How the Acceptance of U.S. Credit Cards in Europe Will Reduce Fraud Losses

First Visa made it mandatory for all U.S. credit card processors to ensure that their merchants’ point-of-sale (POS) terminals can accept chip-and-PIN cards by April 1, 2013 and now MasterCard has joined its larger rival, we learn from various news reports. MasterCard’s move was widely expected, but it’s significant nonetheless.

So we are about to finally make the move to the more secure EMV credit card technology and by itself security is a more than a good-enough reason to do it. Yes, it could be argued that, as cardholders are fully protected against losses from fraudulent transactions, limiting card fraud would only benefit card issuers and processors. Even if that were the case, consumers would still benefit from the certainty that their credit cards will be usable in Europe. However, limiting fraud matters to consumers as well, as issuers’ fraud losses are indirectly reflected in the levels of interest rates and penalty fees we pay. Let’s take a closer look at the new technology and the benefits we should expect to gain from its adoption.

What Is EMV?

EMV stands for Europay, MasterCard and Visa and is a global standard for chip-embedded payment cards and their compatibility with POS terminals and ATMs. The standard was established in 1994 by Europay International (acquired by MasterCard in 2002), MasterCard and Visa (hence, the name).

Today the standard is managed by EMVCo., a joint venture of MasterCard, Visa, JCB and American Express. As of the third quarter of 2011, there were 1.34 billion EMV-compliant payment cards in use globally, up from 730 million in 2008, according to EMVCo. Now that the U.S. is about to adopt the technology, that number is sure to skyrocket.

The main advantage offered by the EMV technology is that the cardholder’s account information is stored into a chip that is embedded into the card. That is more secure than storing sensitive information on a magnetic stripe, from where it can be very easily copied with inexpensive devices through a process known as “skimming.” According to Bankrate.com, in 2010 skimming losses in the U.S. approached $1 billion and Javelin Strategy & Research, a consultancy, estimated that in the same year one in five Americans were hit by an ATM skimmer.

What Should We Expect from the EMV Adoption?

EMV cards rely on PIN verification of the cardholder’s identity, which the data clearly show is a much more secure validation method even when used with magnetic stripe-based cards, compared to signature verification. In fact, the supremacy of the PIN method has been proved even in the U.S. where debit card transactions can be completed both with a signature and with a PIN.

According to data from the Federal Reserve, in 2008 0.06 percent of all signature-based debit card transactions were fraudulent, while the corresponding rate for PIN-based payments was 0.01 percent. The average loss per signature-based debit purchase transaction was calculated at $0.05, or 0.13 percent of the transaction value and the corresponding numbers for PIN transactions were $0.01 and 0.03 percent, respectively. So the difference is huge.

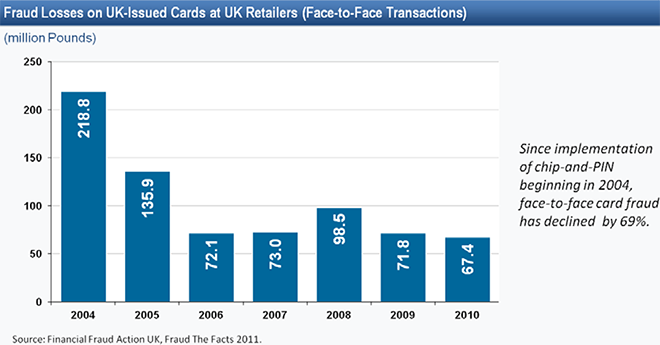

There is another way to illustrate the effectiveness of the EMV technology in reducing fraud. In the U.K., since the adoption of chip-and-PIN (which, by the way, is the generic name by which EMV is known in Britain) in 2004, face-to-face fraud-related losses on U.K.-issued cards used at British retailers have fallen by 69 percent — from £218.8 million to £67.4 million (source).

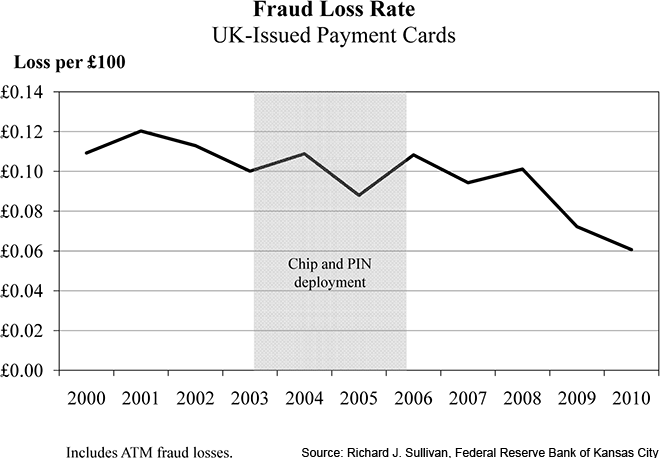

And here is the trajectory of the overall U.K. card fraud-loss rate in the past decade (source):

So yes, there is every reason to expect that the EMV adoption will lead to much lower levels of card fraud in the U.S.

The Takeaway

The adoption of the EMV technology in the U.S. is not controversial. In fact, everyone agrees that it should be done just as quickly as possible. The only reason it hasn’t happened yet has to do with money. According to an estimate by the Mercator Advisory Group, such a wholesale switch would have cost U.S. banks close to $3 billion and apparently that was too big a bill to pay and the banks just kept on swallowing their losses.

Now, however, Visa and MasterCard have forced the issue and we will finally get our EMV cards. That is a good thing, as it will not only reduce fraud, but it will also cure our headaches at European credit card checkouts.

Image credit: B2ps.com.