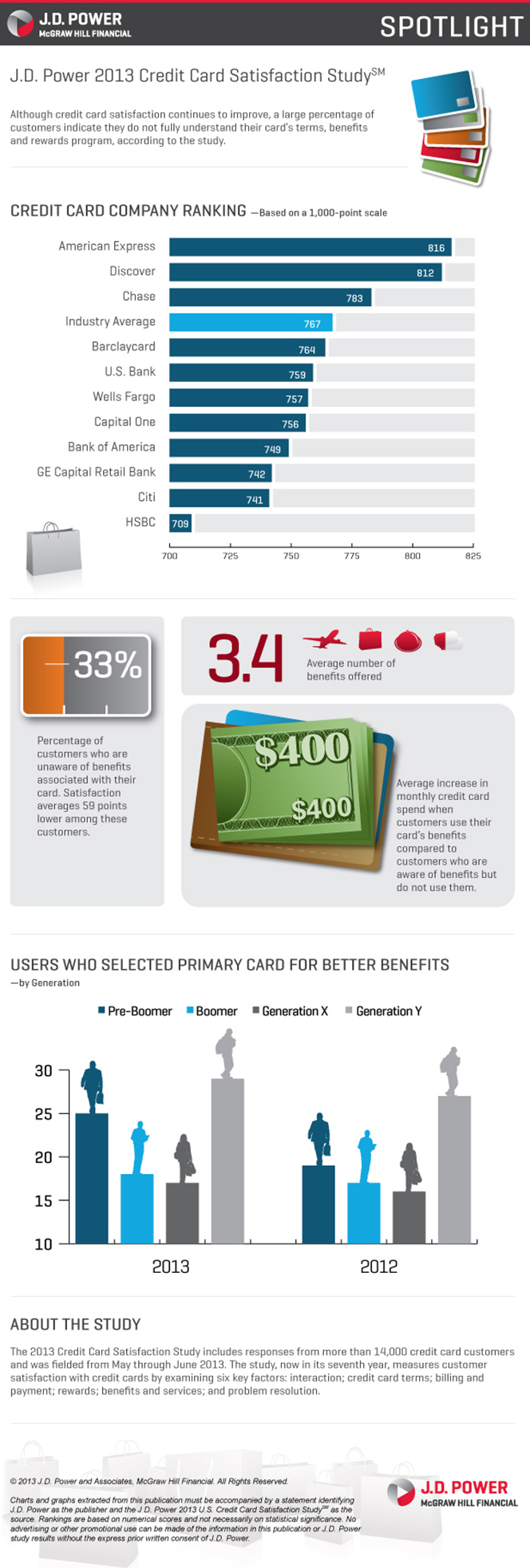

Why You Should Cut up Your MasterCard and Visa and Switch to AmEx or Discover

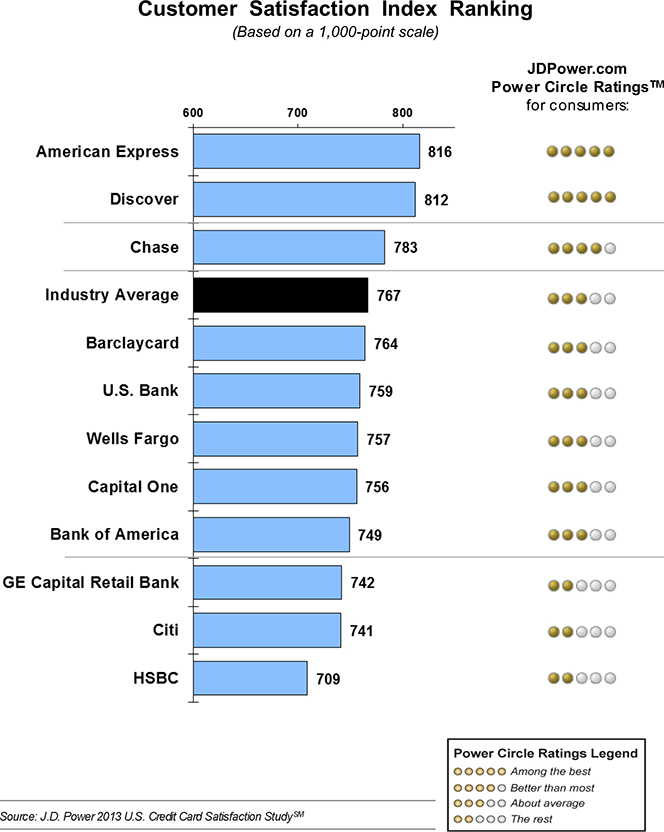

J.D. Power and Associates has ranked American Express the top credit card company among the eleven biggest in the U.S. in its latest annual Credit Card Customer Satisfaction study. It is the seventh consecutive year in which AmEx has topped the chart, with Discover once again finishing a close second and HSBC once more finishing up in last place and doing so in an abysmal fashion. Overall, American consumers’ satisfaction with their credit cards has improved for the fourth year in a row, following a decline in 2009, the year immediately following the financial collapse of 2008, we learn.

Once again, the study finds that the huge banks, which are issuing the MasterCard- and Visa-branded credit cards — all of them among the biggest in the world — are lagging far behind the two leaders. In fact, the distance is so big that Chase is the only Visa and MasterCard issuer whose score is above the industry average. In the previous years we speculated on the possible causes for the discrepancy and got some help from the study’s author. As data accumulate, evidence is piling up indicating ever more strongly that the simplified transaction process, associated with American Express and Discover payments, as opposed to Visa and MasterCard ones, is hugely benefiting these two companies. Let’s take a look at the latest survey.

Once again, AmEx Is Best in Satisfying Customers, HSBC — Worst

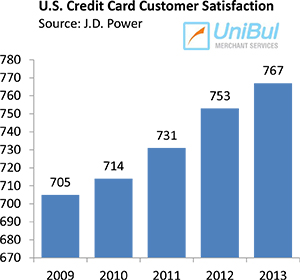

J.D. Power and Associates is using six broad factors in calculating consumer satisfaction with credit cards: interaction, credit card terms, billing and payment process, rewards, benefits and services and problem resolution. The average industry score for 2013 was 767 on a 1,000-point scale, up from 753 in 2012, which itself was up from 731 in 2011, 714 in 2010 and 705 in 2009.

J.D. Power and Associates is using six broad factors in calculating consumer satisfaction with credit cards: interaction, credit card terms, billing and payment process, rewards, benefits and services and problem resolution. The average industry score for 2013 was 767 on a 1,000-point scale, up from 753 in 2012, which itself was up from 731 in 2011, 714 in 2010 and 705 in 2009.

American Express topped the chart with 816 points, up from 807 in 2012, ahead of Discover, which scored 812, up from 799 a year ago. Just as was the case last year, Chase and Barclaycard are ranked third and fourth, but this year only the former issuer has scored above the industry average. In the race to the bottom, Citi has displaced GE Capital Retail Bank to rank second to last with a score of 741, but it still has quite some way to go, before it can challenge HSBC, which is still in firm control of the last spot.

Unlike last year, when consumer satisfaction improved across all measurements, this year’s survey has found that Americans are less happy with their “awareness of earning and redeeming rewards with their credit card”. And, as Jim Miller — one of the study’s authors — says, it is in the issuers’ own interest to do better here:

Customers who use their card’s benefits spend an average of $400 more per month on their card, compared with those who are aware of benefits but do not use them, so clearly this is an area of importance to card issuers… While most customers change cards for a better rewards program, they often don’t fully understand the rewards offered with their current card. There is a clear opportunity for issuers to better communicate rewards programs and benefits to not only keep customers loyal, but also to attract new customers.

Miller adds that the improving economy is helping consumers feel better about their financial situation, which, in turn, helps improve satisfaction with credit card issuers and that is very likely the case. We learn that 27 percent of credit card holders have said that they are better off in 2013, up from 23 percent in 2012 and 20 percent in 2011. Conversely, 17 percent have reported that they are worse off, down from 23 percent in 2012 and 29 percent in 2011.

Why Is the AmEx / Discover Way Better than the Visa / MasterCard Approach?

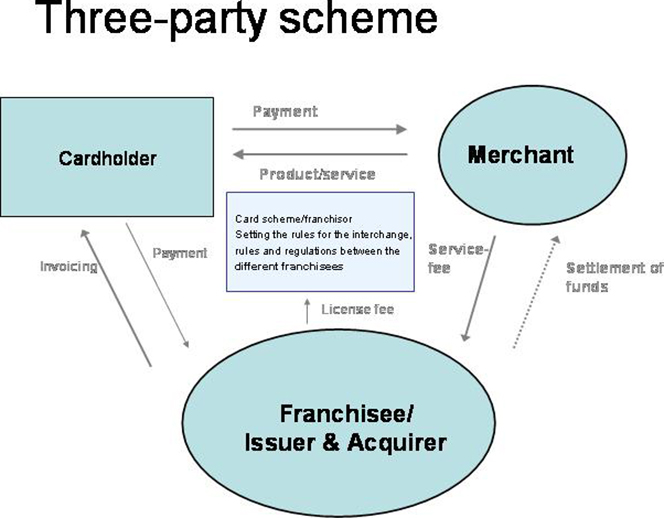

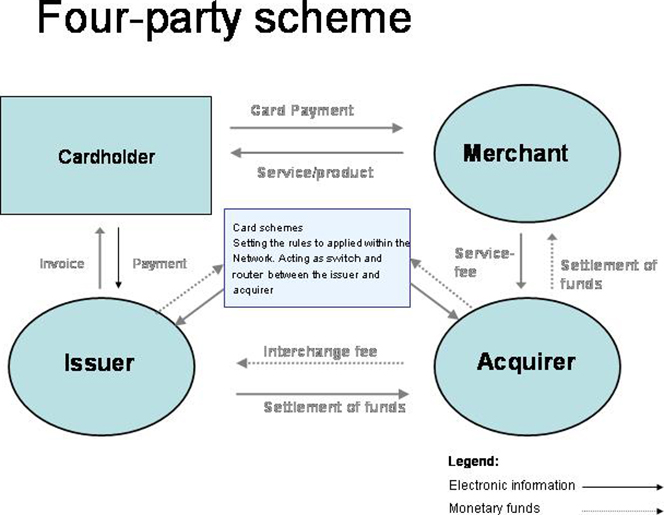

As we keep saying every year, a substantial part of the explanation for American Express’ and Discover’s success in putting such a distance between themselves and the issuers of MasterCard and Visa cards must lie in the fact that they act as both issuers of their cards and processors of their transactions — that is to say, each one of them operates a three-party scheme. In contrast, all other companies in J.D. Power and Associates’ list issue Visa- and MasterCard-branded cards whose transactions can be processed by any other member of Visa’s or MasterCard’s associations — these are four-party schemes. The difference between the two models is illustrated in the following two diagrams (from Wikipedia; sorry for the poor quality, but I didn’t want to spend time doing my own diagrams, as these were already available):

So you can immediately see that the AmEx / Discover approach is a much more simplified version of the one developed by their larger rivals. And that is significant, because being able to both issue your cards and process your transactions makes it much easier to address your customers’ inquiries and resolve disputes in a quicker and more efficient manner, as you don’t need to turn to yet another bank for assistance. The complete control that both American Express and Discover exercise over the whole card transaction process would directly affect the interaction, billing and payment process and problem resolution components of J.D. Power and Associates’ survey model and that could be enough to account for the results.

But there is more. Michael Beird, who conducted the J.D. Power study a couple of years ago, told UniBul that he had identified a few other aspects, which set American Express and Discover apart from the VISA / MasterCard crowd:

- American Express and Discover overcommunicate: they both use multiple communication channels (mail, email, collateral, statements, website, etc.) to inform their customers of changes, new products / services and just communicate relatively simple, focused messages on an ongoing basis.

- Their cardholders have a better grasp of what they get by being a customer: AmEx customers, for example, have stated (back in 2011) that they get over 5 benefits from their card, versus only 3.3 benefits for cardholders of other brands. This is key when it comes time to pay the annual fee.

- Strong brand image: both AmEx and Discover excel in J.D. Power’s assessment of brand image. Measured across 7 attributes, both companies average (again, this is back in 2011) over 0.5 points higher (on a 7 point scale) than the Visa / MasterCard issuers. This customer view of the companies as being more customer-focused, proactive, friendly and financially stable is critical to sustaining high marks in overall satisfaction and customer commitment.

To summarize, there seem to be very good reasons for AmEx and Discover to outperform Visa and MasterCard issuers across the board.

The Takeaway

So, once again, the J.D. Power survey paints a picture of complete dominance by American Express and Discover over their Visa / MasterCard rivals, at least in the eyes of their customers. However, it should be noted that all eleven issuers have scored better in this year’s survey than they did last year. Moreover, most of the Visa / MasterCard issuers have registered greater improvements, in relative terms, than the two leaders. Still, they have much more work left to do to close the gap.

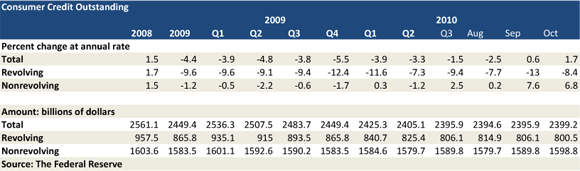

It should also be said that, following the historic lows reached in the wake of Lehman’s collapse, customer satisfaction indices could only have gone up. And as delinquency and charge-off rates continue to fall, these indices are likely to keep rising. After all, when fewer people are behind on their bills, there are fewer stern notices demanding immediate payments and threatening unpleasant consequences otherwise. Whoever receives such a letter is unlikely to give a high mark to the issuer of her card, whatever the specific questions may be, isn’t she?

Finally, here is an infographic produced by the J.D. Power researchers to illustrate their results:

Image credit: Wikimedia Commons.

American express live in their own world. The rates are quite high and a lot of merchants complain about that.

However for their customers the argument may be extremely different.