Citigroup Pushes U.S. Credit Card Charge-offs up, Delinquencies Keep Falling

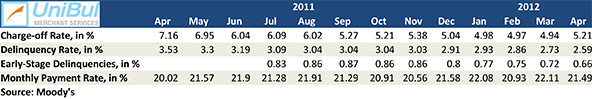

A spike in Citi’s credit card charge-off rate pushed the U.S. average up in April, according to the latest Moody’s Credit Card Indices. The other five big issuers reported lower or flat charge-offs for the month and Citi’s increase will be reversed in the coming months, we are told. The ratings agency still expects that by the year’s end, the national charge-off index will be at around four percent.

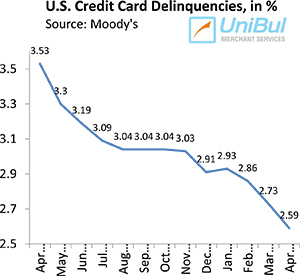

The headline delinquency rate, however, continued its free fall, setting yet another record in the process, the third one in as many months, we learn. Moreover, late payment indices improved across all stages of delinquency: early, mid and late, paving the way for lower charge-offs.

The monthly payment rate (MPR), which in March rose to its highest level ever, fell in April, but it is still at the second-highest point ever recorded by Moody’s and much higher than the historical average. Let’s take a closer look at the numbers.

Credit Card Charge-offs Up to 5.21%

Credit card charge-offs rose for the first time since November of last year, by 27 basis points, according to Moody’s. The current level — 5.21 percent — although the highest one since November, is still lower by 1.95 percent than the April 2011 rate, a decline of 27.2 percent.

Credit card charge-offs rose for the first time since November of last year, by 27 basis points, according to Moody’s. The current level — 5.21 percent — although the highest one since November, is still lower by 1.95 percent than the April 2011 rate, a decline of 27.2 percent.

The charge-off (also called write-off or default) rate is calculated as the ratio of all individual credit card accounts with overdue balances that an issuer no longer expect to be repaid by their cardholders, in relation to the total number of active accounts in the issuer’s portfolio. Charged-off accounts are written off of the bank’s books as losses, usually at 180 days after the last payment on the account has been received.

Credit Card Delinquencies down to 2.59% – an All-Time Low

The late payment rate fell by 0.14 percent in April to 2.59 percent. This is the lowest rate ever measured by Moody’s since the agency began tracking the indicator more than 20 years ago. It is also the fifth month in a row in which the delinquency rate has remained below the three-percent level, which had never been reached before.

The late payment rate fell by 0.14 percent in April to 2.59 percent. This is the lowest rate ever measured by Moody’s since the agency began tracking the indicator more than 20 years ago. It is also the fifth month in a row in which the delinquency rate has remained below the three-percent level, which had never been reached before.

Moody’s headline credit card delinquency rate is calculated as the ratio of accounts on which payments are past due by 30 days or more, in relation to the total number of active accounts. The agency also tracks an “early-stage delinquency rate” for payments that are overdue by 30 – 59 days. This rate also fell in April — by six basis points to 0.66 percent — another all-time low.

There is a limit to how low the delinquencies can fall and it is called zero. The early-stage delinquencies are already very close to it and are much lower than they’ve ever been. And yet they keep falling, dragging down the mid- and late-stage delinquencies as they go and, by extension, the charge-off rate. It’s a fascinating thing to watch and one of the biggest indicators for the huge shift in consumer sentiment toward credit card debt.

The Takeaway

The increase in the charge-off rate in April will turn out to be a one-off event and I expect it to be fully reversed in May. As the default rate is a trailing indicator for the delinquency one, the long-term trend of the former indicator must follow the one of the latter, with some delay. And as the early-stage delinquencies are still trending downward, I think that Moody’s expectation for the charge-off rate to fall to around four percent by the end of the year is rather conservative.

But my favorite credit card indicator these days is the monthly payment rate, because it is a great guide to the future trajectory of the delinquency and charge-off rates. The MPR is calculated as the ratio of the amount of credit card debt which Americans are repaying at the end of each month, in relation to the total outstanding principal balance. In April, the MPR fell by 0.62 percent from its record-setting March level, to 21.49 percent, which is still good for an all-time second-best. Historically, the MPR has hovered in the mid-teens, which tells you just how much higher credit card debt repayment has climbed on consumers’ financial priority list.

My parents never had a credit card. They paid everything in cash, and if they didn’t have enough, they didn’t buy it. It looks to me that Americans may be reverting back to those times and are beginning to live within their means. And that’s good!

It’s not as straightforward as you make it sound. I use credit cards for everything and pay them off in full every month. I’ve never paid a late fee or anything other than my own transactions since I got my first card 15 years ago. And the best thing is that I get 3% in cash back on my purchases just for using my credit card. So why should I use cash, it just makes no sense.

Jennifer, would you mind telling us where did you get this credit card with a 3% cash back? I’m tired of hearing about all these wonderful rewards programs that are all around us but somehow I don’t get any such offers.

Ken, your credit score is probably not high enough which is why you aren’t getting good credit card offers but they exist. Different banks use different models but most of them will not give a really good rewards card to anyone with a FICO lower than 700 or so.

I think I read somewhere that banks are offering reward cards to people with credit scores as low as 660 or so, below that they are considered sub-prime.

The people who are very unlikely to default on their credit cards are also the people who take the time to carefully read the fine print of their contracts before opening up a credit card. The rest seem to have already gone through a bankruptcy or have managed to somehow restructure their credit card debt to make it manageable.

My experience with credit cards is that they are charging outrageously high late fees and interests rates. Basically it is a scam and it is very easy to get you to a point where you can no longer can keep up on your payments. We need better regulation.

I use my AmEx credit card for practically all of my spending and pay it off every month. I pay no interest or fees and don’t even know what they are. I just don’t care because even if my APR is 100% it doesn’t affect me. My reward program isn’t the best in the world but I still get some cash back. If you have the spending and repayment discipline, you’ll never get in trouble with your credit card.

Credit card companies will try to get you any way they can. Citi once tried to introduce an annual fee to an active account I had, one with a balance that I was paying monthly interest os so they were making money on it. I was able to pay it off and canceled it. They got me with a fee for one year but that was all.

What these numbers are telling me is that people are scared. They don’t know whether they’ll have a job tomorrow and they don’t spend as much as they otherwise should and focus on paying down their existing debts. That’s why the delinquency rate is so low and keeps falling.

I agree, people are still very much in a deleveraging mood and are not spending on anything they can’t pay off quickly.

There is nothing wrong with some amount of fear if it keeps you in the straight and narrow, which is the effect the fear of debt is producing. Americans had gone to an extreme with their credit cards and that was going to get into reverse at some point. It is happening now.

I keep hearing this argument, but I don’t think it paints the whole picture. The fact is that debit card spending is also decreasing and at a faster rate than credit cards. So it’s not just about debt slashing but refusing to spend.