U.S. Credit Card Debt Falls Sharply

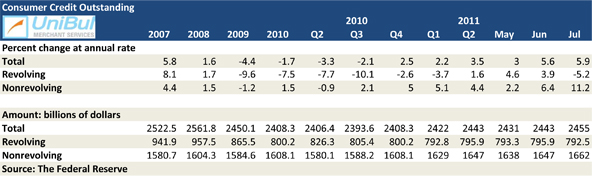

Following two consecutive monthly increases, U.S. consumer credit card debt fell sharply in July. The latest report on outstanding U.S. credit, released by the Federal Reserve on Thursday, showed the biggest drop in revolving credit, comprised mostly of outstanding credit card balances, in six months.

Non-revolving U.S. consumer debt, however, increased at a much faster rate in July, more than making up for the fall in credit card balances. As a result, the total outstanding consumer debt has now risen for ten months in a row.

Credit Card Debt Down 5.2% in July

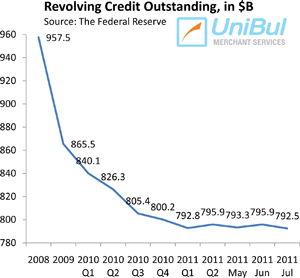

The aggregate amount of outstanding U.S. consumer revolving credit fell in July by 5.2 percent, or $3.4 billion, bringing the total down to $792.5 billion, more than erasing the gains from the previous two months.

Since the financial meltdown began in the wake of the Lehman Brothers collapse in September 2008, there have only been three months, including May and June of this year, in which the Federal Reserve has registered an uptick in revolving credit. The $789.8 billion mark reached in April was the lowest on record in almost seven years.

In the process, the aggregate amount of outstanding credit card balances in the U.S. has fallen by $181.1 billion, from $973.6 billion to $792.5 billion, since August 2008, the month before Lehman collapsed, a decrease of 18.6 percent. On average, each of the 54 million American families with outstanding credit card balances (by the Fed’s count) has reduced its debt burden by $3,354 for the period.

Overall Consumer Credit Up 5.9%

The non-revolving category of the U.S. consumer debt total, comprised of auto loans, student loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-secured assets, registered an increase in July for the twelfth month in a row. The Fed reported an 11.2 percent spike, bringing the total up to $1662 billion, up $15.4 billion from June.

The total of revolving and non-revolving U.S. consumer credit rose by $12 billion, or 5.9 percent, to $2454.5 billion in July, after rising by a revised $11.3 billion in June. It was the biggest gain since April 2008.

The Credit Card Takeaway

I wasn’t sure exactly what to make of the two consecutive monthly increases in outstanding credit card balances, reported for May and June. Even as revolving credit was increasing, American consumers were still maintaining a remarkable level of debt repayment discipline, as indicated by the continually decreasing delinquency and charge-off rates, reported by the card issuers and the credit reporting agencies.

I wasn’t sure exactly what to make of the two consecutive monthly increases in outstanding credit card balances, reported for May and June. Even as revolving credit was increasing, American consumers were still maintaining a remarkable level of debt repayment discipline, as indicated by the continually decreasing delinquency and charge-off rates, reported by the card issuers and the credit reporting agencies.

That was again the case in July when Moody’s reported that the 30-day delinquency rate in the U.S. fell for the 21th month in a row. The current level of 3.09 percent is less than half the 6.23 percent recorded in October 2009. Even more remarkably, the early-stage delinquency rate — credit card payments late by 30 – 59 days — is now at 0.83 percent, which is why Moody’s expects the charge-off rate, measured at 6.09 percent in July, to fall under 4 percent by the end of the year.

Moreover, the monthly credit card repayment rate remains at near record-high levels, indicating that delinquencies will remain low at least in the coming months. In fact, it seems increasingly likely that this dynamic will continue for as long as the economy is depressed and unemployment high.