U.S. Consumers Get More than 90% of All Worldwide Credit Card Offers

Credit card issuers have significantly stepped up their efforts to attract new customers in 2010, doubling the number of solicitations mailed out to consumers, according to Mail Monitor, the credit card mail tracking service of Synovate, the market research arm of Aegis Group.

Globally, credit card solicitations in 2010 rose to 2.73 billion from 1.39 billion in 2009, according to the report. In the U.S., in the second quarter of 2010 alone, consumers received 640.3 million credit card offers, an increase of 83 percent from the 349.1 million offers sent during the same period in 2009.

If the second quarter of 2010 was about average for the year, this would mean that the U.S., with less than 5 percent of the world population, accounted for more than 90 percent of the global credit card mail volume.

Chase, the leading U.S. card issuer in 2010, quadrupled their mailings compared to the same period in the prior year. Citibank was the second largest mailer of credit card offers for the second quarter of 2010, almost tripling their mailings from the first quarter, according to the report. Discover’s mailings rose by 70 percent for the period.

At the same time American consumers are again beginning to spend more on credit cards, the report tells us. On average, households with credit cards, of which there are 54 million in the U.S., according to the Fed, are spending $1,559 across all the cards in the wallet in 2010, an increase of 6 percent compared to $1,471 in 2009. In the second quarter of 2010 alone, this number was $1,627. The only time consumers spent more was in Q3 2008, the quarter prior to the financial meltdown, the researchers remind us.

“We are being repeatedly reminded that anybody betting against the US consumer ends up on the losing side. American consumer spending accounts for approximately 70% of the US’s GDP, and a robust spend of over $1,600 suggests that the ‘Dr. Dooms’ of the world may be underestimating this economy’s recovery,” commented his report’s findings Anuj Shahani, Director of Competitive Tracking Services for Synovate’s Financial Services group.

In addition to flooding the mail boxes of American consumers, issuers are also spicing up their offers with promotion rates. Introductory offers have increased to 71 percent of all mailings, the highest rate in the twenty years that Synovate has tracked these data.

Once the teaser rates expire, however, the regular interest rates are higher than they’ve been in a while. As of Jan. 26 2011, the average prime credit card rate was 14.72 percent, according to the CreditCards.com Weekly Rate Report, just off the record 14.78 percent set in November 2010. The average “bad credit rate” for the period was 24.95 percent.

What is even more troubling is that, as the economy recovers, these interest rates will keep going up. The reason is that most cards now come with variable rates, which are tied to the prime rate. Once the Federal Reserve begins to raise the federal funds rate, which is now practically at zero, the prime rate will rise accordingly, lifting variable card rates in the process.

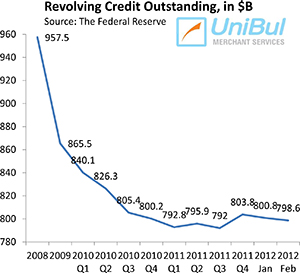

So an economic recovery may actually result in a heavier debt burden for indebted consumers. The silver lining is that U.S. credit card balances have declined sharply since the crisis began, which may limit the damage. According to the Fed, since its peak in August 2008, credit card debt in the U.S. has declined by $177.1 billion, from $973.6 billion to $796.5 billion, a decrease of 18.2 percent. Of course the other side of the coin is that higher credit card rates may help reverse the trend. In any case we will have to wait for the economy to start recovering and for the unemployment rate to fall in any meaningful way first.

Image credit: Repec.org.