PayPal still Most Trusted Mobile Payments Brand

Just over a year ago, a study by GfK, a market research company, found that Americans trusted PayPal more than any other brand when it came to processing their mobile payments, easily beating out rival payment companies Visa and MasterCard and even iconic Apple. A new survey by Carlisle & Gallagher Consulting Group (CG), a consultancy, has asked slightly different questions, but the results have been the same: PayPal is still the preferred mobile payments provider.

The CG study also finds that Americans are ready for mobile wallets and expect them to provide much more than just a depository for their credit card and bank accounts. Unsurprisingly, the ability to receive special offers and incentives top the list of such additional services. Let’s take a closer look at the survey.

80% of Americans Would Use PayPal’s Mobile Wallet

That is, I think, the statistic that stands out the most in the survey. For comparison, the equivalent number for Google and Apple is 60 percent. Unfortunately (and inexplicably), the CG researchers have not included Visa and MasterCard in their study, so we don’t know how PayPal would have measured up against its more traditional rivals. However, I suspect that, if the researchers had asked about them, the two credit card companies would also have outranked the two technology giants. The reason is that yet another survey, conducted six months ago by Market Strategies International, a market research company, found that traditional financial services companies are much more trusted with mobile payments than technology and telecommunications companies and that holds true across all age groups. Here is the gist of that study:

|

Financial Srvcs Company |

Technology Company |

Mobile Carrier |

No Preference |

|

|

18 – 34 |

46% |

17% |

10% |

27% |

|

35 – 44 |

44% |

10% |

11% |

35% |

|

55+ |

34% |

4% |

11% |

51% |

Six months ago I found the above results surprising, because I expected that the huge backlash against the banking industry as a whole would push financial companies down the list of preferred m-payments providers. Moreover, I thought that the iconic status of a firm like Apple would help it score much better in such a survey, at least among the generation Y users. In reality, the researchers found that only 18 percent of respondents favored Apple as a mobile payments provider; only the telecoms — 17 percent — were ranked lower.

What Do We Want from Mobile Wallets?

The researchers found that 48 percent of the survey’s respondents were interested in a mobile wallet and 76 percent of them were either already using or intended to use some form of a mobile banking. Here is what we learn about these consumers:

– The top frustrations for consumers are the inability to manage offers and incentives, and keeping track of payment due dates.

– Sixty-five percent of respondents rated the ability to make better payment choices — such as maximizing loyalty programs or minimizing interest payments as the most valued mobile wallet service.

– Eighty-two percent of Techno Shoppers [consumers attracted to social and shopping features of mobile wallets] responded that making shopping easier was very valuable and 62 percent believe that mobile wallets will make shopping more fun.

So, in case anyone had doubts, consumers’ top priority is getting the most for their dollar, through loyalty programs, special offers, etc. Of course, convenience and ease of account management are, as always, also welcome.

The Takeaway

There are plenty of deep-pocketed candidates for the top spot in the mobile wallet field. Google was the first among the major contenders to launch a digital wallet, with the explicit goal of using it as a data collection tool; the data would then be used for creating special offers, tailor-made for each user. It has so far struggled to make much headway, but the search giant has no intention of giving up anytime soon. American Express has been equally active with its own mobile wallet, called Serve, which, among other things, offers FarmVille residents a way of earning extra Farm Cash, which can then be used for purchasing much needed digital tractors, goats, guard dogs, etc.

PayPal, of course, hasn’t exactly been content to just watch its rivals from the sideline. In fact, the processor just took its own mobile wallet across the pond to the U.K. and the initial reaction has been positive.

The CG survey has confirmed what we already knew about consumer attitudes toward m-payments and mobile wallets in particular. Whoever provider manages to secure the biggest discounts and most attractive deals for its users would stand a much better chance to rule the field than its competitors. If that turns out not to be PayPal, I expect that, a few months from now, we may have a different leader at the top of the consumer preference table.

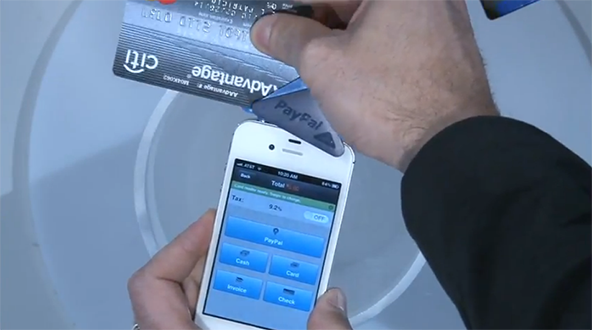

Image credit: YouTube / PayPal.

It makes sense that PayPal is the most trusted company. They’ve been providing web-based wallet services for a long time now and the step to mobile wallets is a short one.

None of these stats mean much. It’s too early yet and people haven’t had the chance to compare services, not least because there aren’t many. Whoever manages to make the best first impression will have a huge advantage.

“Whoever provider manages to secure the biggest discounts and most attractive deals for its users would stand a much better chance to rule the field than its competitors.”

I agree that this is the key. At the end of the day consumers will go with whoever gives them the most.

Yes, just as it is with credit cards. All other things being equal, everyone would go with the card that gives them back the most rewards.

I think we are a long way off from a mobile wallet that would fully replace the physical one. It will not happen until our IDs are fully digitized and I haven’t heard anyone even talking about that. And if I have to carry my driver’s license around and some cash too I might as well just stick to my leather wallet.

I would definitely give an Apple wallet a try if there is one. I’m sure it will be well designed will be easy to use. Whether they can handle the payment processing part behind the scenes as well as they can do the design, that’s what would be interesting to find out.

I would try Apple too if they had a wallet. They have proven that they care about user experience more than anything else and they don’t play tricks on you.

I’m not surprised to see Google not doing well with its wallet and I think there is more to it as a way of explanation than the fact that there aren’t many places where it is accepted. I think people are seriously concerned with the amount of information Google is collecting about us and are refusing to give over even more of it. That said, I don’t think PayPal’s goal is any different.

Exactly, I don’t trust Google with my personal information either and I wonder why wouldn’t someone just create a mobile wallet that does just what a physical wallet does – like storing credit and debit cards – without any of the catches that are being implemented. I can guarantee that there would be a huge market for it.

Allison, you can always opt out of all promotional messages Google would be sending you so you won’t be seeing any of them. But whoever you may choose to be your mobile wallet provider, they will know all of the information that you don’t want to be sharing with Google, whether they run promotional programs or not.

Alex, participation in these promotional programs should not be on an opt-in basis, users should be opted out by default. Also, the mobile wallet provider should not be allowed to collect information about the shopping habits of their users without their explicit consent.

I don’t understand why people are making such a big deal about this. Your credit card company knows everything about where you shop and how much you spend, but you are still using your credit card and collecting your cashback. It will be the same with the wallet. Google will know where you used its wallet and what you used it for and will use the information to send you coupons for the stores you go to the most. What’s so bad about that?

Sam, you are missing the point. Mobile wallet users should be the ones who decide whether or not the service provider would be allowed to use the information about their shopping behavior for whatever purposes. If they agree, they can go ahead with their coupons, but if they say no, the information should not be used for any of this.

With PayPal at least you know what to expect — good or bad — so people are going with the devil they know.