U.S. Credit Card Balances, Late Payments Continue to Fall

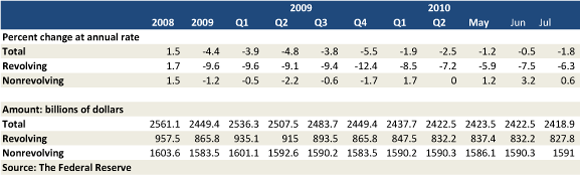

U.S. consumers have reduced their revolving credit lines, comprised mostly of credit card balances, by 6.3 percent at an annualized rate in July from June, a decrease of $4.4 billion, according to the latest data released by the Federal Reserve. These latest figures continue the trend that began with the onset of the financial crisis two years ago. Overall, since the end of 2008, revolving credit in the U.S. has dropped by $129.7 billion to $827.8 billion, a decrease of 13.5 percent.

The latest regulatory filings from the major credit card issuers provide yet another indication that U.S. consumers have become more conservative with their debt management. Credit card delinquencies – payments late by 30 days or more – continued their downward trend at all major issuers. Charge-offs – loans lenders no longer expect to be repaid and have written off their books as losses – have risen from the previous month, but falling delinquency rates will eventually lead to decreasing charge-off rates as well. Credit card companies typically charge-off loans that are 180 days past due.

Here are the figures from the major credit card companies:

- JPMorgan Chase’s 30-day delinquency rate – payments late by 30 days or more – fell to 3.89 percent in August from 4.06 percent in July. Its charge-offs rose to 8.18 percent from 7.95 percent during the same period.

- Bank of America reported a 30-day delinquency rate of 5.68 percent in August, down from 5.92 percent in July. The Charlotte, N.C.-based bank’s charge-off rate rose to 11.72 percent in August, up from 11.39 percent during the previous month.

- Citibank said its 30-day delinquency rate in August was 4.95 percent, down from 5.3 percent the previous month. The New York-based bank charged off 11.18 percent of its balances, up from 9.75 percent in July.

- Capital One’s 30-day delinquency rate dropped to 4.56 percent in August from 4.66 percent in July. The bank’s annualized charge-off rate was 8.19 percent, up slightly from 8.13 percent during the same period.

- Discover reported a 30-day delinquency rate of 4.47 percent in August, down from 4.72 percent during the previous month. Its charge-off rate totaled 7.98 percent of credit card loans that have been packaged into bonds, up from 7.28 percent in July.

- American Express continued to lead its peers in both categories. The New York-based company reported a 30-day delinquency rate of 2.4 percent in August, down from 2.6 percent in July. AmEx’s charge-off rate was unchanged at 5.5 percent.

The rates of late payments determine the amounts issuers set aside to cover potential future losses when balances are written off. Lower levels of delinquent payments translate into lower potential losses.