The Origins of Electronic Payments Redux

We’ve written several times before on this subject, but there always seems to be something more to say about it. Today it is SwitchPay’s turn to enter the conversation. SwitchPay is a Square-like payment processor, whose strategy for competing with its far better-funded rivals (I’m using plural, because any newcomer here has to deal with the likes of PayPal and Intuit, in addition to Square), as best I can tell, revolves solely around offering lower processing rates. It’s not going to work, but the start-up’s business prospects need not concern us today.

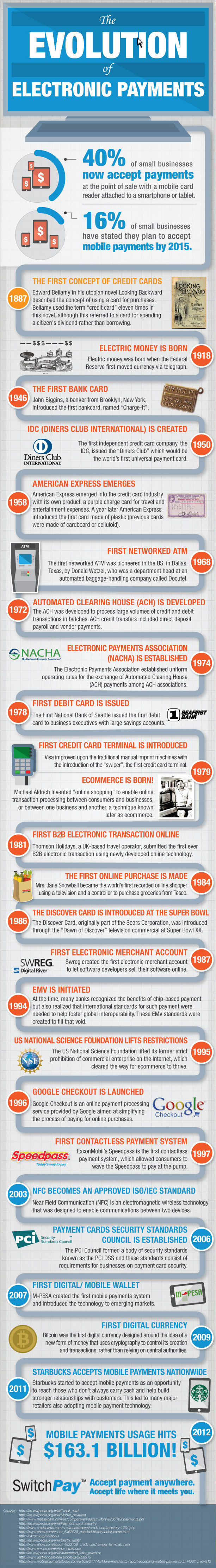

SwitchPay is tracing the concept of e-payments all the way back to 1887 in a new infographic. Much like the more traditional payment methods of years past, e-payments arose, “because of the natural inclinations of humans to innovate and develop pragmatic solutions through the use of available resources”, the authors assert. “New forms of technology that enhance our efficiency and ease of accomplishing goals and creating value are balanced by our discarding of items that are no longer suitable to our goals”, they add, before concluding that, “[h]istorically, people’s methods of handling payments have followed this course”. This process is playing out on several fronts in the payments world right now, but the biggest no-longer-suitable item that is being discarded is the paper check. But let’s get back to e-payments and take a look at the infographic.

The Evolution of Electronic Payments

Payment methods are continually evolving in response to the marketplace, the authors suggest, although I would posit that often enough, payments innovations arise in anticipation of market demand, not as a response to it. Did you really need your mobile phone to act as a credit card all that badly? Anyway, the innovation continues, the SwitchPay guys note, adding that:

For the same reasons that drove us to switch to gold as a replacement for grains as currency, we are now developing electronic forms of payment for worldwide exchanges of products and services.

Well, I could quibble with this analogy — whereas for much of history, gold, in specie, has been used as a medium of exchange in the past, electronic payments, in their various guises, merely offer alternative ways for transacting in whatever the medium of exchange happens to be (say, dollars, euros or yen). So we are not switching from dollars to e-payments as we did from gold to fiat money. Not anytime soon, anyway, whatever the Bitcoin faithful may want to have us believe. Rather, the various e-payment technologies provide electronic versions of the purses and wallets people have been using for millennia to carry money around, as well as virtual versions of the cash drawers, registers and safes merchants have been using to store cash. Of course, e-payments also provide means for exchange of payment information between transaction participants.

But let’s briefly go over the main points in SwitchPay’s e-payments timeline. So, it all begins, we are told, in 1887 when Edward Bellamy describes the concept of using a card for purchases in his utopian novel Looking Backward. Bellamy used the term “credit card” eleven times in his novel, the SwitchPay guys have counted, although what he meant wasn’t really a credit card in the contemporary sense: the card in Bellamy’s novel was used for spending the cardholder’s own money, rather than borrowed money.

Electronic money was born, according to SwitchPay, when the newly-created Federal Reserve “first moved currency via telegraph” in 1918. The first bank card — the aptly named “Charge It” — was issued by a banker named John Biggins in 1946, four years before the first independent credit card company –?á Diners Club International — was created. And on we go through events such as the creation of the ATM, which is often credited with being the sole financial invention to benefit consumers in the past several decades, the Automated Clearing House (ACH), the debit card, the merchant account, etc.

Here is the infographic for you.

Image credit: Wikimedia Commons.