Do You Know What You Owe on Credit Cards?

If you think you know the answer to this question, you are probably wrong, according to a new study by the Federal Reserve Bank of New York (FRBNY). In fact, even if you think that you don’t owe anything to credit card companies, there is a very strong likelihood that they would disagree with you.

To make things even more perplexing, borrowers and lenders agree on the totals in all of the four other debt categories: mortgages, home equity lines of credit (HELOCs), vehicle and student loans.

How can that be and what makes credit card debt any different? After all, our credit card activity and statements are easily accessible online 24 / 7 and many of us still get them delivered monthly on paper. Where can any discrepancy come from? Well, The NY Fed researchers haven’t really come up with a conclusive answer, but the data are nevertheless interesting.

Americans Think They Owe Half of What Credit Card Issuers Claim

The NY Fed’s paper compares household debt, as reported by borrowers to the Fed’s Survey of Consumer Finances (SCF), with the data reported by lenders to Equifax (one of the three national credit reporting agencies), using the FRBNY Consumer Credit Panel (CCP).

The NY Fed’s paper compares household debt, as reported by borrowers to the Fed’s Survey of Consumer Finances (SCF), with the data reported by lenders to Equifax (one of the three national credit reporting agencies), using the FRBNY Consumer Credit Panel (CCP).

Probably the most striking piece of statistics to come out of the paper is the discrepancy in the aggregate credit card debt totals reported by the SCF and CCP. Borrowers estimated their outstanding credit card balances to be at $391 billion, while the lenders put the figure at $820 billion. Even after allowing for adjustments for small business and convenience uses of credit cards and for representativeness of the sample group, the figure reported by borrowers only rises to between 52 and 66 percent of the one reported by lenders.

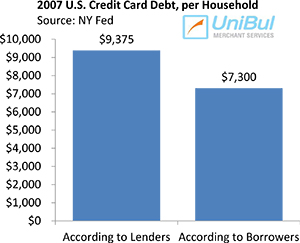

What’s more, only 50.3 percent of borrowers have reported any credit card debt, while the figure reported by issuers to Equifax is 76.1 percent. The discrepancy in the average reported amount is more than $2,000: $7300 versus $9375.

How to Explain the Difference?

The NY Fed researchers identify two possible culprits for the wide divergence in the reported data, although they admit to “attempt to make the most generous allowances for these two explanations that reason permit.” With that in mind, here they are:

- Some consumers may not have credit reports, so they are not represented in the CCP (lender) data. The authors of the paper calculate that group to represent 8.33 percent of borrowers, which are then taken out of the total of SCF-reported households.

- Some cardholders may intend to repay their outstanding balances in full at the end of the monthly cycle, so they may not count it as “true credit card debt.” The researchers estimate the “non-true” credit card debt (that is accrued in the current, as of the time of reporting, billing cycle) to be at 18.73 percent of CCP credit card balances (these calculations are based on 2007 Q3 data).

So the researchers conclude that the unconditional (“true”) average credit card debt, as reported by consumers, even after applying “extremely aggressive adjustments” to the data, is still at 63 percent of the lender-reported level.

The researchers then try a different method for dealing with the discrepancy, but can only lift the SCF level to 66 percent of the CCP one. Finally, they cite consumer underreporting of “long-dormant accounts, which they may regard as no longer relevant or may have forgotten” as a possible contributor to the data mismatch.

The Takeaway

It is simply inconceivable that what Americans think they owe on credit cards is only half of what the actual total is. “Generous allowances” and “extremely aggressive adjustments” can only take us so far.

The authors are of course aware of that and suggest that the remaining discrepancy can be explained away with inaccurate reporting on the part of borrowers. Here is what they have to say:

Uninformedness [that must be a new word] could result from willful ignorance, as large credit card balances are not welcome information, from difficulty understanding the growth of credit card balances, or from other cognition and information costs.

There it is. Borrowers just can’t understand or don’t want to know how much they owe on credit cards. But if that is the case, it leaves me wondering how Americans can know how much they owe in all other debt categories. The NY Fed doesn’t offer an explanation. Any ideas?

Image credit: Smarttech.com.hk.