Young, Less-Educated and Low-Income Consumers Most Affected by Higher Debit Cost

That is the main conclusion of a study by Joanna Stavins, an economist at the Federal Reserve Bank of Boston. In her paper Stavins analyzes the potential effects of the Fed’s rule that limited debit card interchange fees to about $0.24 per transaction, down from an average of $0.44. These are the fees merchants are charged by issuers for processing debit card transactions.

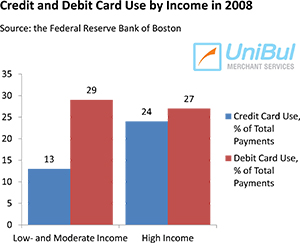

We have long been warning on this blog that the Durbin Amendment, which mandated the Fed to place a cap on debit interchange fees, will end up hurting consumers and especially the lower-income ones, who a previous Fed study told us tend to use debit cards much more often than they use credit cards. In her paper Stavins tells us pretty much the same.

Why Will Debit Use Become More Expensive?

I’ve lost count of how many times I’ve answered this question on our blog, but we keep getting comments and emails that clearly indicate that I haven’t done a good job of it. So let’s have Joanna Stavins answer it instead:

Because banks stand to lose revenues when the interchange fee rule becomes effective, they may raise fees — either on consumer bank accounts more broadly, or specifically on debit cards — to recover their losses.2 In addition, the elimination of automatic overdraft protection in July 2010 might lead to lower revenues from overdraft fees in the future if fewer debit cardholders opt in to the overdraft service.

There it is. Whatever you may think of the Durbin Amendment, one of its major consequences is that banks will try to find ways to recoup lost revenues. By the way, these revenues were not passed on to consumers, but to businesses and mostly to big-box retailers. So we are talking here about government-mandated redistribution of revenues from one industry to another. Again, you may like it or not, but that is what took place.

How Will Banks Make up for Lost Revenue?

There are many avenues banks can exploit to recover their losses and Stavins lists a few of them:

Any price changes may take the form of reduced rewards on debit cards or increased fees, either in a form of fixed term fees or as variable per-transaction fees. Fixed one-time fees are more likely to affect the adoption of a payment method, while per-transaction fees are more likely to affect the use of payment methods.

There is evidence that U.S. banks have responded to the interchange fee regulation already: Wells Fargo and Chase are testing a $3 monthly fee on any customers who use their debit card.3 Chase, PNC Bank, and Wells Fargo have already ended or reduced their debit rewards programs. The availability of free checking accounts also declined in 2010 for the first time since 2003.

We know what happened to the $3 debit card fee tested by Wells Fargo and Chase, as well as the $5 one tried out by Bank of America, but debit rewards and free checking accounts are already gone. What’s more, the issuers are far from done looking for alternative revenue sources.

Who Will Be Most Affected by the Interchange Fee Reform?

Stavins is quite explicit in answering this question:

Stavins is quite explicit in answering this question:

Consumers with the least education (less than a high school diploma), the lowest annual income (below $25,000), and the youngest ages (under 25-years-old) consider cost of use to be the most important characteristic of payment methods. It is probable that these consumers would be most affected by an increase in debit card fees, and most likely to respond by changing their payment behavior.

How will the change in payment behavior manifest itself? Stavins:

If the cost of using debit cards rises, consumers are most likely to substitute credit cards for some of their debit card transactions. Consumer reaction depends on the type of fee increases: a specific increase in the cost of debit cards is expected to have a greater effect on debit card use than would a broader increase in the cost of bank accounts.

That would be precisely the outcome issuers would want to achieve. Of course, many young or low-income consumers have no access to credit cards, but that is why many issuers are working hard on making prepaid cards more attractive.

The Takeaway

Again, whatever you may think of the issuers’ “right” to make up for lost interchange revenues, they will do it, one way or another, much to Sen. Durbin’s chagrin. The question is how this will be done and, most importantly, who will end up paying for it. Here is how I see the story unfolding.

When the dust settles, debit use will have become more expensive for consumers. We already have seen the disappearance of debit rewards and free checking and the banks are likely to find more subtle ways to introduce another fee or two that would pass the consumer tolerance test.

At the same time the issuers will manage to drive a sizable group of consumers away from debit cards and into credit and prepaid use. That shift would end up costing merchants in the form of the higher interchange fees they are charged for processing credit and prepaid card transactions.

So at the end the issuers will have managed to at worst recoup their debit interchange losses and the cost will be split between the merchants and consumers. The big-box retailers will still be net winners, but consumers, especially lower-income ones, will be net losers.

Image credit: PBS.org.

Hello,

Great tips! The information that you shared in your post are really relevant. And i am agree with you.

Thanks