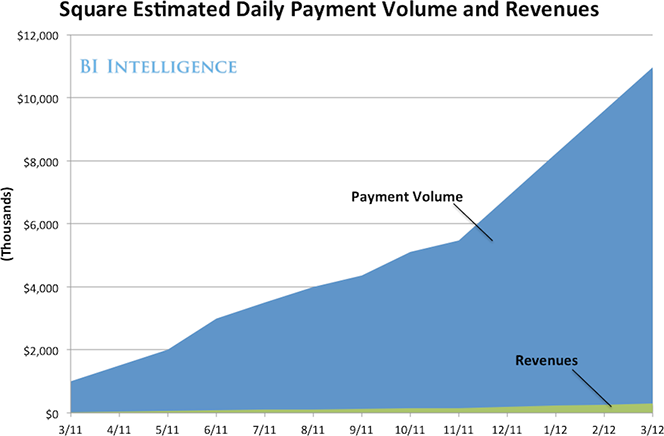

6. The Square Supremacy

In case anyone needed convincing that Square was winning the war in its mobile payments segment, this should do the trick. In the first half of this year, the company has doubled the number of users to two million. Moreover, Square is now processing transactions at a rate of $6 billion per year, up from $2 billion in October of last year. Furthermore, during the month following the launch of PayPal Here, Square increased its processing volume by a quarter! Here is a Business Insider chart for some visual:

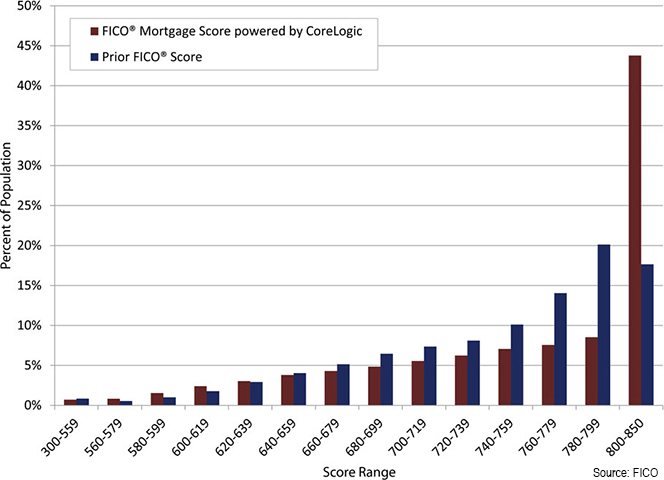

7. Half of Americans Now Have Excellent Credit Scores

A tweak in the algorithm used to calculate your FICO score led to a huge increase in the share of Americans with excellent credit. The 800 – 850 range’s share of the total grew from about 18 percent to about 44 percent. Overall, more than two-thirds of us have better FICO scores when measured using the new model.

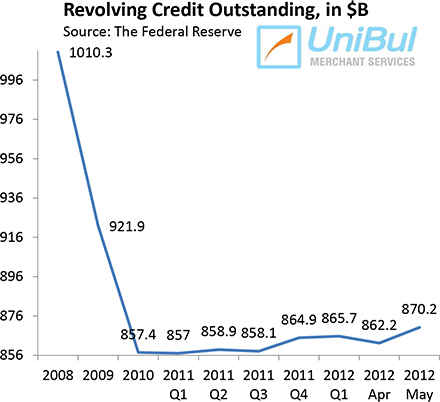

8. U.S. Consumer Credit Card Debt Spikes

American consumers took on a huge amount of fresh credit card debt in May, Federal Reserve data revealed. It was the biggest monthly spike since November 2007, the last month before the Great Recession officially began and was enough to erase all gains made in the past couple of years.

Image credit: Thomaswhitley.com.