Americans Have Fewer Credit Cards, Lower Credit Limits

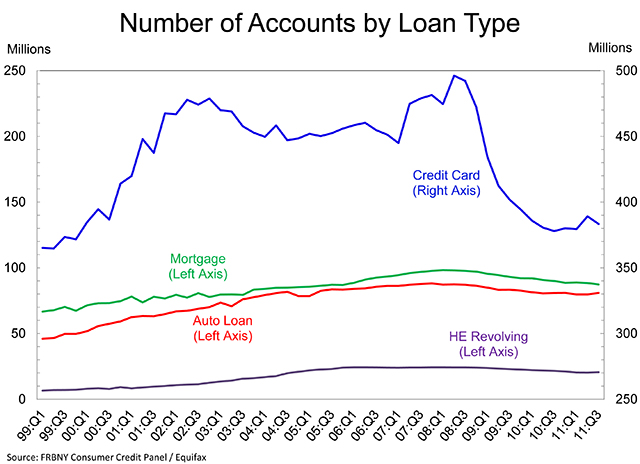

The number of open credit card accounts in the U.S. has once again declined in the third quarter of this year, according to the latest Household Debt and Credit quarterly report, issued by the Federal Reserve Bank of New York (FRBNY). The aggregate credit limits also fell and both numbers are now well below the peaks measured in 2008.

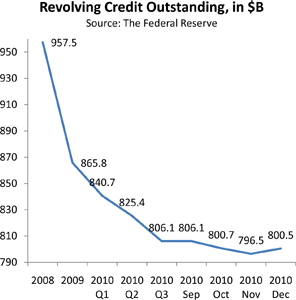

The aggregate consumer debt also fell, for a second consecutive quarter and for the eleventh time in twelve quarters, the FRBNY report tells us. Outstanding mortgage balances also fell, but home equity lines of credit (HELOC) balances rose.

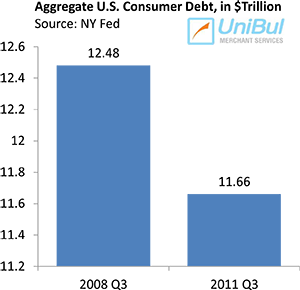

U.S. Consumer Debt Down 0.6%

The FRBNY report’s headline news is that the overall indebtedness of U.S. households at the end of September was $11.66 trillion. That is $60 billion (0.6 percent) lower than the revised level measured at the end of the second quarter and 6.6 percent, or $0.82 trillion, lower than the peak level recorded in the third quarter of 2008, at the end of which Lehman Brothers’ tumbled and the financial crisis began.

The FRBNY report’s headline news is that the overall indebtedness of U.S. households at the end of September was $11.66 trillion. That is $60 billion (0.6 percent) lower than the revised level measured at the end of the second quarter and 6.6 percent, or $0.82 trillion, lower than the peak level recorded in the third quarter of 2008, at the end of which Lehman Brothers’ tumbled and the financial crisis began.

The FRBNY’s Household Debt and Credit report gets its data from Equifax, one of the three national credit reporting bureaus. Here are its key findings:

- Mortgage balances fell by $114 billion, or 1.3 percent, and are now 9.6 percent below their peak level.

- HELOC balances rose by $14 billion (2.3 percent) and are now 10.5 percent below their peak.

- Non-real estate indebtedness rose by $32 billion, or about 1.3 percent, to $2.62 trillion.

- Total household delinquency rates rose to 10 percent in the quarter, up from 9.8 percent in 2011 Q2. About $1.2 trillion of consumer debt is now delinquent, $834 billion (69.5 percent) of which is past due by 90 days or more.

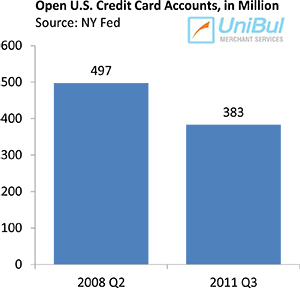

Credit Card Accounts, Limits Fall

The number of active credit card accounts, having increased by 10 million in 2011 Q2, fell by 6 million in the third quarter, to 383 million, according to the NY Fed. That number is about 23 percent lower than the 2008 Q2 peak. The aggregate credit card limits across these open accounts also fell, by $25 billion (0.9 percent), for the period and are now 20 percent below the 2008 Q4 high.

However, we learn that although both the number of active credit card accounts and the aggregate credit limits are down, Americans are once again actively looking for new credit. The number of new credit card inquiries within six months, as reported in 2011 Q3, was 13 percent higher than the 2010 Q1 low.

The Takeaway

The fact that the aggregate number of active credit card accounts is still falling, even as Americans are increasingly applying for new accounts, indicates that the issuers’ underwriting standards are still very tight. The only other variable that can affect this total is the number of closed accounts, which are terminated either voluntarily by the consumer or by the issuer for various reasons like long-term inactivity or, which is more often the case, through a default. The NY Fed report does not give us data on account closures, but we know from various other sources that defaults are now at very low levels and continue to decline. So the impact of closures on the falling number of open account is likely to be minimal.

The fact that the aggregate number of active credit card accounts is still falling, even as Americans are increasingly applying for new accounts, indicates that the issuers’ underwriting standards are still very tight. The only other variable that can affect this total is the number of closed accounts, which are terminated either voluntarily by the consumer or by the issuer for various reasons like long-term inactivity or, which is more often the case, through a default. The NY Fed report does not give us data on account closures, but we know from various other sources that defaults are now at very low levels and continue to decline. So the impact of closures on the falling number of open account is likely to be minimal.

We also know that the number of new card offers has been on the rise for some time now and that issuers are increasingly sweetening up their proposals with some incredibly enticing bonus offers and rewards programs.

However, most of the new offers featuring some form of incentive (about 60 percent of all offers) go to consumers with credit scores above 720, according to Mintel Comperemedia, a company monitoring direct mail, print and online banner advertising. The average American has a credit score of 661, according to Credit Karma, a provider of free credit scores, which means that the surge of high-quality offers bypasses the majority of consumers. Moreover, it is safe to assume that the average credit score is so low, by today’s underwriting standards, that most Americans will not be approved for new credit at any rate.

So, as is so often the case, new credit is offered to those who least need it.

Image credit: Etsy.com.

I do not live in US but I have noticed similar trends in Europa too. World is small, everything is connected in a monetary world.