Your Credit Score Just Got Better

A new version of FICO, the most widely used credit score model in the U.S., has doubled the share of the highest-score consumer category, the company tells us. The biggest beneficiaries are consumers falling into the second-best range of traditional FICO scores, but there have been improvements at the lower reaches of the spectrum as well, we learn.

Now, the new credit score model will not be replacing the current version anytime soon, we are told, but lenders may take a closer look at a loan applicant, if his new credit score puts her above a given threshold. The bottom line is that the update will increase the lenders’ overall approval rate, or at least that’s what FICO is telling us. Let’s see how this will be achieved.

The New Credit Score Model

FICO has developed its new credit score model in cooperation with CoreLogic, a provider of financial data and analytics, and is designed specifically to be used by mortgage lenders. It augments the existing version by taking into account previously ignored data. Here is how Tim Grace, senior vice president of product management at CoreLogic, explains it:

Today, we are announcing an industry first – a new composite, multi-bureau credit score generated from both traditional credit data and CoreLogic supplemental data, expanding the applicant credit spectrum by including property transaction data, landlord/tenant data, borrower-specific public data, and other alternative credit data.

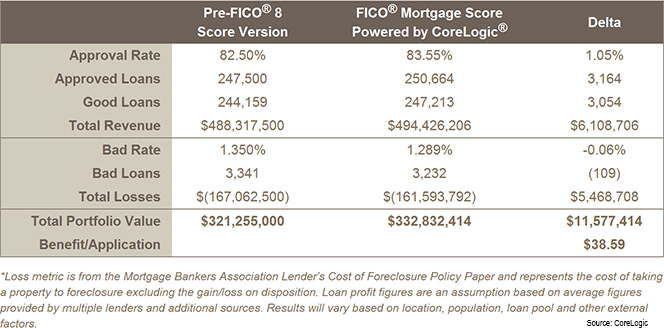

The idea is that these extra data would enable loan officers to approve some of the applicants whose traditional FICO score puts them just below the qualifying threshold. Grace has even calculated with some precision what these gains would be:

For a top-20 lender processing 300,000 applications a year, adopting this new score could translate into 3,900 more loans approved every year along with a net financial benefit of $14.5 million.

Here is how CoreLogic has arrived at these numbers:

So this update should make it easier for well-qualified applicants to get a new mortgage. Now let’s see how it will affect consumer credit scores.

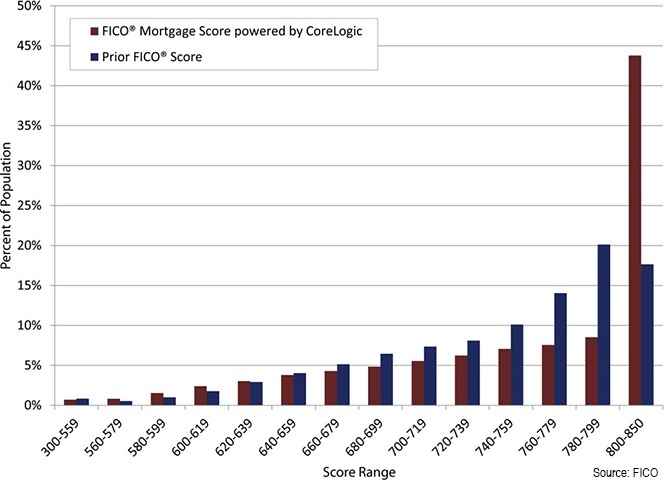

Share of Consumers with Excellent Scores more than Doubles

Looking at the comparison chart below, you see that the biggest beneficiaries of this update are consumers with current FICO scores in the range 780 – 799, more than half of whom have moved into the highest category, as calculated using CoreLogic’s data. Overall, the 800 – 850 range’s share of the total has grown from about 18 percent to about 44 percent. But most other consumers have also benefited. In fact, more than two-thirds of us have better credit scores when measured using the new model.

So the new model makes a huge difference.

The Takeaway

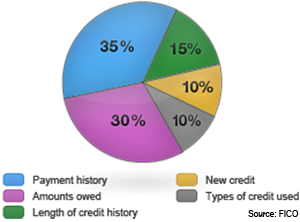

Looking at the chart above, I’m having hard time understanding how the addition of “property transaction data, landlord/tenant data, borrower-specific public data, and other alternative credit data” to the existing information would produce such a profound change in the distribution of consumer credit scores, especially at the very top of the range. Is the existing FICO model (see chart to the right) really that much less accurate at predicting the likelihood of a consumer default? And if it really is, why not replace it altogether with the new, supposedly more accurate, one?

Looking at the chart above, I’m having hard time understanding how the addition of “property transaction data, landlord/tenant data, borrower-specific public data, and other alternative credit data” to the existing information would produce such a profound change in the distribution of consumer credit scores, especially at the very top of the range. Is the existing FICO model (see chart to the right) really that much less accurate at predicting the likelihood of a consumer default? And if it really is, why not replace it altogether with the new, supposedly more accurate, one?

Image credit: Athomebuilders.com.