A Non-News from Isis Tells Us why Google Leads the Digital Wallet Field

Isis, the highly-publicized mobile payments joint venture formed by AT&T, T-Mobile and Verizon, has broken its long silence to announce, well nothing of significance. In fact, if anything, what Isis is telling us reveals why Google is leading the fledgling digital wallet field. That and the fact that Isis hasn’t even launched yet and will not do so until July, on current schedule, while Google Wallet went live in September of last year.

So Google will have had the field to itself for almost a full year, before Isis has made its appearance. That will give the search giant all the time it needs to work out its wallet’s security issues and polish the rough edges of its offering, while making all the mobile wallet news in the process. And it will be very difficult for Isis to catch up when it finally does go live, even if it manages to come up with a good product.

What Is Isis Telling Us?

The announcement at issue, for what it’s worth, was made at the Mobile World Congress in Barcelona and I just can’t help but think that it was done simply because Isis had to say something to get itself back in the news and get some of the spotlight away from its rival. What were we told? Well, the news was that Chase, Capital One and Barclaycard had agreed to enable their cards to be placed into the Isis mobile wallet. That was all.

That is the first news to come out of Isis since July of last year when the company announced that it had opened up its platform to all major U.S. credit card networks, which was a step in the right direction. But what I don’t understand is why they would need the issuers’ approval when they already have the blessing of the card networks?! It’s like PayPal having to ask each individual issuer of MasterCard and Visa cards for permission, before allowing its cardholders to save their card information in their PayPal accounts.

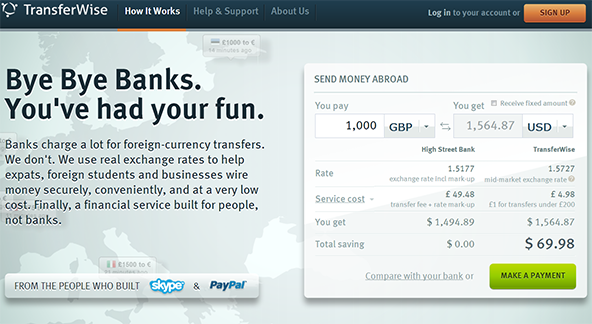

Such a process doesn’t make sense, because a digital wallet provides nothing more than a (presumably) secure storage space for its users’ bank cards. Then, whenever the cardholder wants to make a payment with a particular card, she would simply select it from the list (the equivalent of pulling it out of her physical wallet), as shown in the image above, and complete the payment. Now, you don’t need your issuer’s permission to do that, do you?

How Did Isis Get Here?

Initially Isis had planned to create a much more ambitious closed-loop payments platform, which would have required users to open up a new card account with Barclaycard and all transactions would have been processed through Discover’s payment network. While that arrangement would have been much more profitable for Isis, because it would have allowed it to collect the processing fees, in addition to any service fees, it would also have been very restrictive to consumers who would not have been able to place any of their existing cards into their new digital wallets.

Eventually Isis scrapped the idea when its executives belatedly realized just how enormous of a project they had undertaken. Looking back, I’m still amazed with how ill-prepared for the task at hand they were with so much money at stake, but the failure of Isis’ management produced a rare beneficial side effect for consumers who would now be able to use their wallets with the card of their choice. Or so it seemed.

The Takeaway

I may be misreading this, but I can’t help but read this talk about an “agreement” and “relationship” between Isis and the three issuers, about “partners” and “ecosystems” as a cover for an objective of placing limits on the types of payment instruments consumers can and cannot use with their Isis wallets. The way I see it, Isis should instead be building relationships with its users, using the issuers as nothing more than vendors. That is precisely what PayPal has been doing for more than a decade now and is one of the reasons for its huge success.

At the end, consumers will be the ones who will decide which mobile wallet to use and there will be plenty of options to choose from. We don’t yet know which one will end up being the favorite, but we do know that it will be the one that appeals primarily to its users, not to their card issuers.

Image credit: Isis.