Fewer Americans Default on Credit Cards

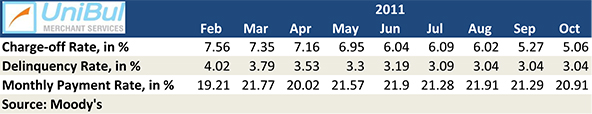

A record-high percentage of Americans kept making their credit card payments on time in October, keeping the aggregate delinquency rate unchanged for the third consecutive month and at the lowest level in more than four years, according to the latest data from Moody’s, a credit ratings agency. The charge-off rate fell by six basis points from its September level and is now about 3.5 percent lower than the rate recorded at the same time a year ago.

The six largest U.S. card issuers reported mixed data for their credit card portfolios in October. Two of them — Bank of America and Citigroup — had lower default rates for the month and the issuers were also split in the delinquency category, with BofA, Discover, Citi and American Express recording decreases.

Credit Card Charge-offs Down 0.06%

The decrease in defaults by 0.06 percent in October, although not nearly as impressive as September’s 0.75 percent decline, was nevertheless noteworthy for continuing a pattern that began immediately following the Lehman collapse in 2008. According to Jeffrey Hibbs, a Moody’s Assistant Vice President:

Earlier in the decade, sharp charge-off improvements in September were typically followed by increases in October, a pattern that has been broken now for the past three years as charge-offs continue their steady descent.

Charge-offs (or defaults) are overdue credit card balances that lenders no longer expect to be repaid and write off (charge off) of their accounting books as losses, usually 180 days after receiving the last payment on the account.

Moody’s expects defaults to continue to decline throughout 2012, with the charge-off rate eventually falling below four percent.

Credit Card Delinquencies Flat at 3.04 Percent

Having previously fallen for 22 months in a row, Moody’s aggregate credit card delinquency rate for October remained unchanged at 3.04 percent for a third consecutive month. That is still about a third below the rate measured a year ago.

Moody’s headline delinquency rate measures the proportion of credit card accounts for which payments are late by at least 30 days. The early-stage delinquency rate — payments overdue by 30 – 59 days — fell by a single basis point in October, to 0.86 percent, which is also a record territory, as Hibbs tells us:

With the early-stage delinquency rate index hovering near its all-time low, the pace of further improvement is likely to be muted. However looking ahead, the calendar is moving into a period that suggests seasonal declines in the early-stage delinquency rate in the coming months.

Isn’t it a bit counterintuitive that the holiday shopping season, when we spend more than at any other time of the year, would produce a more disciplined debt repayment pattern?

Biggest Issuers’ Reports Mixed on Charge-offs, Delinquencies

The six largest U.S. credit card issuers were almost evenly split in their October charge-off and delinquency results. Here is how each of them fared:

|

Charge-off Rate, % of Total |

Delinquency Rate, % of Total |

|||

|

September 2011 |

October 2011 |

September 2011 |

October 2011 |

|

| Bank of America |

5.99 |

5.98 |

3.99 |

3.97 |

| JPMorgan Chase |

4.13 |

4.18 |

2.53 |

2.55 |

| Discover |

3.17 |

3.26 |

2.50 |

2.48 |

| Capital One |

3.90 |

3.96 |

3.65 |

3.73 |

| American Express |

2.30 |

2.70 |

1.50 |

1.40 |

| Citigroup |

5.87 |

5.66 |

3.30 |

3.26 |

Here is how the issuers’ latest measurements compare to the post-Lehman record-highs:

|

Charge-off Rate |

Delinquency Rate |

|||

|

Record, % / Month |

Change, % |

Record, % / Month |

Change, % |

|

| Bank of America |

14.53 / Aug 2009 |

58.84 |

8.01 / Aug 2009 |

50.44 |

| JPMorgan Chase |

10.91 / Jan 2010 |

61.69 |

4.95 / Sep 2009 |

48.49 |

| Discover |

9.11 / Feb 2010 |

64.22 |

5.72 / Oct 2009 |

56.64 |

| Capital One |

10.87 / Apr 2010 |

63.57 |

5.80 / Jan 2010 |

35.69 |

| American Express |

10.40 / Apr 2009 |

74.04 |

5.30 / Feb 2009 |

73.58 |

| Citigroup |

12.14 / Aug 2009 |

53.38 |

n/a |

n/a |

As you see, American Express leads its peers in both absolute numbers, as well as in biggest percentage decreases in both categories.

The Takeaway

The third consecutive month of flat delinquencies gives us the strongest indication yet that the decline in the rate of overdue credit card payments may have come to an end. Charge-offs, on the other hand, are still declining and will continue to do so for several months after the delinquencies have flattened out, which is why Moody’s expects them to fall below 4 percent sometime next year.

The third consecutive month of flat delinquencies gives us the strongest indication yet that the decline in the rate of overdue credit card payments may have come to an end. Charge-offs, on the other hand, are still declining and will continue to do so for several months after the delinquencies have flattened out, which is why Moody’s expects them to fall below 4 percent sometime next year.

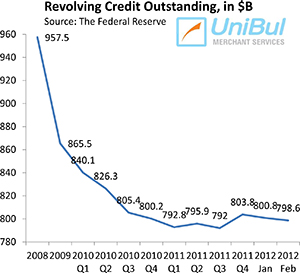

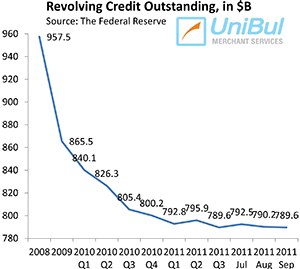

Additionally, the latest Federal Reserve data show that credit card debt in the U.S. is at the lowest level in more than seven years. Moreover, whatever it is they do spend on credit cards, Americans are much quicker to pay back than they have historically been. The October monthly payment rate (MPR), which gives us the proportion of outstanding credit card balances consumers are repaying at the end of each month, is 20.91 percent, according to Moody’s. Although lower by a percentage point from the August peak, the October MPR is still very high compared to a historical average in the mid-teens.

As we keep saying, there is every reason to expect that Americans will continue to be cautious with their credit cards for as long as the economy remains in its current fix and unemployment is at stratospheric levels.