How the Poor Subsidize Credit Card Programs and Other Facts

We’ve known that cash-using households, which also happen to be lower-income, have been subsidizing card-using households, which are also higher-income, since at least 2010 when three Boston Fed economists — Scott Schuh, Oz Shy, and Joanna Stavins — published a paper on the subject. We did cover their findings at the time, but in a recent talk one of the researchers — Scott Schuh — showed a couple of updated tables that I thought were worth sharing.

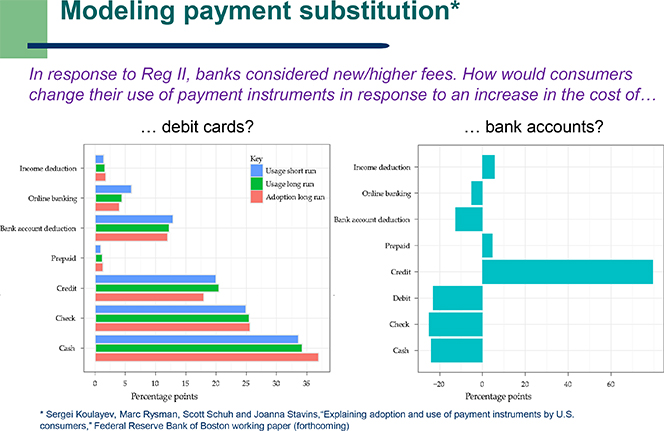

In his talk, Schuh also touched on the indirect effects of the recently enacted Durbin Amendment on consumer payment choices. As many of you know, the limiting of debit interchange fees prompted issuers to start looking for other sources of income and banking costs promptly rose as a result. So let’s take a look at what Schuh had to share with us.

How the Poor Are Subsidizing the Rich

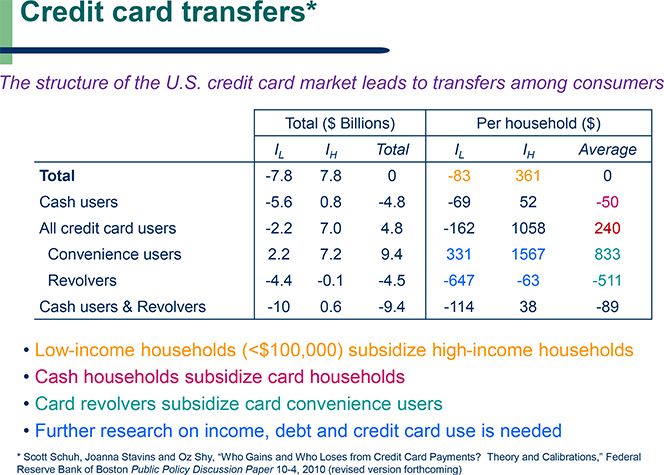

Here is how Schuh and his colleagues summarized their findings in their 2010 paper:

Merchant fees and reward programs generate an implicit monetary transfer to credit card users from non-card (or “cash”) users because merchants generally do not set differential prices for card users to recoup the costs of fees and rewards. On average, each cash-using household pays $149 to card-using households and each card-using household receives $1,133 from cash users every year. Because credit card spending and rewards are positively correlated with household income, the payment instrument transfer also induces a regressive transfer from low-income to high-income households in general. On average, and after accounting for rewards paid to households by banks, the lowest-income household ($20,000 or less annually) pays $21 and the highest-income household ($150,000 or more annually) receives $750 every year. We build and calibrate a model of consumer payment choice to compute the effects of merchant fees and card rewards on consumer welfare. Reducing merchant fees and card rewards would likely increase consumer welfare.

And here is how the researcher presented his findings at his talk last month:

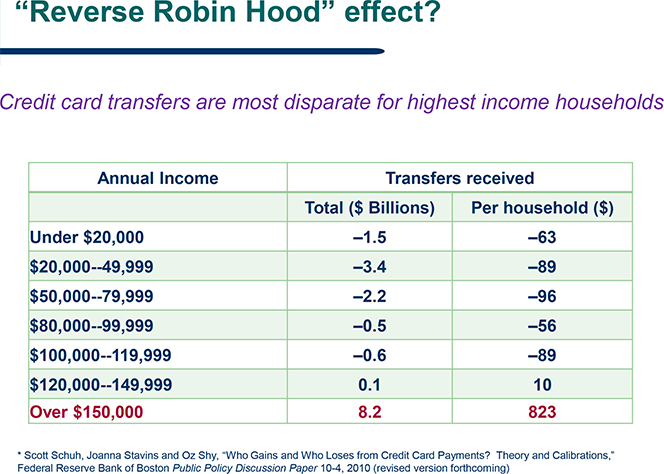

The following table shows even more clearly where the money goes: overwhelmingly the recipients are households with incomes higher than $150,000.

Durbin Amendment Aftereffects Steer Consumers toward Cash, Credit Cards

Card issuers have been hard at work trying to steer consumers away from debit cards and toward using their credit cards more often. Judging from the charts below, their efforts have not been entirely fruitless (Reg II refers to the Durbin Amendment).

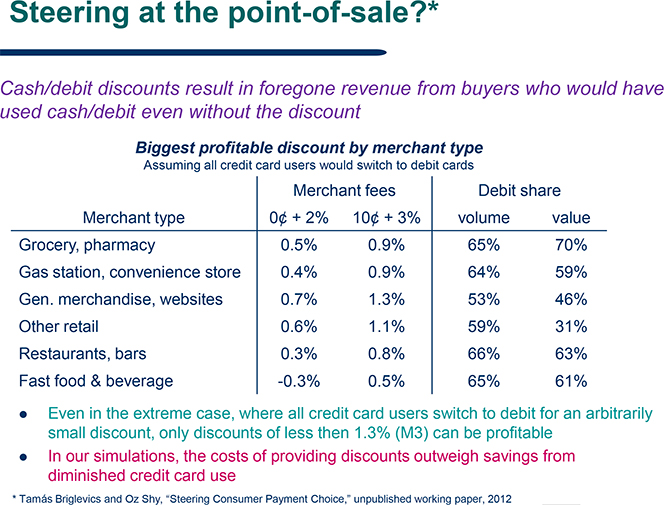

Then Schuh goes on to illustrate that there is not much that merchants can do to steer customers in the opposite direction, toward debit card use. As he reminds us, merchants are allowed to influence their customers’ payment choices by offering a discount on the retail price or free merchandise, but not by placing a surcharge on a given payment method (i.e. credit card). However, as the table below shows, the costs of providing discounts are greater than the savings from lower credit card use.

The Takeaway

The researchers’ model for calculating credit card transfers among different income groups is fairly straightforward. They point out that, because merchants only get paid 97 percent – 99 percent of each card sale’s amount (the rest is processing fees), and are not allowed to surcharge card transactions, they have to raise prices for everyone. So the upshot is that everyone pays higher prices, but those using rewards cards are getting some of the surcharge (or more than that) back in the form of cash-back, airline miles, etc. However, while that is indeed the case, it is also true that the Durbin Amendment did not lead to lower prices, even as it lowered costs for merchants. So does that mean that there was a transfer from consumers to merchants? I think we are very likely to be reading papers on the subject from Federal Reserve and other researchers in the coming months.

Image credit: Marketingcity.se.

I love your Blog. Such a nontransparent industry…. Yours is the best I have found. Keep up the good work.

Pure sci-fi

Great info thanks for sharing…