Who Loses from Credit Card Fraud?

You know that you are fully protected against fraudulent transactions processed on your credit or debit card account. The process of crediting your card with the amount of the unauthorized charge may at times take a bit too long for your taste, but you do eventually get back what’s yours. Yet, someone does pay for it and that someone very rarely is the criminal. When caught, the fraudsters are typically sentenced to jail and ordered to pay back whatever it is they stole, plus any damages the judge may deem appropriate, but that’s hard to do when you are in prison.

What ends up happening is that the loss is shared between the card issuer and the merchant who’s processed the fraudulent transaction. So I thought I’d share with you some statistics about these losses and you may find some of the numbers below surprising.

U.S. Fraud Losses Are Split 59 / 41 between Issuers and Merchants

Kansas City Fed economist Richard J. Sullivan has crunched the numbers for us and has found that in 2006 U.S. card issuers have absorbed 59 percent of the fraud losses, with the remaining 41 percent belonging to the merchants. Here is a more detailed breakdown:

So credit card fraud makes up 61.9 percent of the issuers’ losses, ATM withdrawals add 19.8 percent, signature debit transactions account for 16.8 percent, and the remaining less than two percent belong to PIN debit payments.

On the merchant side, the numbers you see in the table tell only a part of the story. While the POS fraud total is significantly higher than the number for card-not-present transactions, the volume of card-present transactions is about 30 times higher than that of card-not-present ones. So as a share of the sales volume, fraud losses in 2006 were about 20 times higher for internet and MO / TO merchants than for POS ones.

The U.S. Fraud Rate Leads Developed Countries

The U.S. had the highest fraud rate among the six developed countries in the Sullivan study. Here is the breakdown:

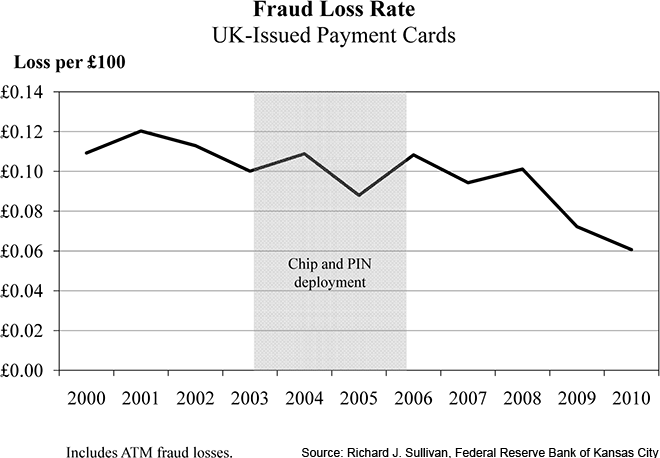

Leaving the U.K. aside, the difference between the U.S. fraud rate and that of the other examined countries is huge. In fact, the fraud rate has since declined substantially in the U.K as well, as shown below (source):

The above diagram clearly illustrates one of the reasons why the U.S. suffers much higher fraud rates than its peers: chip-and-PIN (EMV) cards are much more secure than magnetic-stripe-based ones and the latter type is what we have here in the States. But there is more to this story. Sullivan tells us that the implementation of the EMV technology in a given country causes fraudulent transactions that would have been committed in this country to be processed elsewhere:

Prior to the adoption of chip-and-PIN cards, about 18 percent of fraud on counterfeit cards of UK issuers occurred on transactions outside of the UK, but today it is over 80 percent (APACS). Much of this growth has been on transactions in the United States, where magnetic stripes are still used on payment cards.

So much of the fraud that would’ve taken place in the U.K. was committed on our side of the pond. Great import, chums!

Another reason why the U.S. lags behind is its reliance on signature-based debit transactions. For example:

In Australia approximately 90 percent of debit transactions in 2006 used PIN codes, compared to only about 40 percent in the United States.

And as non-EMV PIN-based transactions are much more secure than signature-based ones, that is another reason the U.S. has such a big lead over its peers in this unenviable category.

Yet another reason is that e-commerce and MO / TO transactions are much more commonplace in the U.S. than elsewhere. For example:

[O]nly 20 percent of individuals ordered goods over the Internet in Spain, compared to 57 percent in the UK (EC Staff Working Document). A 2008 survey of U.S. consumers found that 83 percent of them made purchases on the Internet (Hitachi).

And, as we already know, on a per-dollar-spent basis, the rate of card-not-present fraud is about 20 times higher than the one for card-present transactions.

The Takeaway

So the U.S. fraud rate is much higher than it is in other developed countries, and for good reason. The good news is that we are finally about to switch to the EMV technology. First Visa required its payment processors to ensure that all U.S. merchants can accept chip-and-PIN cards by April 2013 and then MasterCard followed suit. That shift will lead to an immediate drop in the U.S. fraud rate, although we will still lead our peers, because of our love of e-commerce and MO / TO transactions. Still, it will be a significant development.

Image credit: HD.org.