Liquidity, Savings Rate and Student Loans

A recent University of Michigan report on the financial health of the American family reminded me of the old joke about Bill Gates and Warren Buffett, who walked into a bar and immediately made the average patron a millionaire. Similarly, since 2008, the average American family’s savings level has improved, we learn; however, that is the result of more families having $50,000 or more in liquid assets. No other group has shown an improvement.

Such dynamics aren’t surprising, the researchers tell us, adding that a rush to safe assets is exactly what should be expected in the aftermath of a financial crisis. However, only families with more than $50,000 have been able to do that in the current iteration, while all others “are simply treading water, if they’re lucky.” Let’s take a look at the report’s findings.

The Liquidity Trap

Here is what I think is the gist of the report:

As of 2009, 18.5% of families had no liquid assets, and by 2011 this had grown to 23.4% of families. At the same time, the overall percentage of families in the highest category of $50,000 or more in liquid assets increased from 11.8% to 14.6%.

…

Data from the St. Louis Federal Reserve Bank indicate a personal saving rate of 2.1% as of June 2007, with rates of 5.5% in June 2009 and 5.0% as of June 2011. While these estimates imply that there is the potential for assets accumulating at the aggregate level as the overall rate of saving grows, the estimates based on Table 5 suggest a substantial heterogeneity across families.

So, even as the personal savings rate has, on average, more than doubled in the aftermath of the financial crisis, the proportion of U.S. families with no liquid assets has risen by more than a quarter from 2009 to 2011. During the same period, the ratio of families with more than $50,000 in savings has increased by close to 20 percent.

What about Student Debt?

The researchers haven’t paid much attention to the rising student debt, although they do note that there has been

a modest overall rise in non-collateralized debt balances [credit card debt, student loans, medical or legal bills, or loans from relatives] from 2009 to 2011. A part of this rise is student loan balances, which have been shown as one of the rising household debt components since 2008.

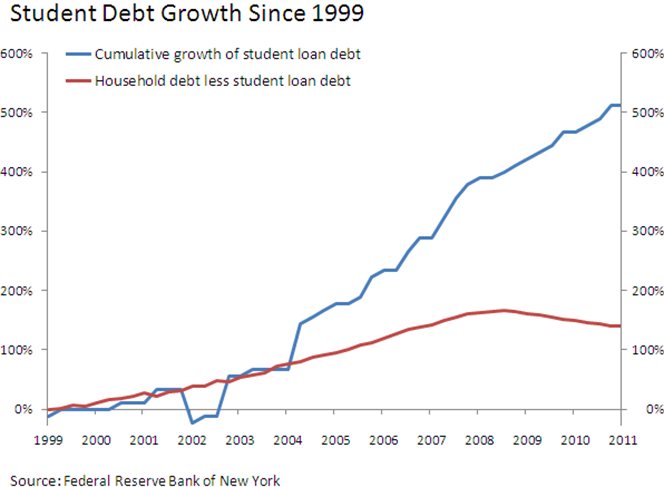

I expect that we will be hearing a great deal more about the rising student debt in the months to come. The issue has already become impossible to ignore. According to the New York Times, 94 percent of students earning a bachelor’s degree today take out loans to pay for it — up from 45 percent in 1993. As we noted in our own report last month, the growth of student debt, which until 2004 had been occurring at the same rate as the rest of the household debt, has since exploded:

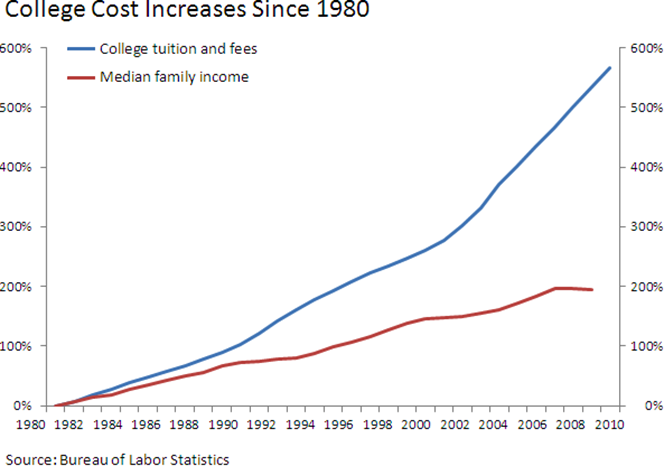

Moreover, the rise of college costs has been outpacing the growth of the median American family income since about 1982. To make matters worse, college costs have been rising at an accelerating rate throughout the crisis, even as the family income growth has become slightly negative, as you can see in the chart below.

This trend is clearly unsustainable and a correction is inevitable. The only question is whether it will be a managed process or a chaotically destructive one. If recent history is anything to go by, we should be bracing ourselves for the latter scenario, but then of course, the next time could be different.

The Takeaway

Here is how Frank Stafford, a co-author of the report sums up his findings:

And even though average savings levels have gone up since 2008, our data show that there has been no improvement in financial liquidity between 2009 and 2011, except among families with more than $50,000 in savings and other liquid assets.

Stafford expects that the home mortgage crisis, which his data suggest is slowly unwinding, will continue for a few more years, but it will affect a smaller share of American families. Let’s hope that its end doesn’t coincide with the beginning of the student loan crisis.

Image credit: AlaskaDispatch.com.