Americans Continue Slashing Credit Card Debt

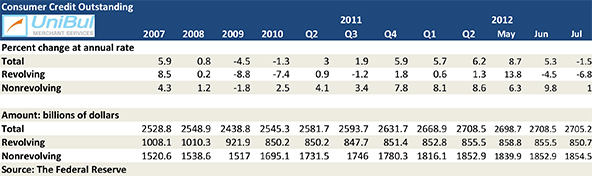

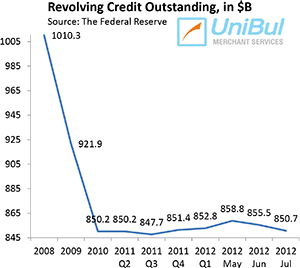

Consumer credit card debt has fallen in July, which, coupled with the decrease in June, has more than offset the steep increase in May, we learn from the latest Federal Reserve consumer credit data, released on Monday. That is not exactly unexpected, as ever since the sharp fall of the aggregate amount of U.S. credit card debt ended in late 2010, every noteworthy monthly increase in the total has been promptly followed by a decline of about the same magnitude. As a consequence, over the past two years, consumer credit card debt has remained virtually unchanged.

By contrast, the much larger consumer debt category that includes student and auto loans has just keeps rising and this past July was no exception. Moreover, following a data revision going back to 2010, the aggregate amount of U.S. consumer debt in July — the sum of credit card and non-credit-card debt — was well above the pre-Lehman record-high level. Let’s take a look at the latest data.

Credit Card Debt down 6.8% in July

The aggregate amount of outstanding consumer revolving credit in the U.S., comprised almost exclusively of outstanding credit card balances, declined in July by 6.8 percent, or $4.8 billion, from June’s level, bringing the total down to $850.7 billion.

The aggregate amount of outstanding consumer revolving credit in the U.S., comprised almost exclusively of outstanding credit card balances, declined in July by 6.8 percent, or $4.8 billion, from June’s level, bringing the total down to $850.7 billion.

Ever since the financial crisis struck in September 2008, U.S. credit card debt had been falling uninterruptedly until the end of 2010. Then, in 2011, half of the Federal Reserve’s monthly reports showed increases in the debt total, including each of the last four. Following the drop in July, the current total is lower by 15.8 percent, or $159.6 billion, than the $1,010.3 figure measured at the end of 2008.

Overall Consumer Credit down 1.5%

The non-revolving portion of the consumer debt total, which is made up of student loans, auto loans and loans for mobile homes, boats and trailers, but it does not include home mortgages and loans for other real estate-backed assets, grew again in July, albeit very slowly. The Federal Reserve reported a mere $1.6 billion — or 1 percent — increase from the previous month’s level, bringing the total up to $1,854.5 billion.

The non-revolving total has grown in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The current figure is higher by 16 percent, or $255.8 billion, than the total of $1,598.7 billion, recorded at the end of 2008.

The total amount of outstanding U.S. consumer credit — the sum of the revolving and non-revolving portions — fell by 1.5 percent, or $3.3 billion, to $2,705.2 billion in July, breaking a run of ten consecutive monthly increases. Following a data revision, the new total is now greater by about $117.8 billion, or 4.6 percent, than the pre-Lehman high of $2,587.4 billion, set in July 2008, precisely four years ago.

The Credit Card Takeaway

So this latest Federal Reserve release provides one more confirmation for the shift in consumer attitude toward credit card debt that began following the collapse of Lehman Brothers four years ago. In my view, that shift should be viewed as one of the defining features of the post-crisis period. Not only did the credit card debt total fall precipitously in the first two years following the financial crisis, but so did the delinquency and charge-off rates. Furthermore, the credit card monthly payment rate (MPR) — the rate at which cardholders are paying down the principal on their credit card debt — has increased by more than a third, compared to the historical averages. And all these three indicators, having already set records, are still improving, even as the credit card debt deleveraging process has now slowed down. So it is quite clear that at present Americans are in no mood for taking on any more credit card debt.