U.S. Credit Card Debt up by Most since before Recession

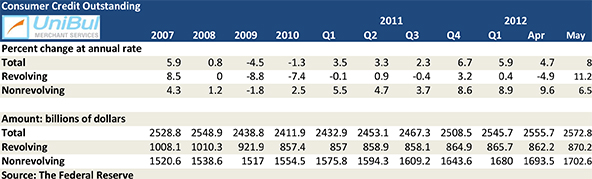

Americans took on a huge amount of new credit card debt in May, the Federal Reserve told us on Monday. It was the biggest monthly spike since November 2007, the last month before the Great Recession officially began and enough to erase all gains made in the past couple of years.

The total in the category that includes student and auto loans also rose, helping to lift the aggregate amount of outstanding U.S. consumer debt up to a level very close to the all-time high set in September 2008. Then the collapse of Lehman Brothers set off the financial crisis that we are still trying to dig ourselves out of, prompting Americans to suddenly discover their frugal side and begin cutting back on debt. That trend, however, has now gone into reverse and we are about to start setting new debt records. Let’s take a look at the latest data.

Credit Card Debt up 11.2% in May

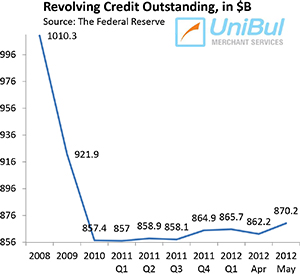

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, rose in May by 11.2 percent, or $8 billion, from the previous month’s level, raising the total up to $870.2 billion.

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, rose in May by 11.2 percent, or $8 billion, from the previous month’s level, raising the total up to $870.2 billion.

Following the financial crisis, U.S. revolving credit had been falling continually until the end of 2010. Then, in 2011, half of the Federal Reserve’s monthly reports showed increases in the credit card debt total, including each of the last four. Now, following the gain in May, the current total is still lower by 13.9 percent, or $140.1 billion, than the $1,010.3 figure measured at the end of 2008.

Overall Consumer Credit up 8%

The non-revolving component of the consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, also rose in May. The Federal Reserve reported a $9.1 billion — or 6.5 percent — increase from the previous month’s level, lifting the total up to $1,702.6 billion.

The non-revolving total has now risen every month since July 2010, with the exception of August 2011 when it fell by 6.4 percent. The current number is higher by 10.7 percent, or $164.3 billion, than the total of $1,538.3 billion, measured at the end of 2008.

The aggregate amount of outstanding consumer credit in the U.S. — the sum of the revolving and non-revolving debt totals — spiked by 8.0 percent, or $17.1 billion, to $2,572.8 billion in May, its ninth consecutive monthly increase and the biggest one this year. The new total is still lower by about $14.7 billion, or 0.6 percent, than the all-time high of $2587.5 billion, set in July 2008, but the gap is closing quickly.

The Credit Card Takeaway

Following its steep decline in the first two-and-a-half years following Lehman’s collapse, the credit card debt total reached its bottom in April 2011 and had remained close to that level in the subsequent months, thanks to a combination of falling delinquency and charge-off rates and record-high monthly payment rate (MPR). May’s results may indicate that this trend has finally reversed itself, although the spike may yet turn out to be a one-off event.

The thing is that the credit card delinquency rates are at record-low levels and are still falling. In May, the delinquency rate was at 2.47 percent, the lowest one on record, according to Moody’s. What is more, the delinquency rate has remained below the three-percent threshold for six months in a row, which had never been reached before. The charge-off rate for the month was reported at 4.90 percent, the lowest since October 2007 and projected to fall to around four percent by the year’s end. Most impressive, however, was the spike in the monthly payment rate (MPR) — the rate at which American consumers are repaying the principal on their credit card debt. The MPR rose by close to one percent to reach 22.47 percent in May, an all-time record and much, much higher than the historical averages, which have hovered in the mid-teens.

So all available data strongly indicate that Americans are still very disciplined with their credit card borrowing and repayment habits. Spending is rising, but so are debt repayment ratios. So we may yet see some further declines in the credit card debt total in the months to come.