With Credit Card Losses at Record-Lows, Issuers Are Raking It In

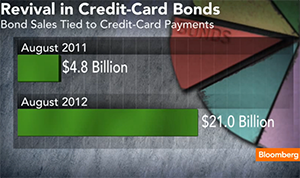

U.S. credit card companies have sold about $21 billion of bonds backed by credit card payments so far this year, up from $4.8 billion last year, Bloomberg is telling us. J.P. Morgan alone has sold $5.4 billion worth of such bonds, triple the amount the bank sold last year, we learn. And, as BusinessWeek’s Nick Summers says, that is a good thing.

See, today the credit card portfolios of U.S. lenders are in much better shape than they have been in years. In the first couple of years following the financial meltdown in September 2008, issuers got busy purging their portfolios of their worst performing customers. That process, coupled with much improved debt repayment patterns among the cardholders who remained active, led to continually falling credit card delinquency rates, which are now at historic lows and are still falling, dragging down charge-off rates in the process. So why wouldn’t investors be willing to buy bonds backed by high-quality collateral? Let’s take a look at the latest numbers.

See, today the credit card portfolios of U.S. lenders are in much better shape than they have been in years. In the first couple of years following the financial meltdown in September 2008, issuers got busy purging their portfolios of their worst performing customers. That process, coupled with much improved debt repayment patterns among the cardholders who remained active, led to continually falling credit card delinquency rates, which are now at historic lows and are still falling, dragging down charge-off rates in the process. So why wouldn’t investors be willing to buy bonds backed by high-quality collateral? Let’s take a look at the latest numbers.

Credit Card Delinquency Rate: 1.82%

The Fitch Prime Delinquency Index, which tracks the rate of credit card payments late by sixty days or more, has decreased for 30 consecutive months, the ratings agency tells us. Having peaked at 4.54 percent in January 2010, the late payment rate has since fallen to 1.82 percent, just four basis points above the record-low of 1.78 percent set in August 1994.

Credit Card Charge-off Rate: 4.45%

The Fitch Prime Chargeoff Index is currently at 4.45 percent, the first time it has fallen below the 5-percent mark since 2007 and is now lower by 60.86 percent than the all-time record of 11.37 percent set in September 2009. The charge-off rate is measured as a ratio of the number of credit card accounts with outstanding balances that the lender does not expect to be repaid by the cardholders, in relation to the total number of open accounts in the bank’s portfolio. Charged-off accounts are written off of the issuer’s books as losses, typically at 180 days after the last payment on the account has been received. The charge-off rate is far off the record-low of 3.10 percent measured in 2006, as Fitch reminds us, but the decline is still ongoing.

Monthly Payment Rate: 22.05%

And now here is my favorite indicator for future credit card performance. The credit card monthly payment rate (MPR) — the rate at which cardholders are repaying the principal on their credit card debt — now stands at 22.05 percent. That is 24 basis points below the record-high of 22.29 percent set in the previous month, but is well above the long term average of about 16.50 percent, according to Fitch.

Improved Underwriting Discipline

Looking at all these numbers, one of the analysts quoted in Summers’ piece states the obvious by saying:

You may have to go back to the 1980s to see credit losses and delinquencies as low as they are right now. It’s a sign that consumers are much more concerned about having good credit today, and a sign that the credit-card companies have been very disciplined in their underwriting.

Indeed. Credit is also given, with justification, to the CARD Act of 2009, which instilled a “forced rationality” into credit card issuers, in the words of another analyst quoted by Summers. The idea is that, by forcing issuers to be more honest with their pricing and to adopt more consumer-friendly practices in general, the legislation helped keep more credit card accounts in good standing, thus helping to improve the quality of the issuers’ portfolios.

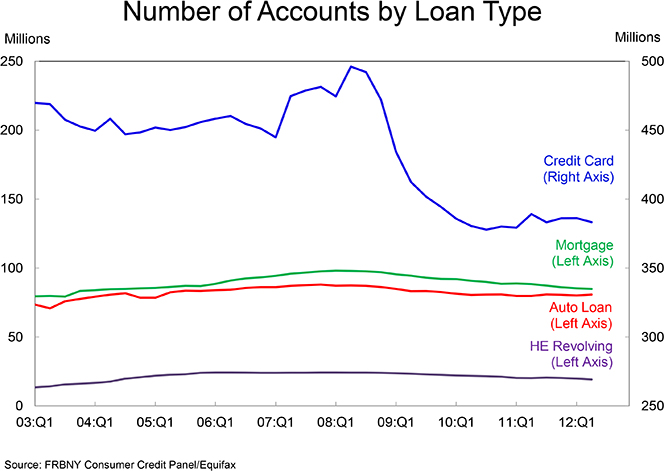

The improved underwriting discipline, coupled with the closure of millions of underperforming accounts, has led to a significant decrease in the number of currently-active credit card accounts. As the New York Fed reported last week, at the end of the second quarter of this year, there were 383 million open credit card accounts in the U.S., down by 23 percent from the 2008 Q2 peak of 496 million.

The Takeaway

So I agree with Summers’ assessment that, far from being a cause for distress, the “$20 billion-and-growing [credit card-backed] bonds trend… is a rare signal of a saner industry”. U.S. issuers’ credit card portfolios are now in great shape and most metrics are still improving.

Image credit: Wikimedia Commons.