Google Wallet’s Survival Strategy: Bribe the Carriers or Sidestep Them

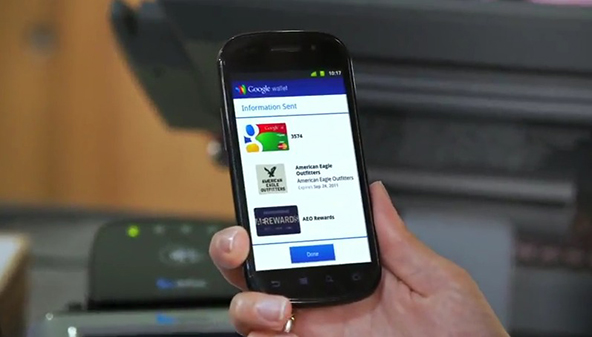

The fact that Google Wallet — the search giant’s heavily publicized mobile payments service — has been slow to take off shouldn’t come as a big surprise. After all, at present there are only two phones that can work with it and there is only one carrier that sells them. Moreover, that carrier — Sprint — is only the third-largest in the U.S., with about half the number of subscribers boasted by each of the two biggest wireless telecoms — Verizon and AT&T.

And yet, Google is unhappy with the progress of its digital wallet and is looking for ways to spur adoption, Bloomberg’s Olga Kharif tells us. But there is a problem: Verizon, AT&T and T-Mobile have invested heavily in a mobile wallet of their own — Isis — that is supposed to go live later this year and are not exactly keen on helping Google take the early lead. So what’s a search giant with plenty of cash on hand to do? Well, there are really only two possible alternatives — work either with or around the carriers — and apparently Google is in the process of weighing the relative value of these strategies against each other. And whatever decision the Google executives make, they’d better get it right, because it will not be easily reversed.

What Does Google Want?

From a consumer’s perspective, Google Wallet, and any other digital wallet for that matter, is a payment tool. It simply lets you store credit and debit card information and then it allows you to select one of the cards for payment at a participating merchant.

However, that’s not how Google sees its latest payment service. Google Wallet’s primary function, as far as the search giant is concerned — is data collection. These data can later be used by participating merchants for targeted ad campaigns, for a price. So early on Google decided that it didn’t want any share of the payment processing fees, which it wouldn’t have received even if it had asked very nicely for it, and it focused instead on the data piece of the equation.

That was the right decision, although apparently not an obvious one. Isis — Google Wallet’s as-of-yet dormant competitor — initially decided to build a closed system, in which the company would be issuing the cards, processing the payments and managing the data. That would’ve been a potentially immensely profitable venture, but it was even more difficult one to build. It took many months of precious time for the Isis executives to finally realize just what they were getting themselves into and they eventually decided to scale down the project’s ambitions to Google Wallet’s level. I’m still amazed with the sheer cluelessness of the Isis management. As a result, Google got a huge jump start on its competitor.

Google’s Way Forward: Bribe the Carriers or Sidestep Them

Isis’ misfortunes notwithstanding, Google has not been able to make much headway with its digital wallet for the reasons I already mentioned. Now, one of them — the scarcity of compatible devices — will soon be resolved, as all major handset manufacturers are expected to release phones supporting NFC (the data transmission technology behind Google Wallet) by the year’s end.

But what can Google do with the carriers? Verizon — the biggest one among them — has blocked Google Wallet, citing security concerns (which are not entirely unfounded). The search giant claims to have resolved the issue, but the ban remains. And now Bloomberg tells us that Google is attempting to bribe its way into Verizon’s system by offering a piece of the advertisement revenue pie, which really is the only thing it has to offer.

It will be interesting to see whether Verizon (as well as AT&T and T-Mobile) will take Google up on its offer. On one hand, doing so would hurt the prospects of Isis, the trio’s own digital wallet. However, if the carriers reject Google’s advances, the search giant might sidestep them altogether. But then, Google may decide to do so anyway and is in fact already exploring carrier-free possibilities. As Bloomberg reports, Google is working with manufacturers of point-of-sale (POS) terminals for a solution that would enable payments to be authorized between the merchant and Google, sidestepping the carrier. It’s not immediately clear how that would be done if Verizon keeps blocking the Google Wallet app from being downloaded by its users, but it’s also not an insoluble problem. If all else fails, the search giant can possibly resort to NFC-enabled stickers, which Google Wallet users can attach to their phones.

The Takeaway

Verizon cannot just keep blocking Google Wallet forever. Whether it decides to work with or against Google, the carrier will have to at some point allow its users to download the app. So I think that Verizon and its competitors will be happy to reach some kind of a revenue-sharing agreement with Google, if one was offered. Google, for its part, doesn’t really need to share the loot. If payments could be reliably authenticated without the carriers’ help, why share anything with them?

Image credit: Droid-life.com.